While real estate lead generation can seem like a relatively easy but monotonous task, in reality, generating enough leads to sustain your business is one of the hardest challenges for real estate professionals. The key to generating real estate leads is finding the right mix of strategies that suit your personality, budget, and skills. That’s why I have compiled this list of 46 underrated real estate lead generation ideas for your business in 2025.

Below, you will find the best online and offline strategies, plus some creative strategies for newer agents to get their businesses off the ground.

Online Real Estate Lead Generation Ideas

Getting into online lead generation for real estate is all about having a solid online presence. I would advise starting by building your website and checking out these online lead generation real estate ideas to get the ball rolling. Choose a few to try and begin getting more clients in real estate.

1. Create and optimize your website for local SEO

-

Cost: Free to $140 per month with Ahrefs Lite or Semrush Pro

-

Time to Generate Leads: Weeks to months

Creating high-quality content and optimizing your real estate lead generation website for local search terms is essential for attracting organic traffic from potential clients in your area. By incorporating relevant keywords, creating localized content, and building local backlinks, you can improve your search engine rankings and make it easier for prospects to find you online.

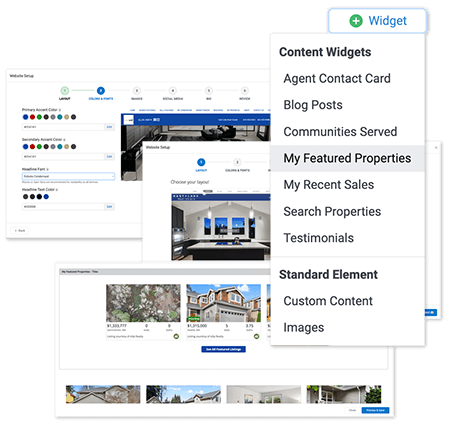

If you plan to scale your business, you’ll want an integrated real estate website that generates leads and automatically populates them into a sophisticated CRM. Using high-end lead conversion tools like Sierra Interactive provides the all-in-one sales ecosystem you need. It also offers ad management and a stylish website design.

2. Create a real estate blog

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Besides creating a real estate lead generation website, blogging is another fantastic way to establish yourself as a knowledgeable resource in your market. Crafting valuable real estate content that addresses the questions and concerns of buyers and sellers will attract potential clients, demonstrate your expertise, and build trust with your audience. Remember to focus on real estate blog ideas that showcase your local market insights and provide actionable advice

3. Buy leads

-

Cost: $100–$1,000-plus per month

-

Time to Generate Leads: Days to months

Buying real estate leads from lead providers can be a great way to supplement your other lead generation efforts and ensure a consistent pipeline of potential clients. Consider evaluating different lead generation companies based on their real estate lead quality, targeting options, and cost per lead.

I advise following up with leads quickly and consistently to make the most of your investment. By combining purchased leads with your own marketing and prospecting efforts, you can generate a steady stream of business and grow your client base more quickly.

Ready to scale your real estate business? Market Leader makes it easy. If you need an IDX website that generates and delivers exclusive leads directly to your CRM with all the tools you need to manage, track, and nurture your prospects, Market Leader might be the tool you’ve been looking for.

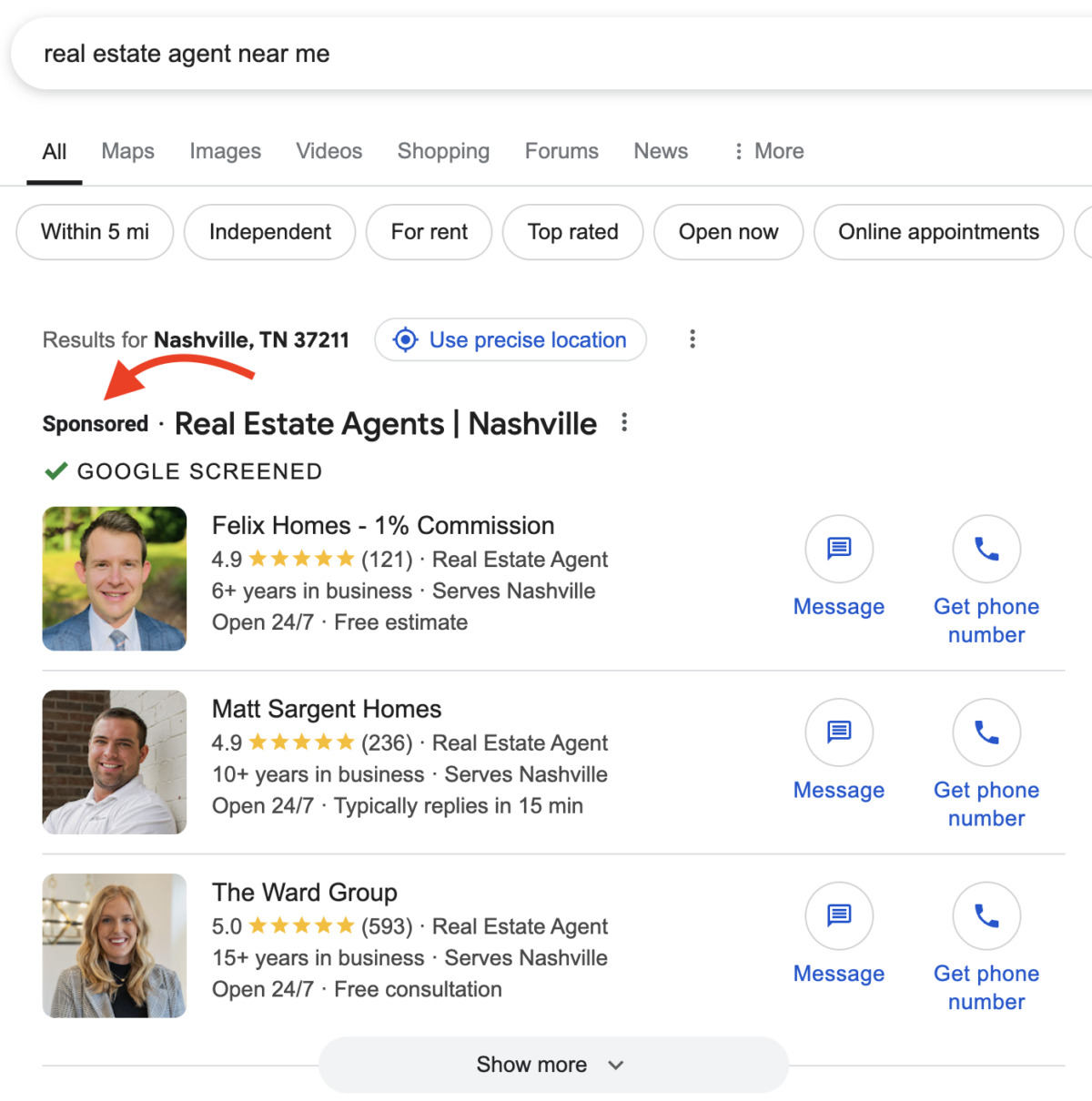

4. Use Google PPC ads

-

Cost: $0.11–$0.50 per click or $0.51–$1.00 per 1,000 impressions

-

Time to Generate Leads: Weeks to months

If you want to reach potential clients actively searching for real estate services, Google Ads can be a game-changer. You can create compelling ad campaigns that drive targeted traffic to your website by targeting specific keywords. Just monitor your campaigns closely and optimize them regularly to maximize your ROI.

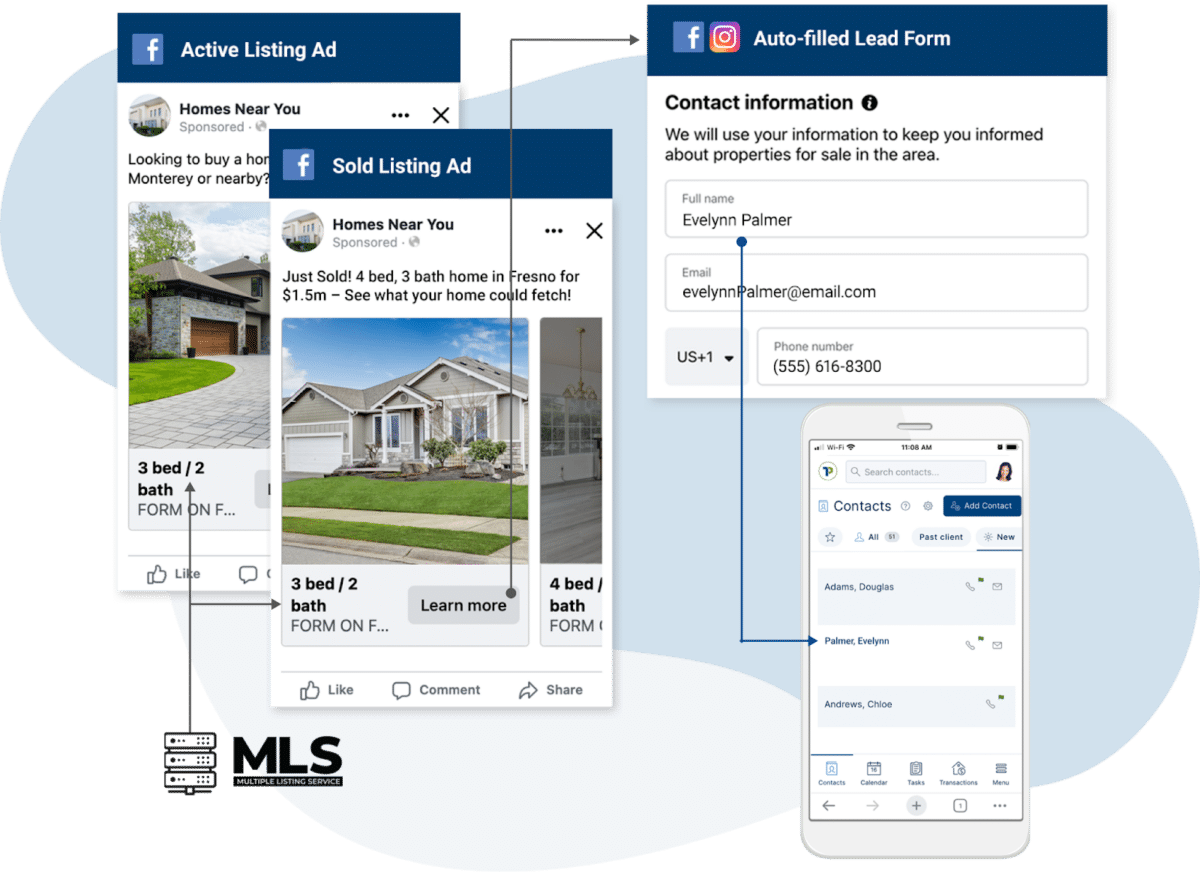

5. Run Instagram and Facebook social media ads

-

Cost: $0–$2 per action

-

Time to Generate Leads: Weeks to months

Social media platforms like Facebook and Instagram offer powerful advertising tools, allowing you to reach your target audience with less effort. Generate a steady stream of clients from social media by designing eye-catching ads that showcase your listings, highlight your expertise, and offer value to potential clients. Don’t forget to experiment with different ad formats, targeting options, and calls to action to find what works best for you.

Boost your database with a consistent flow of affordable and exclusive real estate leads from social media ads. Social Connect from Top Producer is here to help you gather a high volume of leads and guide them through your pipeline until they’re ready to make their real estate dreams come true. For just $300 a month, you can connect with around 30 eager consumers interested in real estate in your local area.

6. Engage in online communities

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Joining local Facebook groups, online forums, and discussion boards can be a great way to generate leads by providing value and building relationships with potential clients. Look for groups where your target audience is active, and engage in conversations by offering helpful advice, answering questions, and sharing your insights. Just be sure to focus on adding value rather than overtly promoting your services to avoid being spammy.

SOLD.com is a free service that matches sellers and buyers with the best real estate service to suit their needs. From traditional realtors and discount brokers to cash buyers, it is the fastest way to connect with a local realtor.

7. Host virtual open houses

-

Cost: Free to $25

-

Time to Generate Leads: Days to months

In today’s digital age, virtual open houses and property tours have become increasingly popular among buyers who prefer to explore homes from their devices. Leveraging tools like Zoom, Facebook Live, or prerecorded video tours, you can showcase your listings to a broader audience and engage with potential clients conveniently and interactively. Be sure to promote your virtual events across your social media channels and email list to maximize attendance.

8. Provide online webinars & workshops

-

Accreditation:

Consider hosting engaging webinars or interactive online workshops on exciting real estate topics your audience will enjoy. To maximize reach, spread the word through social media, eye-catching email campaigns, and your website.

This not only highlights your expertise in the real estate industry but also draws in potential leads eager to learn more. It’s a fantastic way to connect, educate, and share your passion for real estate.

9. Create engaging videos

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Video platforms like YouTube are a realtor’s best friend. Real estate video content is a powerful way to capture the attention of potential clients and showcase your personality, expertise, and local market knowledge.

Consider creating a mix of real estate marketing videos like listing videos, neighborhood tours, educational content, and personal branding videos to attract and engage your target audience. You can share your videos on your website, social media profiles, and even YouTube to expand your reach and generate leads.

10. Build a social media presence

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Building a strong presence on social media platforms is essential for staying top-of-mind with potential clients and establishing yourself as a go-to resource in your market. For social media post ideas, focus on consistently uploading engaging content, interacting with your followers, and joining relevant conversations to build relationships and attract leads.

Don’t be afraid to show your personality and share a mix of professional and personal content to humanize your brand. Remember, your vibe attracts your tribe!

11. Start a real estate podcast

-

Accreditation:

Launch an engaging real estate podcast that explores the latest market trends, offers unique local insights, and features insightful conversations with industry experts. Each episode can cover a variety of topics, from market fluctuations to savvy investment strategies and neighborhood spotlights.

To grow your audience, promote the podcast on social media, podcast directories, and your website. Encourage listeners to dive deeper by visiting your site for extra resources and personalized real estate guidance.

12. Leverage email marketing

-

Cost: Free to $20 per month

-

Time to Generate Leads: Weeks to months

Email marketing is my jam, and it’s my go-to method for nurturing real estate leads, staying top-of-mind with potential clients, and driving repeat business. By creating a targeted email list and sending regular newsletters, market updates, and personalized property recommendations, you can build trust with your audience and position yourself as a valuable resource.

Don’t forget to segment your list based on buyer/seller status, price range, and location to ensure your emails are highly relevant to each recipient. If you’re really ready to take your email marketing to the next level, embed videos in your email marketing campaigns.

13. Implement chatbots

-

Cost: Free–$3,000 per month

-

Time to Generate Leads: Weeks to months

Real estate chatbots are an innovative way to engage website visitors, answer common questions, and capture leads 24/7. Integrating a chatbot on your website allows you to instantly assist potential clients, even when you’re unavailable to respond personally. (2:00 a.m. is prime time for buyers to shop on Zillow!)

Look for chatbot platforms that allow you to customize your bot’s personality, preprogram specific responses, and integrate with your CRM for seamless lead management.

The 7 Best Real Estate Chatbots (Pricing, Pros & Cons)

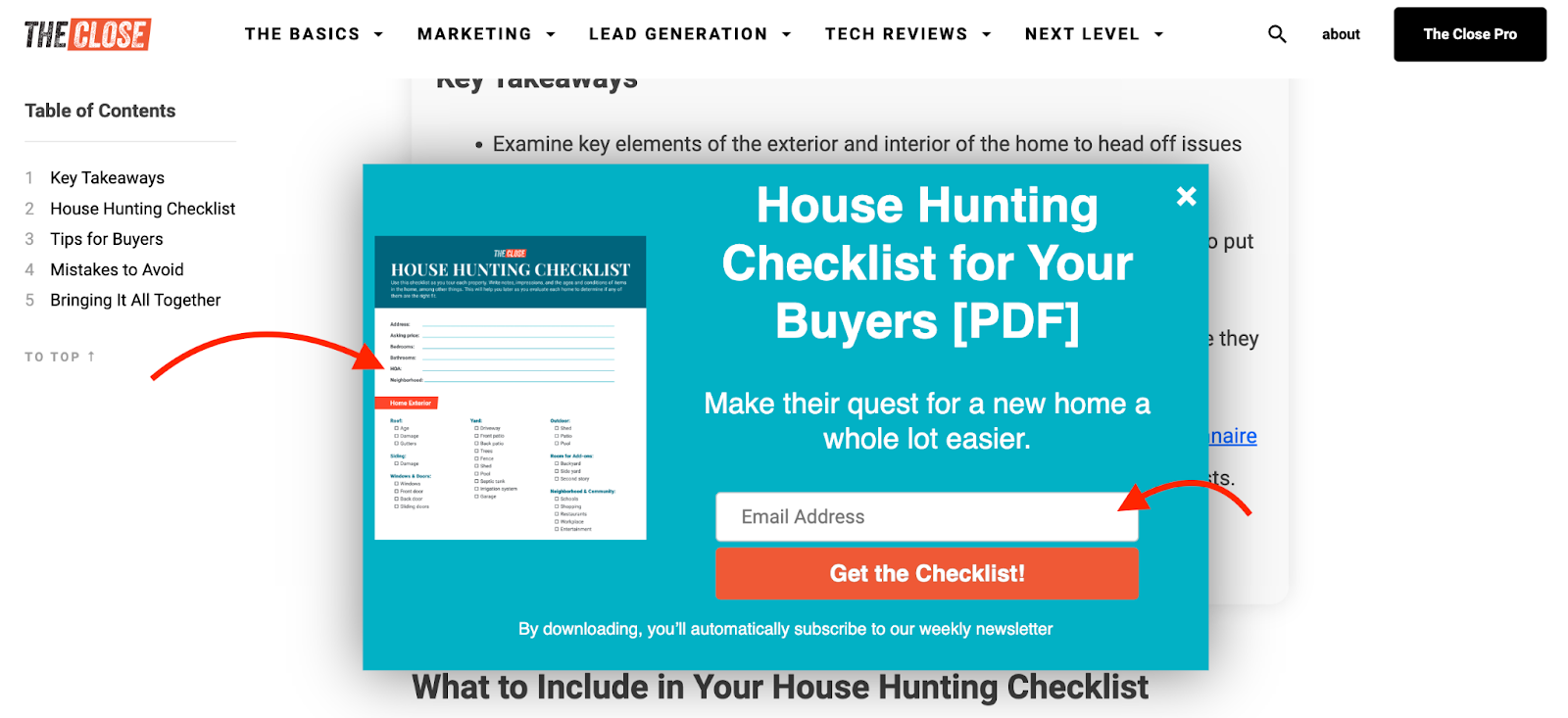

14. Offer downloadable guides

-

Cost: Free to $15

-

Time to Generate Leads: Days to months

Creating downloadable guides, e-books, or checklists — often called lead magnets — is a powerful way to provide value to potential clients while capturing their contact info. Consider creating resources like “The Ultimate Homebuyer’s Guide,” “10 Steps to Selling Your Home for Top Dollar,” or “The Investor’s Guide to Rental Properties” to address common pain points and showcase your expertise.

You can find some of those resources here at The Close. We love creating downloads for you, like our Real Estate Marketing Plan Template. You can quickly build your email list and generate targeted leads by gating these resources behind a simple lead capture form

15. Cross-promote online

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Partnering with local businesses to cross-promote your services online can be a win-win for both parties. Look for companies that serve a similar target audience, such as home stagers, interior designers, or mortgage brokers, and brainstorm creative ways to collaborate. Write guest blog posts for each other’s websites, cohost a webinar or video podcast, or even create a joint email campaign to cross-pollinate your audiences and generate new leads. This works amazingly well on social media.

16. Use LinkedIn

-

Accreditation:

LinkedIn is a real estate leads hotbed. The platform lets real estate pros connect with potential clients, referral partners, and industry influencers. By optimizing your profile, sharing valuable content, and engaging with your connections, you can build your brand and attract your next real estate prospect.

Remember to join relevant groups, participate in discussions, and use LinkedIn’s advanced search features to find and connect with your ideal prospects. For more tips, check The Close’s guide to using LinkedIn to gain more leads.

17. Develop a mobile-friendly website

-

Cost: $10 per month or $5,000 per site build

-

Time to Generate Leads: Weeks to months

It may not seem important, but with more potential clients accessing the internet from their smartphones and tablets, having a mobile-friendly website is no longer optional — it’s required. By developing a responsive website that adapts to different screen sizes and offers a seamless user experience on mobile devices, you can ensure that potential clients easily find and engage with your content, no matter where they are. Don’t forget to prioritize fast load times, clear calls to action, and easy navigation to maximize your mobile lead generation efforts.

18. Leverage AI & predictive analytics

-

Cost: $20–$400 per month

-

Time to Generate Leads: Weeks to months

Real estate artificial intelligence (AI) and predictive analytics tools can help you identify potential leads and target your marketing efforts more effectively. Consider investing in software that can analyze consumer behavior, predict future market trends, or identify homeowners likely to sell soon. By leveraging data-driven insights and automating certain aspects of your lead generation for real estate, you can save time, reduce costs, and focus on the most compelling opportunities.

The Best 6 Real Estate AI Tools for 2025

Offline real estate lead generation ideas

Being online and on social media is only part of the answer when it comes to real estate lead generation. It’s essential to mix things up a bit. Use the online strategies for lead generation above, but mix in some tried-and-true offline techniques to add complexity and depth to your real estate lead generation strategy.

19. Attend networking events

-

Accreditation:

In-person real estate networking is a critical skill, and attending local events is a great way to expand your network and meet potential clients. Look for events that align with your target audience—such as first-time homebuyer seminars, investor meetups, or business conferences—and come prepared with plenty of business cards and a memorable elevator pitch.

Remember, the goal is to build genuine relationships, not just collect leads, so focus on asking questions, providing value, and following up after the event. Read our real estate expert-approved tips for networking for more information.

20. Sponsor community events

-

Cost: Free to $500+

-

Time to Generate Leads: Weeks to months

Sponsoring local community events, such as festivals, charity fundraisers, or sports teams, can be a fun way to increase your visibility and build goodwill in your area. Aligning your real estate branding with events that matter to your target audience will demonstrate your commitment to the community and attract potential clients who share your values. Don’t forget to promote your sponsorship on social media, your website, and any printed materials to maximize your exposure and attendance.

21. Host educational seminars

Hosting educational seminars or workshops is a powerful way to demonstrate your expertise, provide value to potential clients, and generate leads. Consider topics that address common pain points for your target audience, such as “First-time Homebuyer Tips,” “Maximizing Your Home’s Value Before Selling,” or “How to Get Started in Real Estate Investing.” Promote your event through social media, email marketing, and local advertising, and collect attendee information for follow-up after the event.

22. Participate in charity events

Volunteering for local charities or causes you care about is a great way to build relationships, establish yourself as a community leader, develop your brand, and generate leads organically. Look for events such as serving on a local nonprofit board, mentoring students, or participating in community cleanup events. Bring plenty of business cards to exchange. You’ll naturally attract like-minded individuals who may become future clients or referral sources by giving your time and talents to make a difference in your community.

23. Join business associations

-

Cost: $50–$5,000 per year

-

Time to Generate Leads: Weeks to months

Joining your local Chamber of Commerce or other business associations can be a great way to network with other professionals, stay up-to-date on local market trends, and generate referrals. Attend regular meetings and events, volunteer for committees or leadership roles, and look for opportunities to collaborate or cross-promote with other members. Remember to follow up with the connections you make and find ways to provide value to your fellow members outside of the organization as well.

24. Collaborate with professionals

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Partnering with complementary or adjacent professionals, such as mortgage brokers, home inspectors, or attorneys, can be a fun and fantastic way to expand your network and generate referrals. Look for professionals who share your values and commitment to exceptional service, and brainstorm ways to collaborate.

Try cohosting events, creating joint marketing campaigns, or simply referring clients to one another. By building strong relationships with other professionals in your industry, you can create a powerful referral network that benefits everyone involved.

25. Distribute door hangers

-

Cost: $0.55–$1.50 per door hanger

-

Time to Generate Leads: Weeks to months

Creating eye-catching door hangers or flyers and distributing them in targeted neighborhoods is a great way to get outside and get some vitamin D while generating leads in real estate and building brand awareness in your local market. Consider highlighting a recent sale, offering a free home valuation, introducing yourself to your new geographic farm, or doing circle prospecting for your open house to capture the attention of potential clients.

Be sure to include a clear call to action with your contact information. Use a QR code to direct your prospects to your website or landing page. Want to take it up a notch? Consider partnering with a local business, such as a pizza shop or lawn care service, to offer recipients a special promotion or discount.

25. Advertise in local media

-

Cost: $100–$5,000-plus per month

-

Time to Generate Leads: Weeks to months

Placing real estate ads in local newspapers, magazines, or radio stations can effectively reach potential clients in your area, particularly those who may not be active online. Consider running ads that showcase your unique value proposition, highlight a specific listing or service, or invite readers to an event you’re hosting.

Be sure to include a clear call to action and a way to track the response to your ads, such as a unique phone number or landing page URL, to measure your ROI. Use a QR code in print ads to make getting to your landing page easy. Check our collation of the best real estate ad examples for some inspiration on how to approach creating yours.

26 . Send personalized postcards

-

Cost: $0.20–$1.00 per postcard

-

Time to Generate Leads: Weeks to months

Who doesn’t love getting personalized mail in their actual mailbox? Send personalized postcards to past clients, leads, or targeted neighborhoods as part of your real estate prospecting mix. Consider sending postcards that showcase a recent sale, offer a free market analysis, or simply express gratitude for their business or referrals. Be sure to include a clear call to action and your contact information, and consider handwriting a personal note or using a unique design to stand out in the mailbox.

27. Host client appreciation events

-

Cost: Free to $500+

-

Time to Generate Leads: Days to months

Organizing client appreciation events, such as a summer BBQ, holiday party, or movie night, can be a great way to nurture relationships with past clients and generate referrals. Consider inviting your clients to bring a friend or family member who may be interested in buying or selling a home and using the event as an opportunity to showcase your personality, expertise, and commitment to exceptional service. Don’t forget to follow up with any new leads after the event and add them to your email list for future nurturing.

28. Target FSBOs

While not for everyone, focusing on for-sale-by-owner (FSBO) properties can generate tons of leads and demonstrate your value as a real estate professional. Consider creating a targeted marketing campaign highlighting the benefits of working with an agent, such as increased exposure, expert negotiation skills, and reduced stress.

Offer a free consultation or market analysis to FSBO sellers, and be prepared to showcase your track record of success and local market expertise. Building relationships with FSBO sellers (our FSBO scripts can help) and providing valuable insights can sometimes turn them into clients. Still, you’ll definitely need to hone your real estate lead conversion skills to make the most of these leads.

29. Pursue expired listings

Targeting older expired listings that have been off the market for a while — around six to nine months is the sweet spot — can be a great way to generate leads and help homeowners who may be frustrated with the selling process. Consider creating a targeted real estate prospecting letter campaign or phone script that empathizes with the seller’s situation and offers a fresh perspective on selling their home.

11 Best Real Estate Prospecting Letter Templates for 2025

Be prepared to showcase your marketing plan, pricing strategy, and success stories with similar properties. You can win the listing and help the seller achieve their goals by providing valuable insights and a renewed sense of hope.

Cut down on your time digging up expired listings and spend more time setting appointments. REDX delivers fresh expired listings to your inbox so you can kick-start your day with fresh leads and spend more time making connections and landing new listings.

30. Network with attorneys and real estate lenders

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Build relationships with divorce, bankruptcy, and probate attorneys to generate leads, and provide value to clients (and their attorneys) going through challenging life transitions. Consider attending legal industry events, joining local bar associations, or offering to provide educational content or resources, like an e-book or guide, to their clients.

By establishing yourself as a trusted resource and empathetic advisor, you can earn referrals from attorneys and help their clients navigate the complex process of buying or selling a home during a difficult time.

This same concept would apply to building relationships with real estate lenders. By positioning yourself as a professional and creating this symbiotic relationship, you can earn referrals from trusted real estate lenders.

Want to get a jump on properties inherited through probate? Check out how Catalyze AI uses probate and public records to predict homeowners who might want to list their property before anyone else. Being first is often the biggest advantage you have in landing the listing.

31. Target absentee owners

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Focus on absentee owners, such as those who have inherited a property or live out of state, and provide valuable solutions. Consider creating a targeted direct mail campaign highlighting the benefits of working with a local agent, such as reduced stress, increased rental income, or a faster sale.

Offer a free rental market analysis or consultation to help owners understand their options and make informed decisions. By providing expert guidance and local market insights, you can convert absentee owners into clients and earn referrals to other potential investors.

32. Identify distressed properties

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Owners of distressed properties, such as those facing foreclosure or needing significant repairs, need your expert solutions for challenging situations. Create a targeted marketing campaign that offers a free consultation or market analysis, and be prepared to demonstrate your experience with short sales, renovations, or creative financing options. By providing empathy, expertise, and a plan of action, you may be able to help distressed homeowners avoid foreclosure, sell their property quickly, or even keep their home and build equity.

33. Master a specific niche

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Focusing on a highly targeted real estate niche, such as waterfront properties, luxury homes, equine properties, or eco-friendly buildings, is a great way to differentiate yourself and attract a specific type of client. Consider creating a website, blog, or social media presence featuring your expertise in the niche. Attend industry events or join relevant organizations to network with potential clients and referral sources.

By establishing yourself as the go-to expert in your niche, you can generate distinctive, higher-quality leads, command premium fees, and build a strong reputation in your market. For some help on finding the best fit for you, check our guide to the hottest real estate niches you can jump in on.

34. Host a new agent open house

Hosting an open house event marketed explicitly as a “New Agent Open House” can be a great way to showcase your services, meet potential clients, and build buzz around your brand. Consider choosing a listing that aligns with your target audience and promoting the event heavily through social media, email marketing, and local advertising. During the event, focus on providing exceptional service, answering questions, and collecting contact information from attendees for future follow-up.

Real estate lead generation ideas for brand new agents

If you are a brand new agent, starting out in real estate can be intimidating, especially since you may have never learned how to run your business in real estate school. Use some of these strategies to kick-start your real estate lead generation and quickly get your business off the ground.

35. Reach out to your sphere of influence

When you’re just starting out as a new agent, reaching out to your sphere of influence, including family, friends, and colleagues, can be a great way to generate your first leads and build momentum in your business.

Consider sending a personalized email or letter announcing your new career and offering your services or hosting a small get-together to share your excitement and ask for their support. Be sure to make it easy for them to refer you by providing your contact information, business cards, or even a small gift with your branding. For more insight, check The Close’s tips for building your sphere of influence.

36. Attend investor meetups

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Suppose you’re looking for real estate investors to work with. In that case, attending local real estate investor meetups is a great way to network with experienced professionals, learn about the industry, and find mentors or clients.

Look for meetups that align with your target audience — such as those focused on fix-and-flip investors, rental property owners, or commercial real estate investors — and come prepared with business cards and a clear value proposition. Be sure to follow up with any promising connections after the event and look for ways to provide value or collaborate in the future.

37. Assist experienced agents

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Offering to assist experienced agents in your office with open houses, showings, or administrative tasks can be a great way to learn the ropes, build relationships, and generate potential leads. Consider reaching out to top-performing agents in your office and offering your services or asking your broker to recommend agents who may be looking for assistance. Be sure to approach the arrangement with a learning mindset and a willingness to go above and beyond to provide value to the agent and their clients.

38. Create a direct mail campaign

-

Cost: $1.00–$1.50 per piece

-

Time to Generate Leads: Weeks to months

Developing a targeted direct mail campaign can be a great way to introduce yourself to a specific neighborhood or demographic. Consider creating a series of real estate postcards or letters that showcase your unique value proposition, offer a free market analysis or home valuation, or invite recipients to an upcoming event or open house. Be sure to include a clear call to action and your contact information, and consider partnering with a local business to offer your recipients a special promotion or discount.

39. Attend community events

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Participating in community events, such as festivals, farmers’ markets, or charity auctions, can be a great way to introduce yourself to potential clients, build relationships, and establish yourself as a trusted local. This is the perfect opportunity to set up a booth or table at the event, offer a free giveaway or raffle, and collect contact information from interested attendees. Be sure to follow up with any leads after the event and add them to your email list for future nurturing.

40. Offer complimentary services

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Provide complimentary services like home valuations, buyer consultations, or staging advice to demonstrate your expertise, provide value to potential clients, and generate leads. Consider promoting your complimentary services through social media, email marketing, or local advertising and ensuring you have a straightforward process for collecting contact information and following up with leads. You should also consider partnering with a local lender or home inspector to offer a joint complimentary service package.

41. Join a team, find a mentor or brokerage

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Joining a team or finding an experienced mentor can be a great way to jumpstart your lead generation efforts, particularly when starting your business. Look for teams or mentors who align with your values, target audience, and career goals, and be sure to communicate your expectations and what you can offer in return. By leveraging a successful team or mentor’s resources, expertise, and network, you can accelerate your learning curve and generate leads more quickly.

Another option could be to look for and join a brokerage that offers leads or exclusive listings. Regardless, if you are a new agent and need affordable top-of-funnel leads, zBuyer is a solid choice. Its leads start at just $9 each, with no contract or setup fees. It even offers one free prospecting lead for every dollar you spend—up to 400 free leads per month.

42. Continuously educate yourself

-

Cost: Free to $1,000+ per class

-

Time to Generate Leads: Weeks to months

Investing in your education by attending training sessions, workshops, and conferences can be a great way to stay up-to-date on industry trends, develop new skills, and network with other professionals. Look for courses on social media marketing, lead generation, or negotiation techniques. You’ll be able to provide exceptional service to your clients and stand out from the competition. Use your newfound knowledge to create valuable content for your website and social media profiles.

43. Differentiate with unique skills

-

Cost: Free

-

Time to Generate Leads: Weeks to months

Leveraging your unique skills or background can be a powerful way to differentiate yourself from other new agents and attract a specific target audience. Consider how your previous experience, education, or personal interests could be valuable to potential clients. For example, if you’re fluent in a second language, you could target international buyers or investors. Highlight what makes you unique. Showcase your personality and passions in your branding and marketing efforts—people want to work with an agent they know, like, and trust.

Frequently asked questions (FAQs)

How do realtors generate real estate leads?

Realtors generate real estate leads through SEO web optimization, targeted social media ads, community events, and local business networking. The key is to focus on providing value to potential clients and building relationships with your target audience. By consistently implementing a range of real estate lead generation tactics and staying top-of-mind with your sphere of influence, you’ll be able to attract a steady stream of leads and grow your business over time.

What is the best strategy for lead generation?

The best strategy for real estate lead generation is the one that works with your unique strengths, market, and target audience. There’s no one-size-fits-all approach. Some of the most effective strategies include building a strong online presence, leveraging your sphere of influence, and providing exceptional service, leading to referrals. Focus on quality over quantity, and prioritize building relationships rather than just trying to close a sale.

How do you attract lead generation?

To attract lead generation, you must make yourself visible to potential clients and provide value upfront. This can include creating educational blog posts or videos, offering free home valuations or buyer consultations, and consistently engaging with your target audience on social media. The key is to position yourself as a trusted resource and expert in your market and make it easy for potential clients to find and connect with you online and offline.

What are some common lead generation challenges real estate agents face?

Some of the most common lead generation challenges real estate agents face include high competition, quality over quantity, lead conversion, market fluctuations, costs of lead generation, and lack of consistent lead flow. Some of the most effective ways to curb these challenges are to make a concerted effort to stand out in a competitive market, improve your lead quality, master digital marketing, nurture the leads you do have, and stay compliant with regulations.

Bringing It All Together

I hope these real estate lead generation ideas spark creativity and motivate you to take action. Success comes from consistency, innovation, and the courage to try new strategies. By blending online and offline lead generation tactics, delivering value to your audience, and continuously improving your approach, you’ll be on the path to becoming a top-performing agent in your market. Now, go out there and start building the thriving real estate business you envision!

What are your favorite lead generation techniques? Share your best ones in the comments below!