Listen, we’ve all been cautious of predictive analytics in real estate—looking at you, Zestimate! But with big data and historical pricing information, there are tools that can send homeowners regular messages reviewing what their house is worth. Homebot has entered the chat.

Homebot isn’t just a win for homeowners, though. It’s a way for agents to nurture their sphere as well as educate them—two birds with one stone. In the age of disinformation, people want to hear from a trusted source. Why can’t that be you? So let’s dive into the top features of Homebot, its pricing, and my full breakdown.

My Verdict

As both a real estate agent and coach, I’ve seen my fair share of software and even some cool AI tools designed to help agents stay connected with clients. Homebot stands out for me. It’s not just another tool—it’s a way to offer valuable insights that your clients will actually appreciate. People want to know what the value of their home is—Homebot keeps them off Zillow and engaged with you on a monthly basis. And at $25 a month, it feels like a no-brainer.

I recommend Homebot to every one of my coaching clients because of the low cost and the added value you’ll bring to your sphere. While I still coach agents to use the FORD method—asking their sphere about their family, occupation, recreation, and dreams—I do think Homebot can help agents who worry about just making small talk a few times per year. While it’s still important to stay up to date with your clients’ lives, Homebot provides you (and your clients) with actionable advice. If you’re looking to up your client engagement game without emptying your wallet, I’d recommend checking out Homebot.

What Is Homebot?

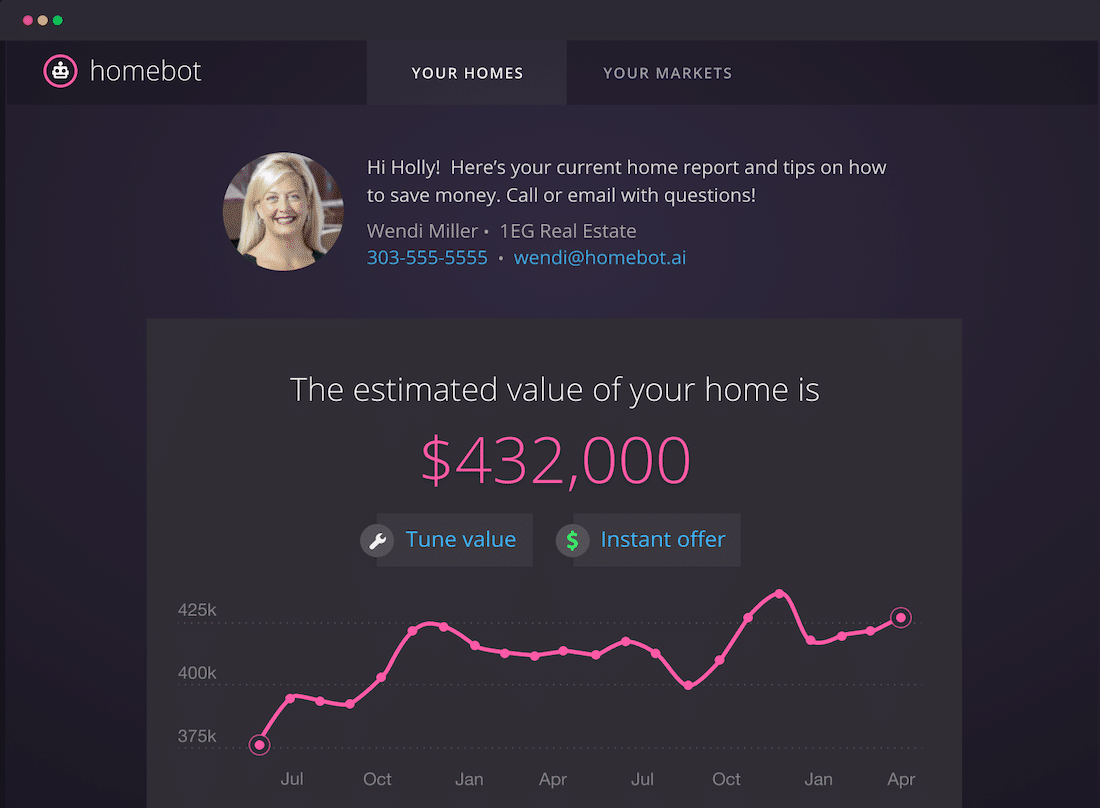

Homebot is a lead nurturing tool that helps real estate agents educate clients on what their home is worth via a monthly automated email. What’s great about Homebot is that it offers personalized insights, not just a number. This automated valuation model (AVM) is based on market data from more than 20,000 neighborhoods, updated weekly.

You can also partner with a lender to unlock other cool features like a Chrome extension plugin and browsing on Zillow with a Homebot insights sidebar. You might not be able to keep leads off Zillow, but you can still provide better insights while they browse it.

Homebot Pricing

For Real Estate Agents

Homebot offers a straightforward and budget-friendly pricing model for agents. There’s even a way to get a freemium version through your lender partner. The Pro Plan for agents starts at $25 per month with a one-time setup fee of $50. Here’s what you get:

- Personalized home value insights delivered to 500 clients every month

- Customized insights for homeowners

- Basic integrations

Note: If you want to add more clients, you can do so in blocks of 500 for an additional $10 per month.

For Lenders

In most transactions, the lender is essential—and most agents have a few preferred mortgage professionals in their pocket. When your lender partners with you on Homebot, that’s where the magic happens. You’ll unlock these premium features:

- Homebot Home Search Chrome browser extension

- Video manager and video email

- Personalized URLs for your listings

- Additional insights for clients when they browse Zillow

With these extra bells and whistles, pricing is a bit more involved for lenders. There’s a $200 one-time setup fee and a base subscription of $150 per month. The reason for the big jump in pricing when compared to the agent offerings is that the lender pricing unlocks other features specific to mortgage professionals, such as the ability to offer a freemium version to agent partners.

Key Features

Automated Home Value Insights

One of the core features of Homebot is its ability to provide automated and personalized home value insights. They use one of the largest real estate databases, Altos Research, to give homeowners an accurate picture of what their home is worth.

If your clients don’t agree, they have the option to change it (after which you’ll receive a notification). Don’t worry—your clients are only given a realistic adjustment range based on Homebot’s data models and market trends. This number will be saved for your client, but won’t impact Homebot’s data reporting.

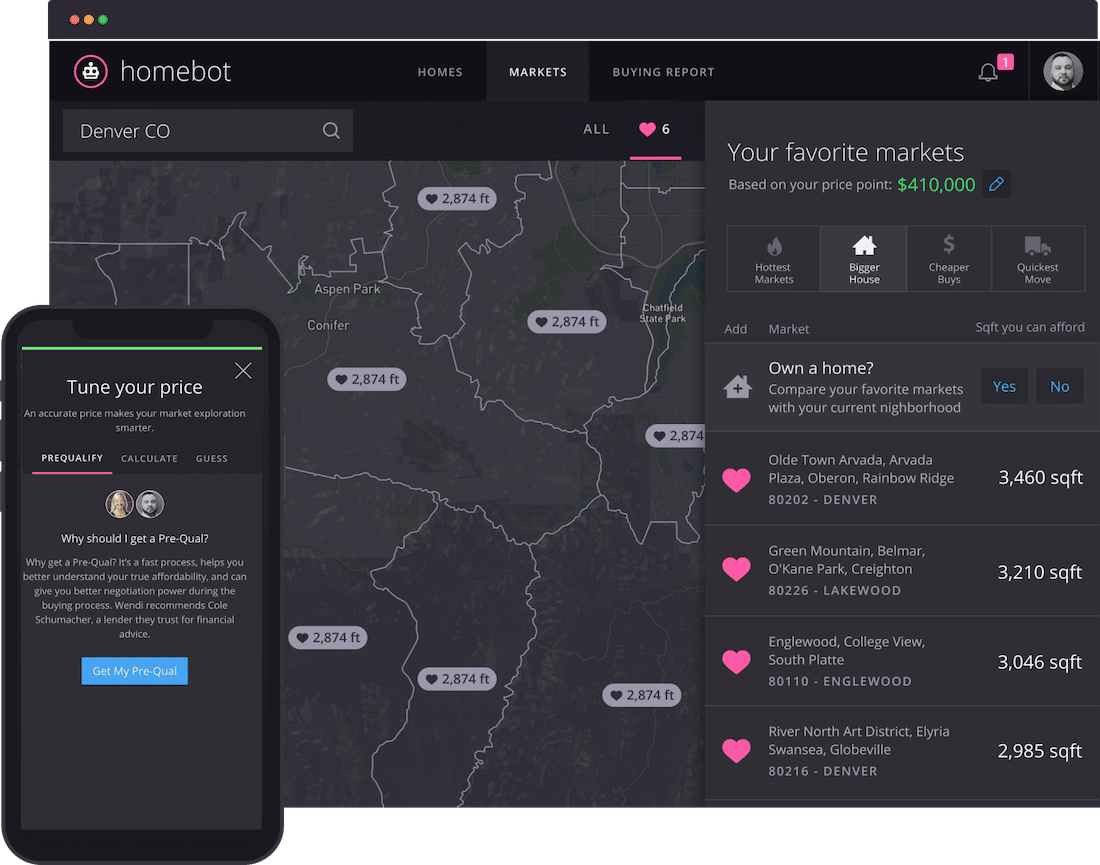

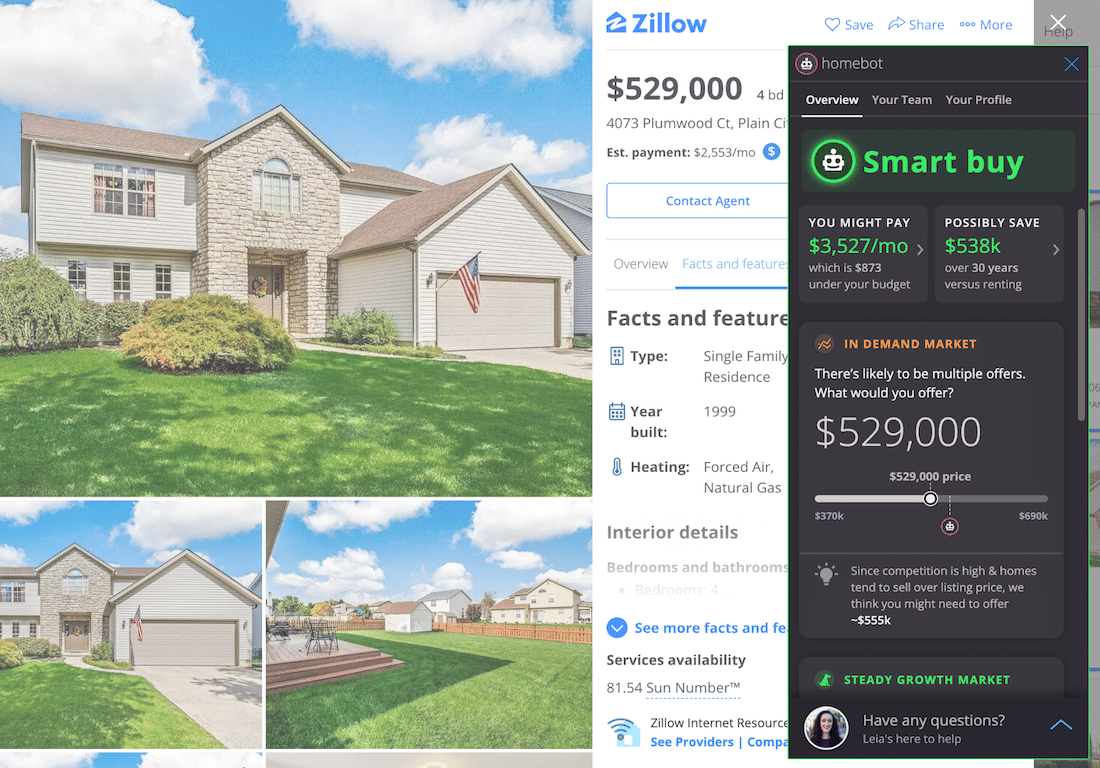

The insights also extend into the “Homebot Home Search Experience.” This is a really cool feature where Homebot integrates directly with Zillow in the user’s browser, so your clients will get added Homebot insights while they browse Zillow. Let’s dive into that feature further.

Homebot Home Search Experience

The question on your mind at this point is most likely, “Are Homebot’s values more accurate than Zestimates?” The answer is unequivocally yes. I’ve dug into the Zestimate data and Zillow’s nationwide margin of error is 7.7% for homes that are off market. Altos Research, which provides data to Homebot, has roughly 20,000 hyperlocal markets and pulls data on “over 100 million properties every week.”

Zillow’s model is limited to the data that Zillow has access to—which relies on partnerships with MLSs nationwide. But agents know how fickle those partnerships can be. On the other hand, Altos Research positions itself as “the only company to analyze the entire active market in real time, tracking every property listed for sale or rent in the U.S.”

Looking at the snip above, this is what homeowners will see when they use the Homebot home search function. It’s a much cleaner interface that keeps your clients engaged with you, not the featured Zillow Premier Agent.

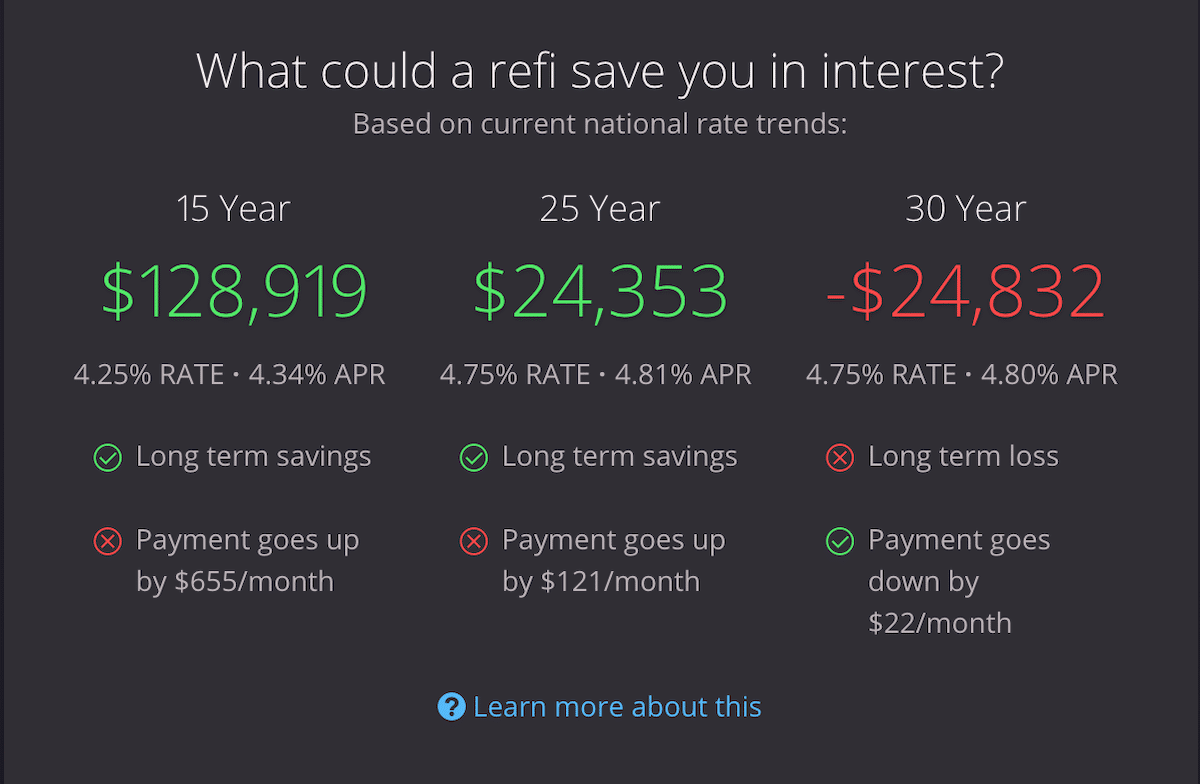

Refinancing Scenarios

With rates at recent highs, a lot of homeowners don’t have any idea of what they could afford if they chose to refinance or buy. Homebot gives your prospects several possible refinancing scenarios based on current mortgage rates. You can help your clients better understand the value of their largest financial asset, especially in uncertain times.

Personalized Landing Pages (PURLs)

Personalized URLs, or PURLs, are a way Homebot can help you grow your client base. These landing pages capture new leads and put them directly into your Homebot database. When a new visitor lands on your PURL, they’re prompted to enter their home address to receive an instant home valuation (powered by Homebot).

You can use this in a lot of different ways, like with social media advertising or with an open house on a new listing. We’ve seen the power of landing pages for real estate agents, and the fact that Homebot designs this for you is a boon for your productivity.

These pages have a great user interface and an actual reason for visitors to input their info—they’ll get the value of their home without waiting for a real estate agent to pester them. I also like the fact that you have an easy intro for your follow-up. Just ask your new client about what they thought of their home’s predicted value.

📌 Pro Tip

Use a PURL as a sign-in page for your next open house to add visitors directly to your database!

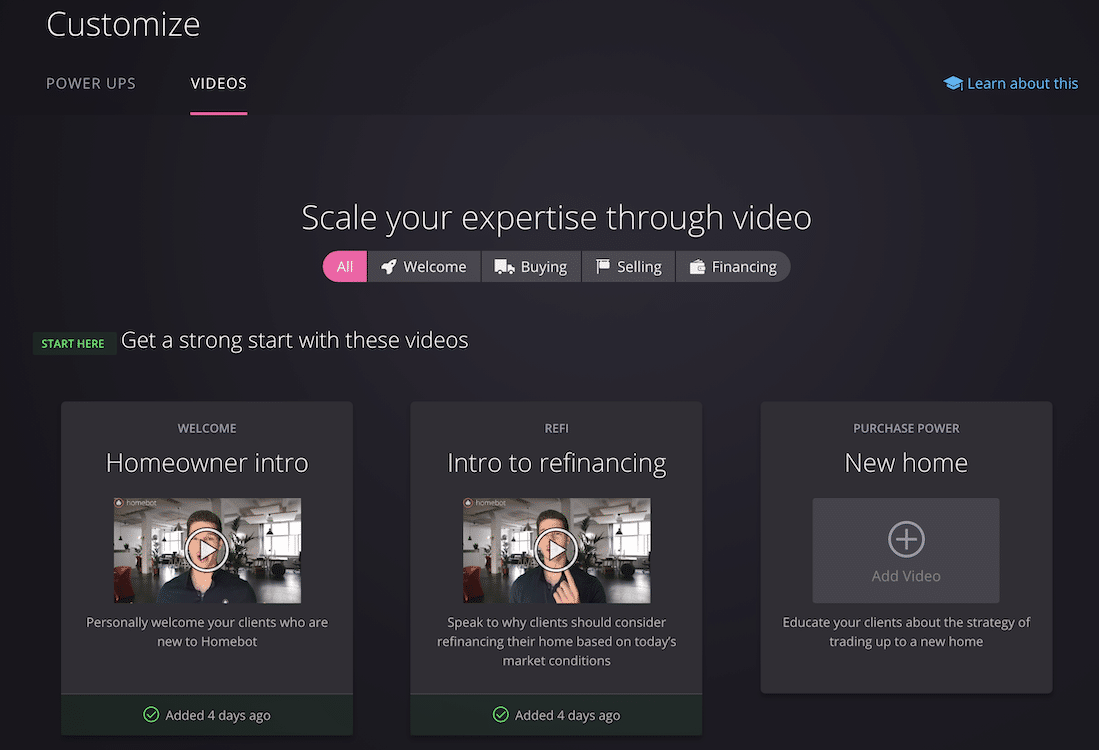

Client Nurturing With Video Manager

Another great feature I love is Homebot’s video manager*. With this, you can upload videos around common client pain points and send them to your sphere every month as an engagement tool. You can import these from YouTube, BombBomb, or other popular video platforms as well. This makes it super easy to email your videos to keep your clients engaged beyond the automated home value email.

Make a few videos that explain refinancing, provide personalized video market updates, or just simply check in with your sphere to give them that personal touch. When you get a new client in your Homebot database, your “Homeowner Intro” can be sent at the touch of a button.

*Video Manager is only available to agents cosponsored by a lender or lenders on the Pro plan. Otherwise, you can choose from a few premade videos to engage your clients.

Integrations

Within the Homebot platform, you can view your open rate, click-through rate and see which of your prospects have engaged with their Homebot email. It’s pretty straightforward so I don’t want you to worry about the fact that Homebot doesn’t have a ton of integrations.

Homebot does partner with Total Expert CRM, BombBomb, and Mortgage Coach. But more importantly, the company has an open API. So if you’re a tech-savvy agent, you can get in touch with their team to put together a custom integration. This also means you can use a tool like Zapier to connect Homebot to a CRM you’re using with minimal headaches.

When you partner with a lender, those plans offer a Chrome extension and a Zillow plugin. After all, we know it’s almost impossible to keep your clients off of Zillow. This feature could be the extra nudge you need to nurture a great conversation with your client about a home they saw on Zillow. Based on the buyer’s profile, Homebot provides a “buy score” for a home, letting them know if this is a smart, fair, or a weak purchase price, as well as estimated monthly costs and savings compared to renting.

📌 Pro Tip

Touch base with your lender partners to see if they’re interested in partnering with you on Homebot. Some of the lender plans come with a freemium version for real estate agents. Strengthen the relationship with your preferred lender and perhaps even snag some referrals!

Homebot Alternatives

Here’s the thing—in the world of real estate tools, Homebot stands alone. With artificial intelligence (AI) valuations, it’s more important than ever to keep that client relationship alive. Homebot is an innovative tool that has more accurate valuations than a Zestimate and provides real value for your clients. I haven’t been able to find a tool that does what Homebot does, especially for the price. However, if some of these features sound appealing, here are a few other companies you might like to consider.

Wise Agent

If you like the lead nurturing aspect of Homebot, Wise Agent could be a good choice for a more all-in-one solution, including a customer relationship manager (CRM). It’s budget-friendly and has great support. In contrast to Homebot, which focuses on home value and financing, Wise Agent gives you a broader range of functions if you’re not already using a CRM or lead nurture software.

Wise Agent Review: Pricing, Features, Pros & Cons

Agent Legend

If you like the fact that Homebot’s lead nurturing is automated, you might want to check out Agent Legend. You can tailor follow-ups via text and email, with plenty of templates to customize your communication. While Homebot is geared more toward nurturing your current sphere, Agent Legend is really more about converting your new leads. This could be a great alternative for agents using online lead generation companies.

Agent Legend Review: Pricing, Features, Pros & Cons

Kiavi

If you work more with real estate investors, Kiavi is great. Your clients can use anticipated rental income in qualifying for a mortgage. This software levels the playing field for your clients looking to step into the investing world. You can use this in tandem with Homebot to help those who refinance and are looking to roll that money into a rental property.

The 6 Best Hard Money Lenders of 2025 (+ Interest Rates & Fees)

The Bottom Line: Is Homebot Worth the Money?

Homebot is an amazing addition to any agent’s existing toolkit, and it won’t cost you an arm and a leg. This isn’t just “touching base” to see how things are going—you’ll be offering personalized financial insights to your clients, which go much further than calling them to ask them the FORD questions for the third time this year.

Homebot’s focus is on client nurturing—something I preach a lot in my coaching. What I like about the company’s approach to this vital part of the client relationship is that Homebot is designed to complement your current system. If you’re aiming to give your client nurturing strategy a tech-forward edge without overwhelming yourself, Homebot is your go-to.

Methodology

In evaluating Homebot, I used my firsthand experience of the platform as both a real estate agent and a coach. I’ve been a fan of Homebot for years and I’ve recommended it to many of my coaching clients with great success.

Here at The Close, our goal is to offer actionable advice to help our readers succeed. Just to be clear: Homebot has not paid for this review, and my enthusiasm for Homebot has not influenced my evaluation. Our product review methodology emphasizes thoroughness and an unbiased take.

What’s Your Take?

What do you feel about predictive analytics software and letting AI predict home value in real estate? Do you feel like this product could work for your business?

We love to hear from our readers. Please share your experience with Homebot or other thoughts in the comment section below.

Add comment