If you’re looking into investing in real estate and are weighing your options on how to finance it, a hard money loan might be something to consider. Especially if you may have difficulty obtaining funding from a traditional bank loan, or are looking for something more flexible. Hard money loans are usually short-term, and secured by real estate being financed.

If you’re looking for a hard money lender that has flexible qualifications and can offer quick access to funds for a new investment or fix-and-flip property, take a look at the lenders I’ve reviewed below.

- Kiavi: Best overall for favorable rates and terms

- RCN Capital: Best for investors with varying experience

- Lima One Capital: Best for various investment strategies

- New Silver: Best for instant loan approvals

- Groundfloor: Best for new investors

- The Investor’s Edge: Best for 1-on-1 project assistance

The Close’s top picks for best hard money lenders

| Kiavi: Fix-and-flip financing | Visit Kiavi ↓ | |||

| RCN Capital: Large loan amounts | Visit RCN Capital ↓ | |||

| Lima One Capital: Various investment strategies | Visit Lima One Capital ↓ | |||

| New Silver: Instant loan approvals | Visit New Silver ↓ | |||

| Groundfloor: New investors | Visit Groundfloor ↓ | |||

| The Investor’s Edge: 1-on-1 project assistance | Visit The Investor’s Edge ↓ |

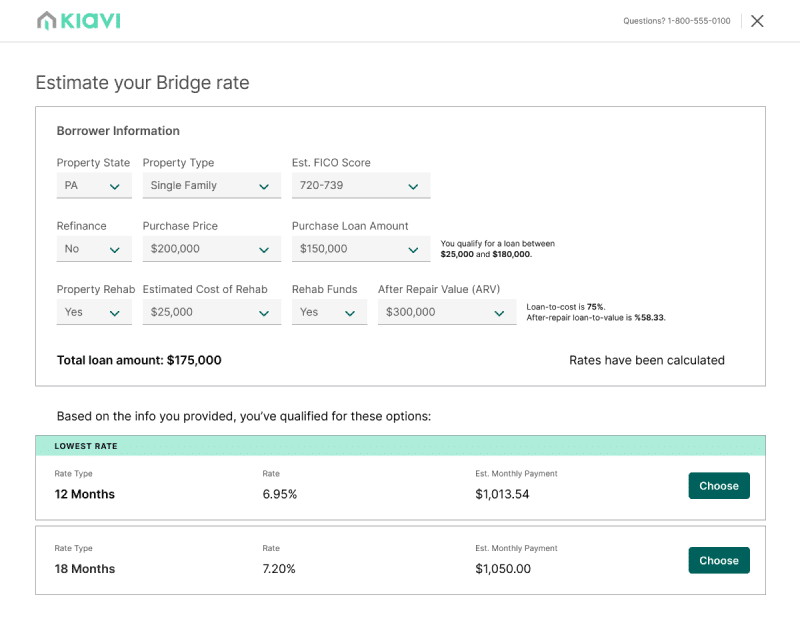

Kiavi: Best overall for favorable rates and terms

|

|

|---|---|

Pros | Cons |

|

|

|

|

|

|

| |

Rates & Terms

- Starting interest rate: 7.75%

- Loan-to-value ratio (LTV): 95% LTC (loan-to-cost), covering up to 100% of rehab costs, 80% ARV (after-repair value)

- Upfront fees: No upfront fees; 1.5% to 3% origination fee

- Term: 12, 18, and 24 months

- Credit requirement: 660

- Min and max loan amount: $100,000 to $3 million

- Prepayment penalty: Yes

- Property types: Single-family homes, attached and detached planned unit developments (PUDs), and 2-4 unit rentals

Why I chose Kiavi

For fix-and-flip investors, Kiavi is a noteworthy contender to consider. It offers fix-and-flip financing and efficient loan processing that can get you access to funding for your investment quickly. You can close in as little as 7 days, allowing you to compete with cash buyers and tackle your project as quickly as possible. It keeps the process simple, with no application fees, appraisals, or income verification to get started.

Additionally, its starting rates are highly competitive, along with its flexible qualification requirements. You don’t even need prior flipping experience in order to be considered eligible, which can be a great benefit for new investors working on their first few projects.

Additional features

- Prequalification: With just a soft credit pull, real estate investors can prepare to make quick offers on any opportunities that arise.

- Flexible loan amounts: With loans up to $3 million, Kiavi can accommodate a wide variety of project needs, from small renovations to large-scale projects.

RCN Capital: Best for investors with varying experience

|

|

|---|---|

Pros | Cons |

|

|

|

|

|

|

|

|

Rates & Terms

- Interest rate: 9.20%

- Loan-to-value ratio: Up to 90% of the purchase price, 100% of renovation cost (not to exceed 75% of ARV)

- Term: 12 & 18 months

- Upfront fees: No upfront fees. 3% to 6% origination fee

- Credit requirement: 650

- Min and max loan amount: $50,000 to $3 million

- Prepayment penalty: No

- Property types: Condo, townhouse, single-family, duplex, multiunit, mixed-use; not for owner-occupied properties

Why I chose RCN Capital

Whether you’re a new, intermediate, or experienced investor, RCN Capital has financing options available for your project. It can fund large-scale development projects, multiple rental properties, and more since it offers high lending limits. That said, it determines the maximum loan value based on the loan program and the value of the real estate asset as collateral. Rates and LTV can vary based on your experience. However, rates, terms, and qualifications are quite competitive.

With RCN Capital, you only pay interest on the money you’ve actually borrowed, not the portion set aside for renovations. Since there are no penalties for paying early, you can wrap things up ahead of schedule and keep more cash in your pocket. It has a pretty standard application process that can be completed online and involves credit checks, background checks, bank statements, and property appraisals.

Additional features

- Rehab Budget Builder: This tool is available to help investors analyze their investments to understand cost, risk, ROI, etc.

- Video Library: It includes up-to-date videos that offer market updates, investment tips, and motivational content.

Lima One Capital: Best for various investment strategies

|

|

|---|---|

Pros | Cons |

|

|

|

|

|

|

Rates & Terms

- Interest rate: Varies

- Loan-to-value ratio: 92.5% of LTC, 75% ARV

- Term: 6 to 24 months

- Upfront fees: Varies

- Credit requirement: 600

- Maximum loan amount: Varies

- Prepayment penalty: None

- Property types: Townhouse, single-family, multiunit up to 4; not for owner-occupied properties

Why I chose Lima One Capital

This includes fix-and-flip loans, lines of credit, and bridge loans. These can be used for a wide variety of investment uses, such as rentals, new builds, multifamily properties, and short-term rentals. Plus, it gives investors a bunch of different loan terms and structures depending on their specific investment needs. With repayment terms up to 24 months, it’s a great pick for experienced borrowers looking to finance and manage their projects quickly.

Its qualifications are pretty flexible, but rates, terms, and conditions will all vary based on your creditworthiness, experience, and investment goals.

Additional features

- Case studies: Detailed case studies on the website illustrate the strategies, financial figures, challenges, and outcomes of real-world property investments.

- Podcast: A podcast covers various topics relevant to real estate investing and provides ongoing education and industry insights in an easily accessible audio format.

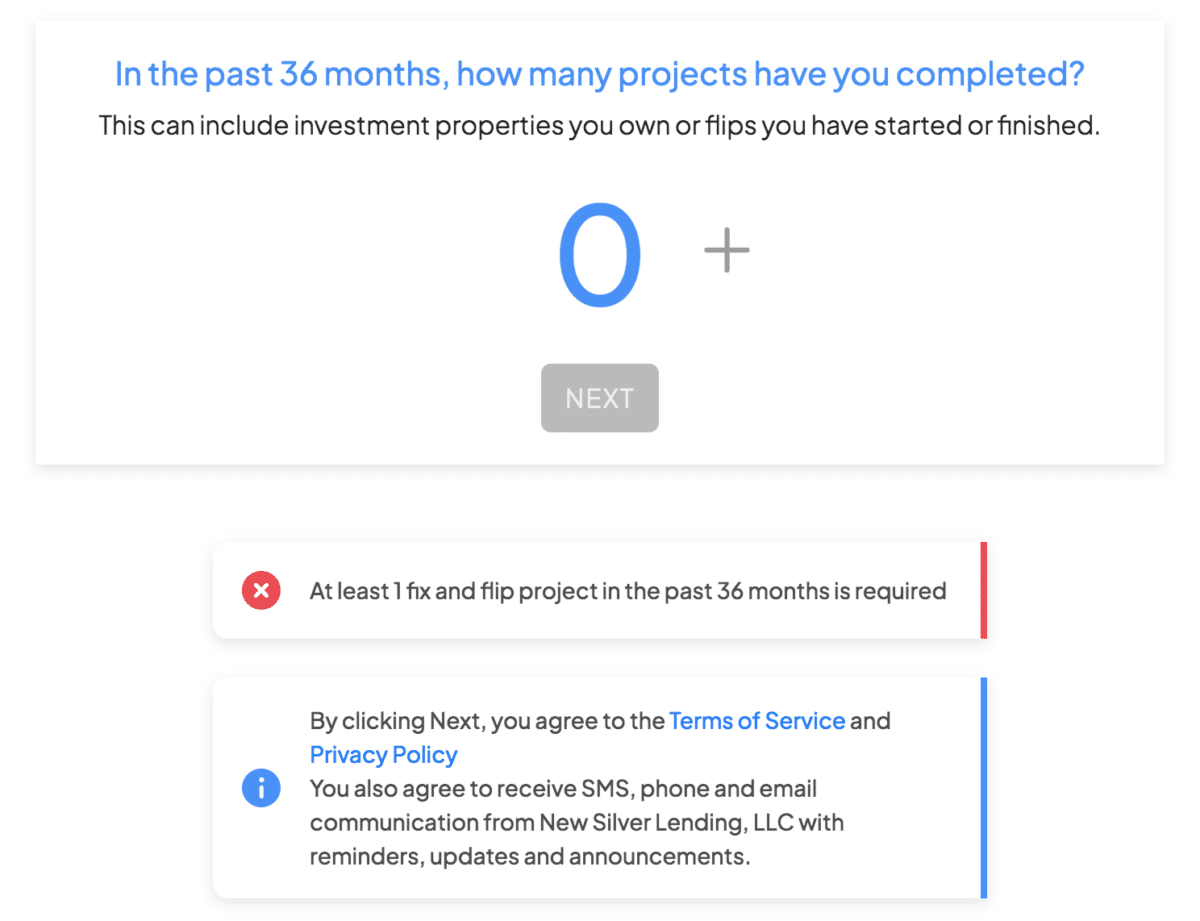

New Silver: Best for instant loan approval

Pros | Cons |

|

|

|

|

|

|

Rates & Terms

- Interest rate: 9.5% to 11.25%

- Loan-to-value ratio: 92.5% of LTC, 80% of ARV

- Term: 18 months

- Upfront fees: 1.25% to 2% origination fee, $1,000 underwriting fee, $1,350 legal fee

- Credit requirement: 650

- Maximum loan amount: $100,000 to $5 million

- Prepayment penalty: None

- Property types: Residential 1 to 4 units, condos, townhomes

Why I chose New Silver

New Silver offers a streamlined loan application and approval process that’s fueled by AI. Real estate investors looking for a fix-and-flip hard money loan can benefit from its instant online approval, in which the application takes as little as 5 minutes. The closing timeline is also swift, and can be facilitated in as quick as 5 days.

The loans are secured by real estate and only require a soft credit pull and property value assessment to get started. There’s no income verification necessary, cutting down the need for paperwork and ultimately speeding up the time between application and accessing funds for your project.

Additional features

- Advantage Program: Enhanced loan terms and rates for repeat borrowers who have successfully completed previous projects with New Silver.

- The Lender Blog: An up-to-date blog covering various real estate topics such as strategy, market trends, and success stories.

Groundfloor: Best for new investors

Pros | Cons |

|

|

|

|

|

|

Rates & Terms

- Interest rate: 9.99%

- Loan-to-value ratio: 70% of LTARV

- Term: 6 to 18 months

- Upfront fees: $495 evaluation fee, 2% to 4.5% origination fee, $1,250 closing fee

- Credit requirement: 640

- Maximum loan amount: Up to 100% of purchase price

- Prepayment penalty: No

- Property types: New construction, condo, townhome, single-family, multiunits up to four

Why I chose Groundfloor

Groundfloor can be a great option for investors new to the fix-and-flip scene, as no experience is required to be considered eligible. It offers nationwide financing opportunities that can provide you with quick access to funds, since closing can take as little as 7 days. Based on your investment needs, it can cover 100% of costs, although specific loan terms will vary based on the investment scenario and your qualifications.

It also has a solid education hub, which provides investors with tons of videos on building wealth and managing finances, which can be a great benefit for borrowers looking for continued growth opportunities.

Additional features

- Blog: A regularly updated blog provides news, insights, updates, and educational content related to real estate investing and personal finance.

- Debt service coverage ratio (DSCR) loans: Long-term loans are available based on the cash flow generated by the property instead of loan approvals based on the investor’s income.

The Investor’s Edge: Best for 1-on-1 project assistance

|

|

|---|---|

Pros | Cons |

|

|

|

|

|

|

Rates & Terms

- Interest rate: 10% to 18%

- Loan-to-value ratio: 80 to 100% of LTC, 74% ARV

- Upfront fees: $495 evaluation fee, 5.5% to 6.5% origination fee, $1,200 doc prep fee

- Credit requirement: No minimum credit score

- Maximum loan amount: Up to 100% funding, varies per property

- Prepayment penalty: None

- Property types: New construction, condo, townhome, single-family, multiunits

Why I chose The Investor’s Edge

The Investor’s Edge is all about creating personalized investment plans and working closely with investors on their projects. It offers free one-on-one consultations to help you determine financial goals and the best investment strategies. Beyond consultations, The Investor’s Edge team helps you identify, fund, and sell your properties. If you want one of the best hard money lenders for flipping houses, it has a variety of specialized courses on flipping homes and land, which can be a great benefit for real estate investors looking to gain the necessary skills and knowledge to thrive in the market.

Additional features

- Gap financing: A short-term loan available to investors covers the difference between the total funding needed for a project and the principal amount already secured.

- The Investor’s Edge Software: A comprehensive tool for investors to efficiently perform real estate market analysis, property valuation, and investment strategy planning.

Frequently asked questions (FAQs)

What are the typical interest rates for hard money loans?

Hard money loans tend to be more expensive than traditional bank loans. Since they come with a bit more risk, this is often mitigated by a higher interest rate or fees. Rates can vary widely based on a variety of factors such as creditworthiness, property details, and lender preferences, however you can generally expect a rate between 7% to 15% or more.

How quickly can I receive funding from a hard money loan lender?

One of the best reasons to get a hard money loan is that they often provide quick access to funding. In some cases, this can be as little as a few days from application and approval, with 7 to 10 days being the most common. This can be a great benefit if you’re competing with cash buyers or have a quick turnaround project timeline.

What are the typical financing terms of the best hard money loans?

Terms will vary widely with a hard money loan depending on the lender and investment scenario. Common characteristics generally include a short-term repayment period, interest-only installments with a balloon payment at maturity, and collateral requirements that involve the real estate property itself.

How to choose a hard money lender

Whether you’re a seasoned investor or a first-timer, working with the right hard loan lenders is vital to the success of your project. It’s important to carefully consider your options and determine your budget and strategy. Keep these factors in mind when you’re on the lookout for a hard money lending institution:

-

Lender reputation: Research the lender’s track record, customer reviews, and industry reputation to ensure they are reliable and fair.

-

Loan terms: Fully comprehend all loan terms, including interest rates, fees, loan-to-value ratio, and repayment schedule.

-

Speed of funding: Since time is often critical, assess how quickly the lender can process and fund the loan.

-

Professional advice: Consider consulting with a financial advisor or real estate professional to help navigate the process and select the best lender for your unique needs.

-

Compare multiple offers: Don’t settle for the first lender you meet. Compare different offers to find the best terms and rates.

-

Transparency: Ensure the lender is transparent about all costs, fees, and any penalties associated with the loans.

Methodology: How I chose the best hard money lenders

We use a methodology focused on the most critical factors to find the top hard money lenders for real estate to create an unbiased review. I reviewed various lenders against multiple key factors to ensure I viewed them through the lens of what would be most important to a potential real estate investor. The detailed analysis then isolated lenders that support good, solid financial solutions and blend well with various investment strategies and goals.

Key factors involved with this process included the following:

- Interest rates and loan terms: Assessed the competitiveness and flexibility of each lender’s offerings.

- Speed of loan processing and funding: Evaluated how quickly each lender processes and disburses funds, a crucial factor for time-sensitive investments.

- Lender reputation: Examined customer reviews and industry feedback to gauge each lender’s reliability and overall customer satisfaction

- Transparency: Focused on how openly each lender communicates fee structures and loan conditions, ensuring no hidden costs exist.

- Geographical coverage: Considered the availability of services across different regions to accommodate investors in various locations

- Target audience suitability: Analyzed which types of real estate investors (e.g., fix-and-flippers, buy-and-hold investors, and commercial developers) best cater to them based on their product offerings and specialty areas

Your Take

Comparing hard money loan lenders can be overwhelming when looking to finance your next investment. This guide can help you at least have a starting point, along with help in understanding rates, terms, and fees. The best choice for you will not only finance your project but also support your strategy and overall investment goals. Be sure to choose the right lender that will set you up for success.

Add comment