If you’re like most agents, diving into the details of your real estate agent commission splits might not be as thrilling as closing a big sale, but getting it right can make all the difference in your paycheck. Whether you’re a seasoned pro or a newcomer hustling to make your mark, understanding how your hard-earned cash is divided between you and your broker is crucial. So, let’s break down the nuts and bolts of real estate commission splits.

How Is the Real Estate Commission Split?

Real estate commission is a key real estate term that refers to the fee paid to real estate agents for their services in facilitating the sale or lease of a property. Commissions are typically an agent’s primary source of income and are earned through the sale, purchase, or leasing of properties.

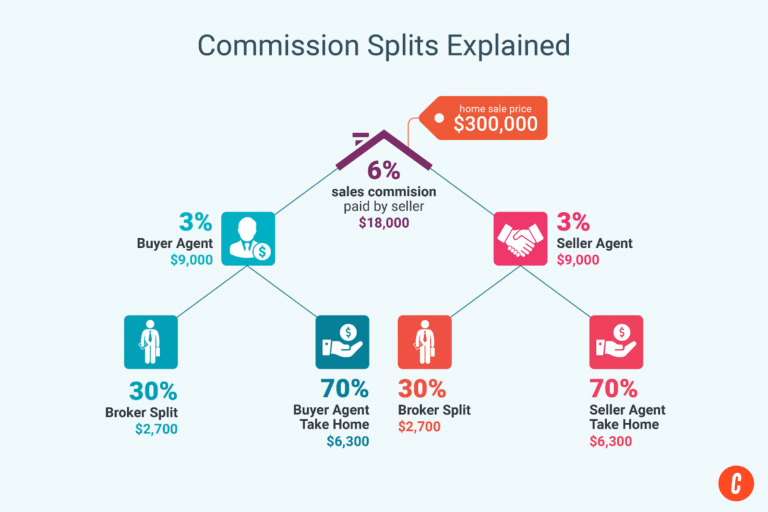

Commission split between agents in the transaction: The total commission is usually a percentage of the sale price or rental fee, agreed upon in the listing agreement between the seller or landlord and the listing broker. This percentage can vary significantly based on location, property type, market conditions, and the type of transaction, usually ranging from 2% to 6% for sales and often one month’s rent for leases. The commission split agreement between agents varies depending on the listing agent’s agreement with the seller.

Example calculation:

Sale price of the home: $500,000 Total commission rate: 6%

Step 1: Calculate the total commission

Total Commission = Sale Price x Commission Rate

Total Commission = $500,000 x 6% = $30,000

Step 2: Divide the commission between the listing and the buyer agents

Assume the commission is split equally between the listing agent and the buyer’s agent.

Commission per Agent = $30,000 / 2 = $15,000

Commission split with brokerage after the transaction: After this initial commission split agreement between buyer and seller agents of the total commission, each agent further divides their share of the commission with their respective brokerages. This real estate agent commission split with brokers will occur according to their contract terms. These brokerage splits can also vary widely and are influenced by factors such as the agent’s sales volume, experience, and negotiated terms with the brokerage.

Example calculation: Adding to the example calculation above and assuming the agent has a 70/30 split agreement with their brokerage:

Agent’s share: 70% Brokerage’s share: 30%

Step 1: Calculate agent earnings

Agent’s Earnings = Total Commission x Agent’s Share

Agent’s Earnings = $15,000 x 70% = $10,500

Step 2: Calculate brokerage earnings

Brokerage’s Earnings = Total Commission x Brokerage’s Share

Brokerage’s Earnings = $15,000 x 30% = $4,500

Side note: Dual agency can occur when a single agent represents the buyer and the seller in the same transaction. In such cases, the agent involved does not need to split the commission with another agent. This type of agency can increase the earnings for the agent, as they retain the full commission agreed upon in the listing agreement. However, you must disclose the dual agency to all parties. You also must have the explicit consent of both buyer and seller in writing, as it can raise concerns about conflicts of interest and the agent’s ability to negotiate fairly on behalf of both clients.

Commission Split Calculator

Use The Close’s commission split calculator below to quickly calculate your take home money!

Types of Real Estate Commission Splits

Real estate agent commission splits determine how earnings from property transactions are divided between agents and their brokerages. These splits can vary significantly, reflecting different business models and individual agreements, and play a crucial role in shaping a real estate agent’s salary, financial success, and career satisfaction.

Each split model has benefits and challenges for real estate agents tailored to fit various experience levels, performance, and market conditions. Here are some common types of commission splits that agents encounter in the industry:

- Fixed percentage splits: This is one of the most straightforward models where the real estate agent and the brokerage split the commission based on a fixed percentage agreed upon in advance. Common splits include 50/50, 60/40, or 70/30, where the agent receives 60%, 70%, or more, depending on the agreement with their brokerage.

- Graduated splits: In this model, the split percentage changes based on performance criteria such as sales volume or revenue milestones. For example, an agent might start the year at a 50/50 split but could move up to 60/40 after achieving a certain level of sales, providing an incentive to exceed sales targets.

- Cap system: Some brokerages implement a cap system, requiring agents to contribute a set amount of their commissions to the brokerage until they reach a predetermined cap within a year. Once agents reach the cap, they may keep 100% of their yearly commissions. This model is particularly appealing to high-performing agents.

- 100% commission plan: Under this plan, agents pay a flat fee to their brokerage per transaction or a monthly office fee instead of splitting the commission. This structure allows agents to keep all the commissions they earn, which can be highly beneficial for agents with substantial sales volumes.

- Team splits: Agents should understand how real estate teams split commissions before agreeing to join. Often used in team settings, this split involves distributing the commission among multiple team members, including the lead agent, junior agents, and sometimes administrative staff, based on their roles and contributions to the transaction.

Who Pays the Commission?

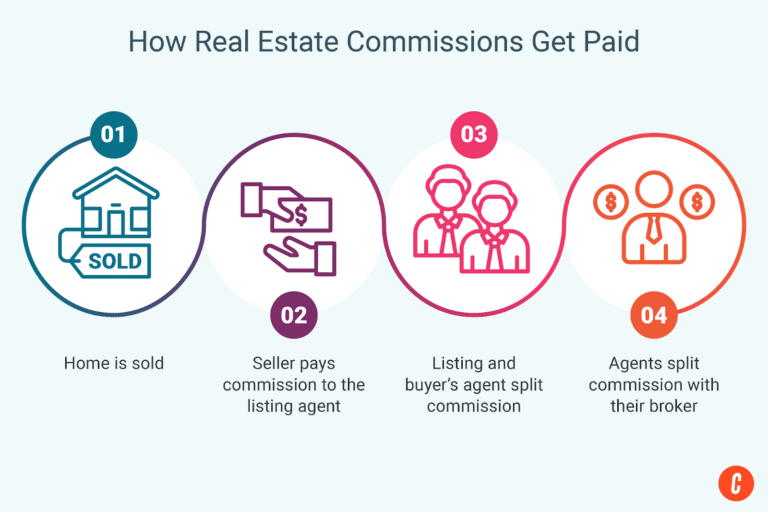

The seller typically pays the commission in sales transactions. This arrangement is agreed upon when the seller signs a contract with a real estate broker during the listing process. The agreement stipulates that a specific percentage of the sale price will be allocated to the real estate agent or broker as a commission. This commission is shared between the listing agent and the buyer’s agent according to the pre-established commission split.

Agents should understand that although the seller pays the commission, the funds come from the buyer’s purchase price. Thus, the buyer indirectly contributes to the commission through the overall price of the property. This understanding can influence how agents approach negotiations and explain the process to their clients.

The payment structure in rental transactions can vary. The landlord usually pays the commission, often equivalent to one month’s rent. However, if a landlord does not offer a commission or it is lower than usual, tenants may be required to pay directly for the agent’s services. This scenario is more common in competitive markets or high-end rentals where personalized service is a significant aspect of the rental process.

How to Negotiate Your Commission Split

Once agents complete their real estate license and seek out a brokerage, they will receive an independent contractor agreement outlining their duties, responsibilities, and the specifics of their commission splits. As you excel in your career, you can negotiate this agreement to reflect your growing expertise, higher sales volumes, and enhanced market knowledge.

The real estate agent commission split with a broker significantly determines your income. Negotiating a favorable real estate agent commission split can substantially boost your earnings, allowing you to better reap the rewards of your hard work. Many agents will switch real estate brokerages if they feel their current terms do not adequately compensate them for their efforts.

Negotiating terms with your brokerage isn’t just about demanding more—it’s about demonstrating your value, understanding the business norms, and crafting a proposal that aligns your interests with your brokerage’s. Here are strategies to help you effectively negotiate better terms with your brokerage:

- Know your worth: Before entering negotiations, assess your performance metrics, such as sales volume, gross commission income, customer satisfaction ratings, and contributions to the brokerage. Solid evidence of your success strengthens your case for a higher commission split.

- Understand market standards: Research the typical commission splits offered by other brokerages in your area. Knowing the industry standard gives you a baseline for negotiations and can help you argue for a competitive rate. Frequently, you will find many real estate agents have real estate side hustles in these down markets to supplement their income. This approach helps stabilize their earnings during slower periods and broadens their skill set.

- Build a strong case: Prepare to present a clear and compelling argument to your broker. Highlight your achievements, continuous professional development, and how you’ve added value to the brokerage. Be specific about your goals and how a better split will motivate you to work even harder.

- Consider timing: Timing can be crucial. Approach your broker about a better split during times of success, like closing a big deal or surpassing your sales targets. Alternatively, annual reviews are natural times for such discussions.

- Offer solutions: Be prepared to offer solutions that benefit both the brokerage and you. For instance, propose a graduated split that increases as you hit higher sales targets or suggest taking on additional responsibilities in exchange for a higher split.

- Practice negotiation skills: Effective communication is key in negotiations. Practice your negotiating techniques, possibly with a mentor or colleague. Being calm, clear, and professional during these discussions can lead to more favorable outcomes.

- Be ready to compromise: While you should aim for the best possible terms, prepare yourself to find a middle ground. If a higher split is off the table, consider other benefits such as marketing support, leads, or better operational tools.

- Get everything in writing: Once you reach an agreement, document all details. This step protects both you and the brokerage and clarifies the terms of the new agreement.

What Factors Can Affect Commission Income?

This commission rate varies significantly depending on geographical location and property type. For instance, in some cities, sellers might pay as little as 4% in realtor fees, while in others, the rates can climb to 7% for residential properties and even up to 10% for commercial real estate.

Location plays a critical role in determining commission rates in the real estate industry. Market conditions, average property values, and local competition all influence how much agents can charge for their services. Due to higher agent competition, commission rates might be lower in bustling urban centers.

In contrast, higher rates may prevail in rural areas due to fewer transactions and the need for more extensive marketing efforts. Understanding the nuances of your local market is essential for setting realistic commission expectations and negotiating effectively with clients and brokerages.

Average Real Estate Commissions Across the U.S.

Understanding the typical commission rates in the real estate market is crucial for agents to know what is a good commission split in real estate. Then, they can set competitive and realistic expectations for their earnings. The average real estate commission in the United States is between 5% and 6% of the property’s sale price, typically split between the buyer’s agent and the listing agent.

| State | Average Commission Rates | State | Average Commission Rates |

|---|---|---|---|

| Alabama | 5.52% | Montana | 5.67% |

| Alaska | 4.99% | Nebraska | 5.71% |

| Arizona | 5.68% | Nevada | 5.08% |

| Arkansas | 5.72% | New Hampshire | 5.19% |

| California | 5.14% | New Jersey | 5.17% |

| Colorado | 5.58% | New Mexico | 5.83% |

| Connecticut | 5.38% | New York | 4.66% |

| DC | 5.3% | North Carolina | 5.56% |

| Delaware | 5.18% | North Dakota | 6.0% |

| Florida | 5.53% | Ohio | 5.81% |

| Georgia | 5.84% | Oklahoma | 5.63% |

| Hawaii | 5.39% | Oregon | 5.43% |

| Idaho | 5.69% | Pennsylvania | 5.44% |

| Illinois | 5.29% | Rhode Island | 4.86% |

| Indiana | 6.08% | South Carolina | 5.94% |

| Iowa | 6.15% | South Dakota | 6.0% |

| Kansas | 5.8% | Tennessee | 5.8% |

| Kentucky | 5.69% | Texas | 6.0% |

| Louisiana | 5.2% | Utah | 5.39% |

| Maine | 6.0% | Vermont | 6.0% |

| Maryland | 5.46% | Virginia | 5.58% |

| Massachusetts | 5.25% | Washington | 5.67% |

| Michigan | 5.93% | West Virginia | 5.44% |

| Minnesota | 5.53% | Wisconsin | 5.86% |

| Mississippi | 5.62% | Wyoming | 5.5% |

| Missouri | 5.79% | (Source: FastExpert) | |

Frequently Asked Questions (FAQs)

What is the typical commission split between agent & broker?

The typical commission split between an agent and their broker can vary widely, but standard arrangements include 50/50, 60/40, and 70/30 splits. The specific split often depends on the agent’s experience, sales volume, and the brokerage’s policies. More experienced agents or those producing higher sales volumes may negotiate more favorable splits.

What does a 60/40 split mean as a commission?

A 60/40 commission split means the agent receives 60% from a real estate transaction, while the broker gets 40%. This type of split compensates the agent for their direct work with clients and the brokerage for providing support, resources, and brand affiliation.

How is a real estate agent's commission split with a broker?

A real estate agent’s commission is split with a broker according to their agreed-upon contract. This split typically reflects the support and resources provided by the brokerage, such as office space, marketing, and administrative assistance. After a property sale is completed and the seller pays the commission, it is first received by the brokerage. The brokerage then disburses the agent’s share according to the negotiated split. This model aligns the interests of the agent and brokerage, encouraging both parties to contribute effectively to the sales process.

Bringing It All Together

The real estate industry is about more than finding the right properties. It’s also about nailing the perfect commission split that makes every sale feel like a celebration! As you set off on this exciting journey, understanding and choosing your commission structure is as crucial as picking the right shoes for a marathon. With each transaction, your knowledge of commission splits isn’t just padding your wallet but also fueling your career growth and ensuring your efforts are recognized.

Remember, the art of negotiation is your secret weapon. Whether you’re the fresh face on the block or the seasoned and successful real estate pro everyone whispers about, negotiating your commission split is your chance to shine. Show off your value, and don’t settle for less than you deserve. Brokerages come in all shapes and sizes, each offering a smorgasbord of commission options. Align yourself with a good brokerage that’s as invested in your success as you are.

Add comment