In my 27-year real estate career, I have opened or coached more than 20 startup real estate brokerages. Over that time, I learned an important lesson: Creating a successful budget for a new real estate brokerage takes a lot more effort than most new brokers think. There are many elements you must consider when creating your real estate brokerage budget.

Common mistakes many new brokerage owners make are overlooking expenses or overestimating revenue. Doing either of these may lead to you losing money, or even worse, utter failure. To give you the best chance for success, I created my real estate brokerage budget worksheet to help you get started with your budget without missing a step.

Download the Brokerage Budget Worksheet Now

Step 1: Download My Brokerage Budget Worksheet

Fortunately, you won’t need to start from scratch to build your real estate brokerage budget because I have already done the hard work for you. Start by making a copy of this Real Estate Brokerage Budget Worksheet and reviewing each section (you’ll need to log into your Google account to get copying permissions).

Next, I will walk you through how to fill out each section by adding some assumptions, then expenses, and finally, I’ll help you estimate revenues. Feel free to add or subtract expenses to modify the worksheet for your needs.

Once you have downloaded the worksheet, go to step two to enter your brokerage averages.

Step 2: Add Your Brokerage Assumptions

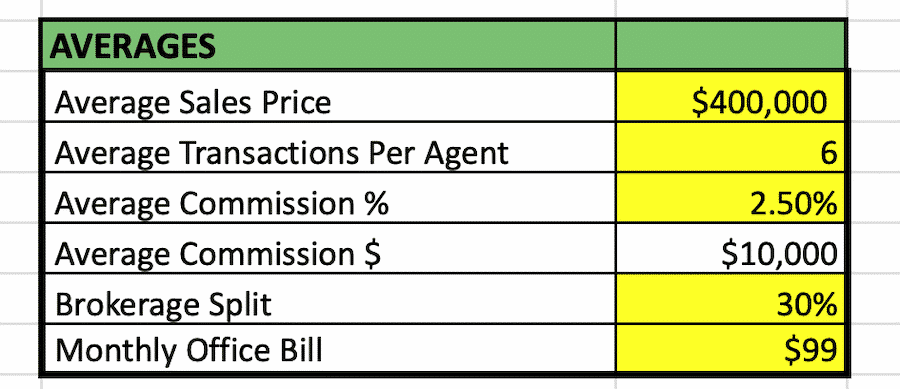

Once you have downloaded the worksheet, you will need to research and determine some assumptions about your market and what you believe your average agent’s production will be. These estimates will be used later to calculate your brokerage earnings. Be careful not to overestimate.

When it comes to your budget, you are often better off underestimating the income and overestimating the expenses. Ideally, your budget is conservative, so you are easily able to surpass any expectations you may have. A conservative approach ensures that you will have the money and resources to achieve your ultimate goal, which is long-term business success.

For example, when you’re estimating the average sales price of a home in your market, you may use 80% of the area’s average sales price if you are a buyer-heavy brokerage and 90% if you are a listing-heavy brokerage.

Add Your Brokerage Assumptions Into the Worksheet

Using the Real Estate Brokerage Budget Worksheet, add what you believe the average sales price and the average transactions your agents will produce each year. Then input the average commission percentage your agents will charge.

Next, add the splits and fees your brokerage will charge. If you are not charging either a split or monthly office bill, you can leave it blank. If you charge your agents a monthly fee for E&O, you can also add it here.

Once you finish adding your estimates, it’s time to move on to your expenses.

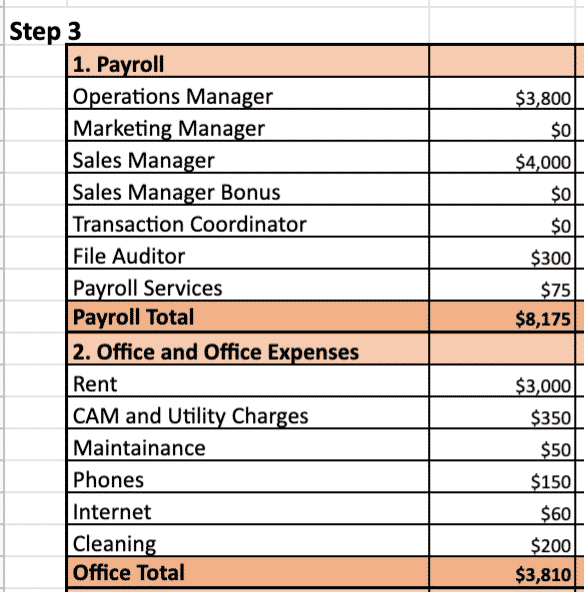

Step 3: Calculate the Expenses to Run Your Brokerage

Your brokerage’s total annual expenses are the sum of all the expenses to run your real estate brokerage for an entire year. These include payroll, brokerage software, staff, office space, office supplies, and advertising expenses. For a complete list of expenses and estimates, see my previous article on how to estimate expenses for your new real estate brokerage.

Once you have them together, add them to the budget worksheet.

Enter Your Expenses Into the Worksheet

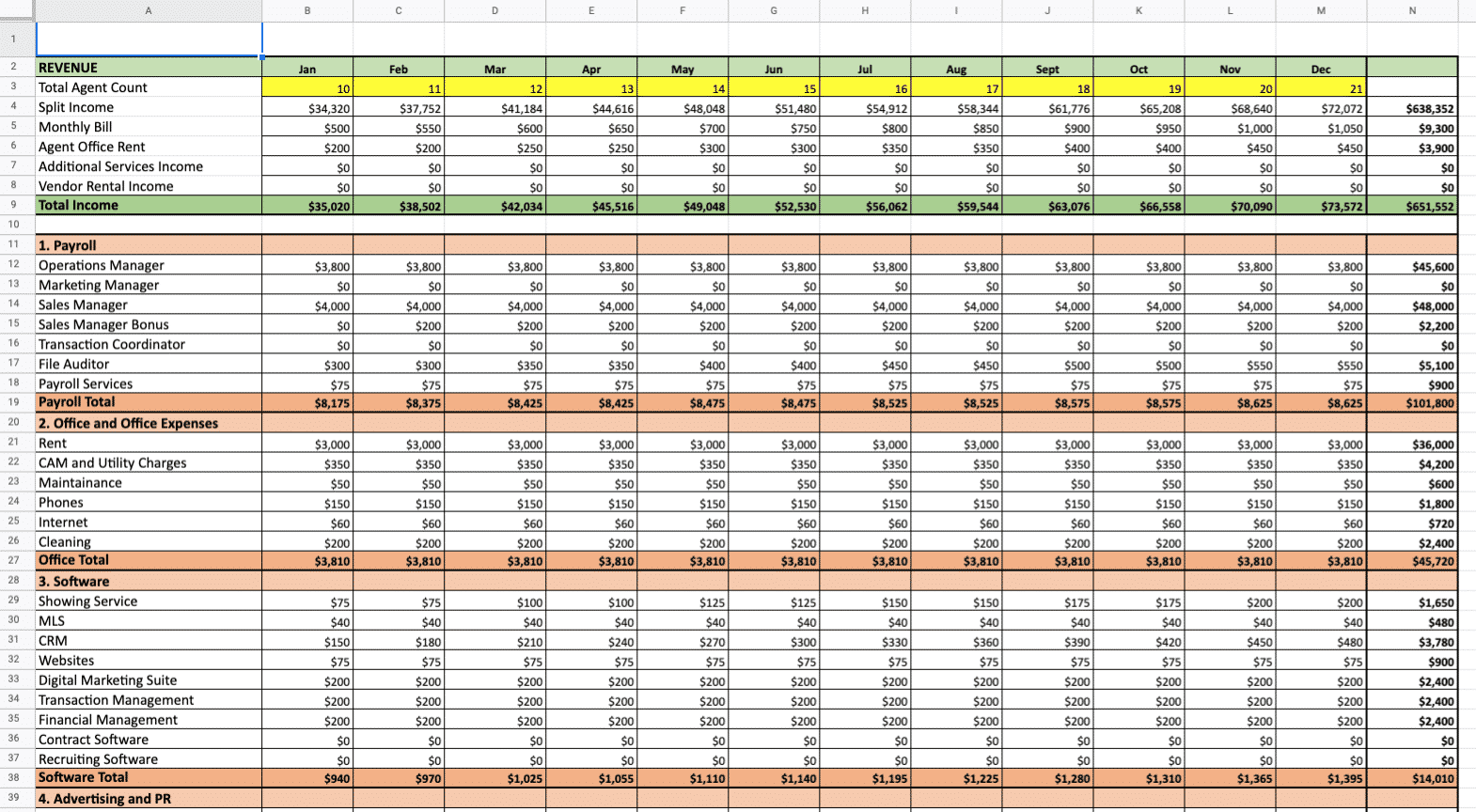

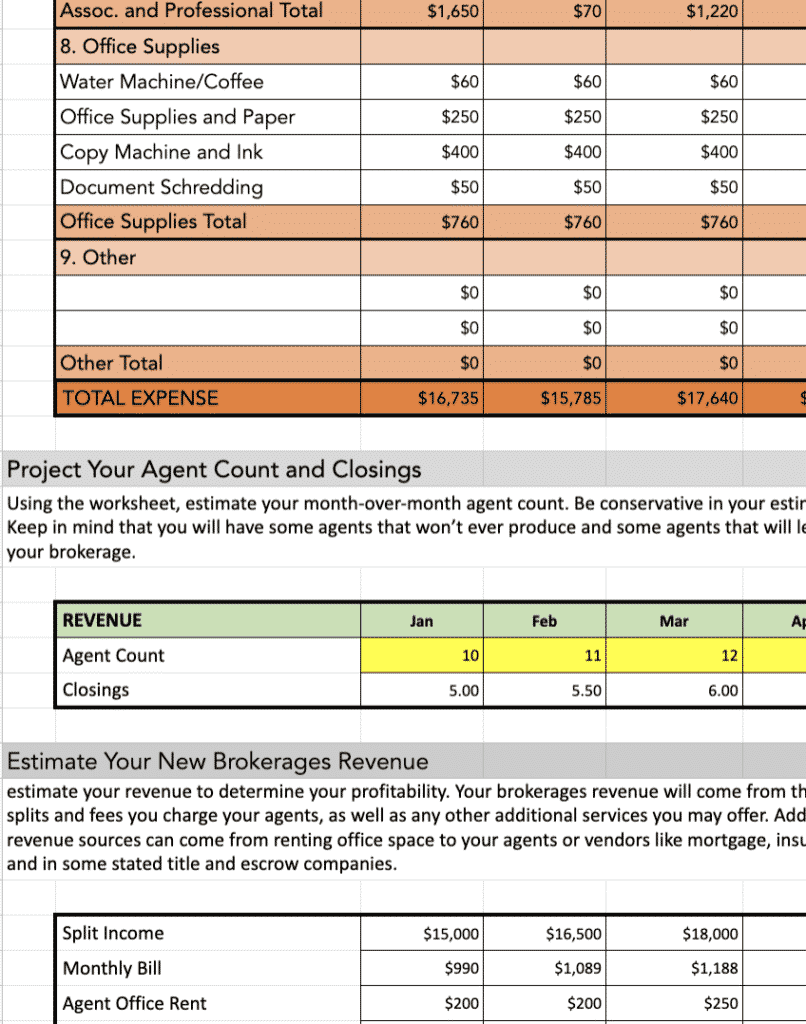

Working your way through the spreadsheet, you will enter the appropriate monthly expenses into the correct month and category. The worksheet will automatically calculate the year-end totals.

Fixed Expenses vs Variable Expenses

Notice that you may have both fixed and variable expenses. Fixed expenses are ones that don’t fluctuate month to month, like rent and payroll. Variable expenses are those that fluctuate based on sales, agent count, or seasonality. These are expenses like listing photography, training events, agent websites, and association dues.

Take your time here to ensure you are accounting for all of your brokerage expenses. Brokers often overlook costs related to common area maintenance charges, coffee and snacks, and office cleaning.

Each section will automatically calculate a monthly expense and total to the right. Next, you will estimate your theoretical agent count and closings.

Step 4: Project Your Agent Count & Closings

The type of agent you choose to recruit and the size of your brokerage will have significant impacts on your real estate brokerage’s overall profitability.

It’s no secret that newer agents sell fewer homes—and less expensive ones at that—than agents who have been in the business for five to 10 years. Therefore, if your brokerage is geared toward newer agents, you will need more of them to generate enough closings and revenue to cover your expenses.

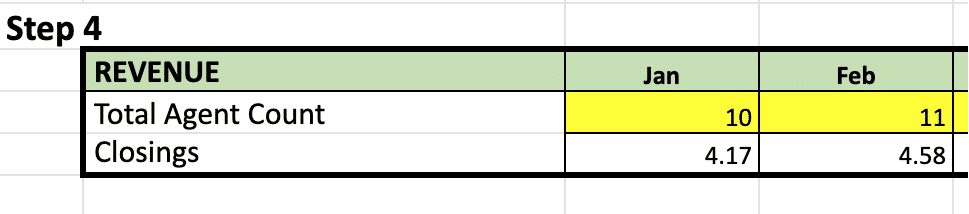

Estimate Agent Count in Your Budget Worksheet

Using the real estate brokerage budget worksheet, estimate your month-over-month agent count. Be conservative in your estimates. Keep in mind that you will likely have some agents who won’t ever produce and others who will leave your brokerage.

When you enter your agents, the worksheet will automatically calculate the closings and commission income based on the estimates you entered in step two. If you wish to adjust the number of transactions your agents close, you can return to step two and adjust the average transactions per agent.

Once you have completed your month-over-month agent count, move to the revenue section to complete the budget worksheet.

Step 5: Estimate Your Brokerage’s Revenue

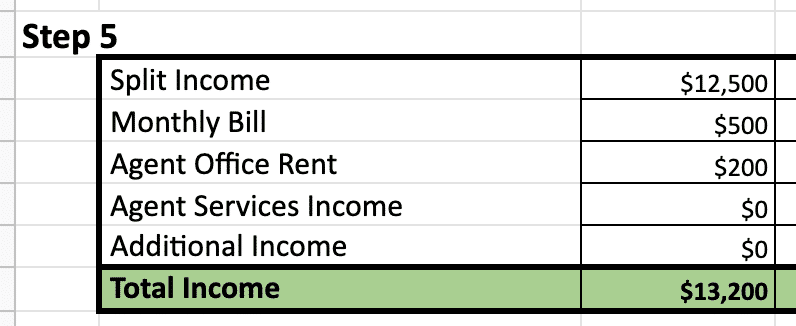

Now you will estimate revenue to determine your profitability. Your brokerage revenue is derived from the splits and fees you charge your agents, as well as any other additional services you may offer.

Additional revenue sources can come from renting office space to your agents or vendors. In some states, you may also be able to secure additional revenue through mortgage, insurance, title, or escrow services.

Enter Your Revenue Into the Budget Worksheet

The split income and monthly bill sections will automatically calculate from the estimates you provided in step two. If your real estate brokerage has office space and offers shared or private office space for rent, add it to the worksheet under agent office rent.

Agent services income is the revenue your brokerage will receive for providing additional services like transaction coordination, marketing services, and training. Estimate and insert this additional revenue into the worksheet.

Don’t forget to account for additional revenue opportunities like training, event sponsorships, and vendor marketing agreements.

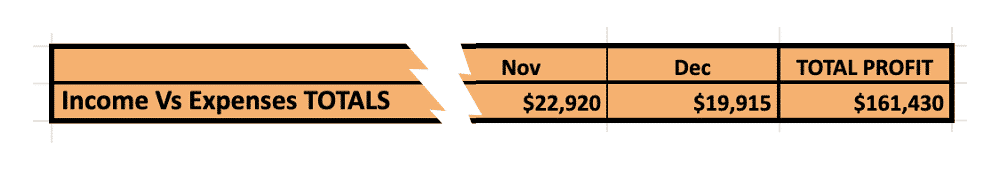

Step 6: Calculate Your Profit!

Congratulations, you have completed your brokerage budget! Now you may have noticed that your profitability isn’t what you had hoped, or you may even be showing a loss. It is normal for a startup business to lose money for a few months or even years.

The secret is knowing this in advance and being prepared by having enough money set aside to cover the losses until you are consistently profitable.

Adjusting Your Brokerage Budget: Easy Areas to Cut Costs

If you’re losing more money than you are comfortable with, you may need to adjust your business plan or budget. Be cautious with this. It is easy to get swept up in the possibilities of success and overlook the actual difficulty of achieving some of your goals.

Keep a clear head and have someone else review your budget for overly optimistic assumptions and inaccuracies. Here are some tips to follow when making adjustments to your budget.

Services & Software

Review your services. Are there services that agents can just as easily provide for themselves? If so, delete them and save the money for more impactful expenditures. Or are there services you can provide later, once your brokerage grows in size? I have found that most agents don’t or won’t use the customer relationship manager (CRM) their brokerage provides, making a CRM an easy item to cut from your budget and add later on, in your next phase of growth.

Staff

Fewer services and software also means fewer staff to fulfill the offerings or to train agents on the software. Start your brokerage lean and mean, with part-time and outsourced help whenever possible.

Office Space

Sadly, the “build it and they will come” mentality has doomed many potentially profitable new brokerages. New broker-owners think splashing out on expensive office space will help them attract top-producing agents right out of the gate. Don’t fall for this.

You are better off starting in a less costly building or location and drawing agents with your services and company culture, rather than renting an expensive office only to find out that agents don’t value the services you’re offering or your company’s splits and fees.

Splits, Fees & Agent Count

It is easy to “correct” your budget by overestimating your splits, fees, and agent count. Therefore, don’t make adjustments to these until you are confident that your services warrant the fees you are charging, and you can attract agents using your brokerage’s compensation plan.

Over to You

Do you have budget items that we overlooked? Let us know in the comments below!

Further Reading for Aspiring Broker-Owners

If you are building or considering starting your own real estate brokerage, check out our growing list of industry insider articles on starting, running, and growing your brokerage:

Add comment