Like other real estate professionals, mortgage brokers need consistent leads to grow their businesses. Mortgage lead generation is unique since many homebuyers and sellers aren’t actively searching for a mortgage loan officer. However, mortgage brokers can create and maintain steady, high-quality leads using effective marketing methods like landing pages, social media, advertising, and networking. Here are ten of the most effective tips to generate leads for mortgage brokers.

1. Buy Mortgage Leads

-

Cost: Subscription starts at $22 per month

Learning how to get leads as a mortgage broker can be a unique process since various methods exist to grow your business. However, it’s wise to consider buying leads because this may be the fastest and most direct way to build your clientele. Start by establishing your budget so you know how much you can afford to invest. Remember also to consider the tactics you’ll need to use to reach these leads, such as cold calling, email, or direct mail marketing campaigns.

Even when you purchase leads from one of the best mortgage lead sources available, pay attention to your return on your investment (ROI). The money you earn needs to be commensurate with the money you invest to generate leads. A few of the best mortgage lead generation companies include the following:

| Mortgage professionals who want full-service marketing and automation tools | |||

| Mortgage brokers focusing lead generation efforts on social media | ||

| Mortgage teams who want to organize and track lead generation and nurturing efforts |

2. Generate Leads With a Website & Landing Page

-

Cost: $50-$500

A real estate website serves as a home base for businesses in all industries and is essential for generating leads for mortgage brokers. Getting a mortgage is confusing and overwhelming for many consumers, so having a website that showcases your value and answers potential customers’ questions is vital to growing your business.

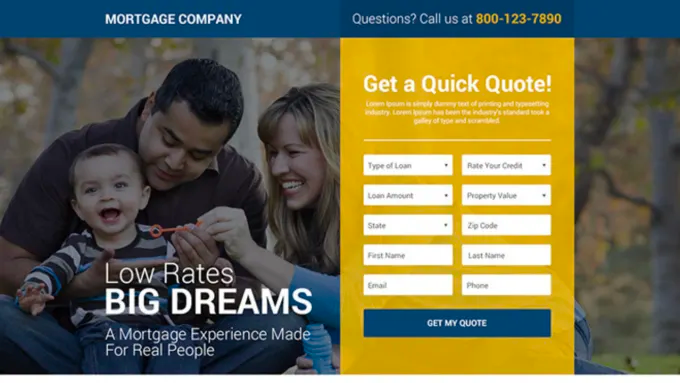

In addition to your website, build separate landing pages to target each type of lead and prompt them to provide their contact information. For example, your landing page could offer a free rate quote, downloadable home loan checklist, or mortgage calculator in exchange for the prospect’s name and email address. Landing pages make it easy for visitors or social media followers to receive targeted content in just a few clicks and convert it into leads.

Landing pages must be informative, visually appealing, and include a call to action (CTA) to direct leads into your pipeline. If you’re not sure how to get started with your website and landing page, consider using a paid service like Fiverr. With Fiverr, choose from a large pool of pre-vetted and qualified freelancers to assist you with designing and creating your website and landing page.

3. Run Online Advertising Campaigns

-

Cost: $10-$1,000 per month

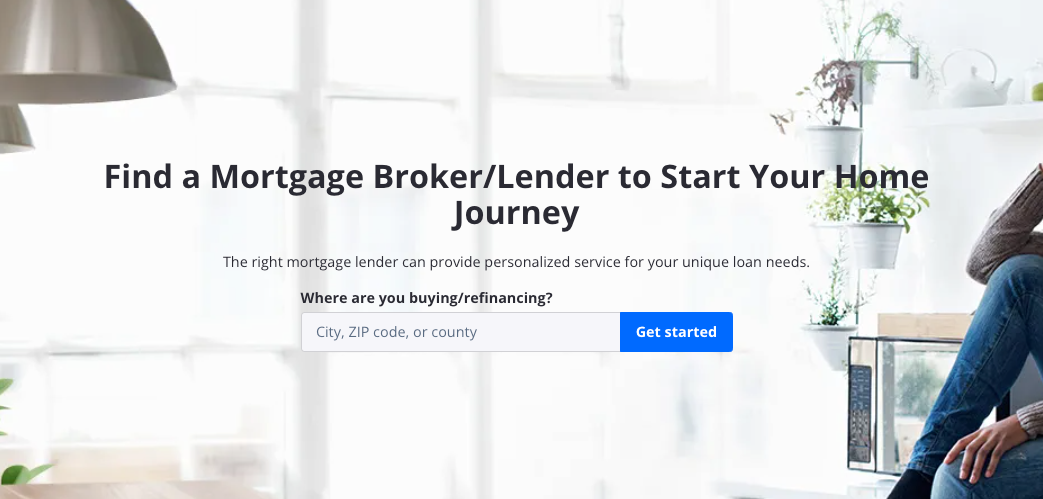

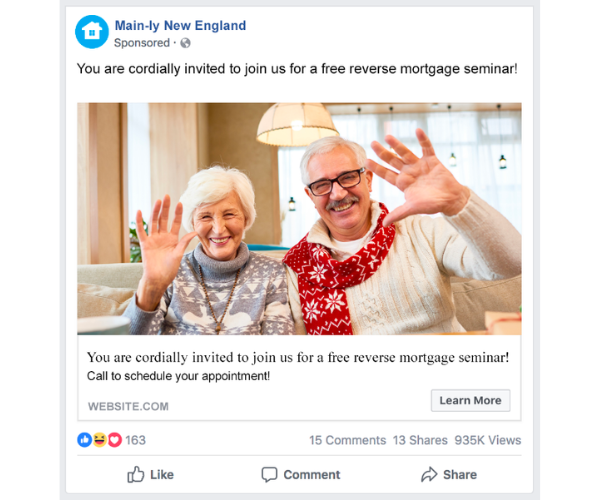

Leverage your website and online content for mortgage loan originator (MLO) lead generation, as online advertising is an ideal way to attract targeted customers. Online ad platforms like Google, Facebook, and Zillow have detailed targeting capabilities. They allow you to target specific locations, behaviors, demographics, and interests—ultimately getting your ads in front of the individuals most likely to convert into leads and customers.

There are an endless number of online advertising options, but a few of the best mortgage lead generation strategies include the following:

- Google ads: Many people start thinking about getting a mortgage by searching for information in Google, so getting your name and website in their search results is an ideal way to attract the highest converting mortgage leads. Learn more about using Google ads for lead generation in our guide.

- Social media ads: Social media is an incredibly effective way to find and connect with a targeted audience. 60% of mortgage brokers say that Facebook is the most effective social platform and has some of the most advanced advertising and targeting tools. Running ads on social media could be the key to attracting consistent quality leads online.

- Local advertising: Consider investing in hyperlocal online platforms like Nextdoor, Ring Neighbors, Facebook groups, or Facebook Marketplace. These allow you to take advantage of online targeting but keep your ads focused within a geographical area.

- Zillow Connect: Zillow is among the best lead generation for mortgage lenders as the top real estate platform. Connect, their mortgage lead generation platform, provides advertising on Zillow and Trulia and helps loan officers connect with ready-to-purchase leads quickly and easily. However, availability is limited, so contact Zillow to learn more about the program.

4. Tap Your Sphere of Influence for Referrals

-

Cost: Free

Your sphere of influence (SOI) includes the relationships you already have in your life, from friends, family members, and community peers to past clients and other business owners. Your SOI is a valuable mortgage lead source—especially former clients—because they already know you and have firsthand experience with you as a valuable, trusted resource.

Your existing network will most likely generate some of the best mortgage leads because of their personal experience with you, so consistently ask them for referrals. Generate referrals by sending emails, communicating on social media, or delivering small pop-by gifts to show your appreciation.

One of the best and most efficient ways to send pop-by gifts to previous clients is by using an automated gift-giving service like EvaBot. They provide various gift options for every budget, like Polaroid cameras, doorbell cameras, candles, coffee, and cocktail kits. Customize the gifts to each recipient’s preferences or send branded gifts with your logo to remind clients about your business.

5. Establish Relationships Within the Real Estate Industry

-

Cost: No cost, but you’ll need to invest several hours of your time each week

Mortgages and real estate purchases go hand-in-hand. This is why building relationships and partnerships with real estate agents are tried-and-true strategies to generate leads for mortgage brokers. It’s essential for agents to have a trusted mortgage broker to recommend to their clients—after all, their clients’ mortgage experience will reflect on them and will simplify or complicate their transactions.

Consider providing a presentation to agents explaining how you’re an asset and creating a partnership to generate real estate leads and benefit both parties. You can also offer to help host a first-time homebuyer seminar, becoming a fixture for questions and information related to mortgages. Make sure to have business cards ready to connect with mortgage leads at each event.

6. Optimize Communication With a CRM

-

Cost: Free; subscription costs as low as $14 per month

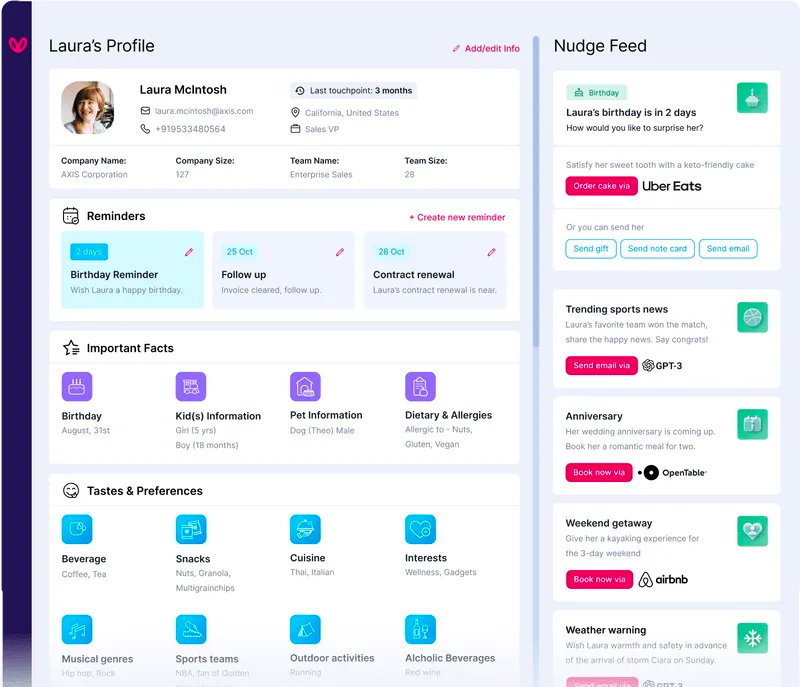

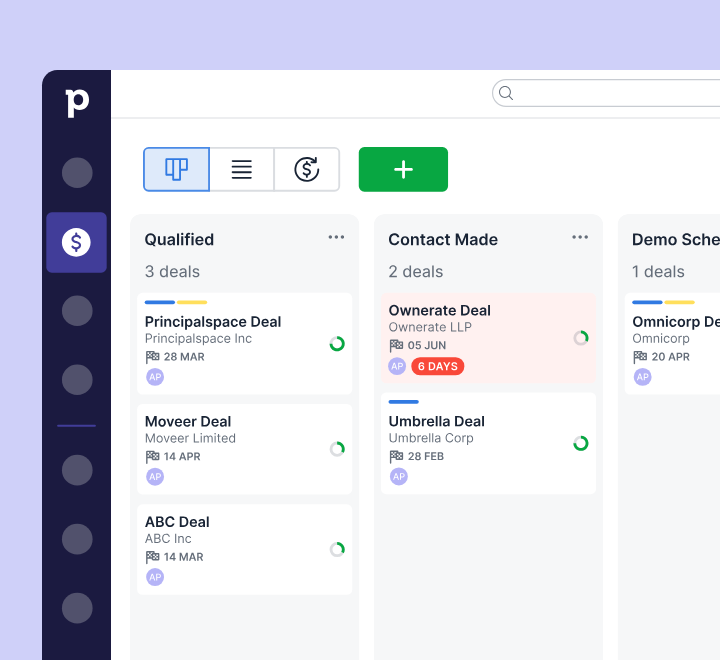

As you invest in mortgage lead generation, you’ll grow a contact list that quickly becomes too large to manage manually. This is when it’s best to choose a customer relationship manager (CRM) to organize, track, and monitor every lead to prevent customers from falling through the cracks.

Although most CRMs have a learning curve, they’re an essential tool for mortgage professionals who want to become successful and build a sustainable business. CRMs provide lead management, and many have marketing, transaction management, and robust digital communication capabilities.

If you want an affordable and versatile CRM to track and customize your pipelines, try Pipedrive. With Pipedrive, you can organize and manage your leads and clients more efficiently by automating tasks such as reminders and email follow-ups. Additionally, Pipedrive’s integration capabilities with various tools for document management, invoicing, payment tracking, and lead nurturing allow brokers to work directly within the platform.

7. Showcase Your Expertise & Personality on Social Media

-

Cost: Free; subscription for social media templates starts at $10 per month

One of the challenges of marketing a mortgage business is that it’s a topic that many consumers don’t understand or feel particularly interested in. However, social media marketing is an ideal way to overcome that obstacle to connect with people in your community and showcase your personality, expertise, and trustworthiness. Use social media platforms like Facebook, Instagram, LinkedIn, YouTube, and TikTok to educate your audience about real estate mortgages. For example, you could create videos on mortgage rates and answer complex questions.

If consumers see you post educational and easy-to-understand content, they are more likely to trust your expertise and reach out to you. This is likely one reason why 44% of loan officers say social media is a successful tool for generating leads for mortgage brokers.

8. Provide Value Through Content Marketing

-

Cost: Free

The mortgage process is complex, so it’s natural for people to feel confused or have questions about it. Taking out a mortgage is also a substantial financial commitment, which makes it even more important for homebuyers to feel confident about their understanding and decision-making.

Like social media, content marketing is ideal for addressing these challenges by publishing valuable resources that clearly show your expertise level and ability to make complex topics easy to understand. For example, you can create content like:

- Individual guides to the types of mortgage loans (conventional, Federal Housing Administration (FHA), and Veteran Affairs (VA) loans)

- Financial comparisons of each type of mortgage loan

- Frequently asked questions (FAQs) about getting a mortgage in your county or state

- Case study about a client’s unique needs

- Infographic of mortgage rates and statistics

Content marketing can be done in various ways or on multiple channels, like blog posts, email, direct mail, videos, e-books, or infographics. This allows you to pick and choose the marketing avenues that are the most comfortable and practical for your business. Ensure all content is visually appealing and relevant to your audience’s needs and questions.

9. Network With Other Businesses

-

Cost: No cost, but you’ll need to invest several hours of your time each week

In addition to partnering with real estate agents and companies to generate leads, other business relationships can boost mortgage lead gen efforts. Think of professionals working with homeowners who know their clients’ finances. For example, mortgage brokers can successfully partner with:

- Certified Public Accountants (CPA): Accountants know their client’s financial situation in more detail than almost any other profession, which makes them an ideal source of lead generation mortgage leads.

- Divorce attorneys: Individuals getting divorced often sell a shared home and purchase separate homes once the divorce is finalized, so mortgage brokers can sometimes generate multiple leads.

- Real estate attorneys: Real estate attorneys often work directly with buyers who need expert guidance, so this is an ideal partnership to generate leads for mortgage brokers.

- Financial advisors: Advisors work closely with clients to help them purchase a primary home or additional homes for investment opportunities. Offer your expertise on various mortgage options and become their clients’ go-to mortgage loan officer.

Are you considering a different career in the real estate industry? Make sure to read our guide to jobs you can get with a real estate license to determine what could be the best fit for you.

10. Automate Email Marketing

-

Cost: Subscription costs as low as $14 per month

Mortgage lending is a long-term game since the median duration of homeownership is 13 years. You won’t always have to wait over a decade to have a repeat client, but it’s essential to establish a strong long-term strategy to follow up with your clients. Staying top of mind is key when it’s time for them to buy a new home or refer someone they know.

Email marketing is one of the most efficient ways to stay in touch with clients. 92% of adults use email, and 61% use it every day, making it one of the only channels effective for clients in every generation. A few valuable and engaging topics to communicate through email include the following:

- Interest rates: Send updated information and statistics on current mortgage interest rates and help clients determine if it’s a good time to buy or sell their home.

- Refinancing: Review the client’s mortgage interest rate against current rates to see if they could refinance to get a better rate and save money.

- Renovations: Discuss loan options for home renovations and repairs, like the pros and cons of home equity loans.

- Annual review: Clients should have the opportunity to understand the bigger picture of their mortgage and financial health once every year. This will help them see if they qualify for a better loan, lower PMI (mortgage insurance), or have options to pay off their mortgage faster.

Bringing It All Together

Lead generation for mortgage brokers can be highly effective and straightforward by using the right tools and creating the right strategy. There are organic and paid techniques for mortgage lead generation. So, set yourself up for success by consistently trying several methods to determine what works best for your business.

What’s your go-to lead generation strategy? Let us know in the comments!

Add comment