If you dream of starting your own real estate brokerage, this guide is for you. It will walk you through each step of the process, from determining if this is the path you should take to recruiting agents. Let’s dive into how to start a real estate brokerage so you can take a leap in your career and use your expertise to help others achieve their real estate dreams.

Step 1: Decide if a Real Estate Brokerage Is Right for You

Starting a real estate company comes with its own set of risks and demands. It takes a good chunk of time, money, and effort. Even if you’re pumped and ready to begin, it’s helpful to know what to expect. That way, you can stay focused and navigate the inevitable ups and downs that’ll come your way. Here are some pros and cons to help you decide.

| Pros | Cons |

|---|---|

|

|

|

|

|

|

Step 2: Evaluate Your Goals

To be successful at any difficult task, it’s important to set clear goals. It’s easy to daydream about what your ideal brokerage would look like, but figuring out what it takes to get there and making a solid plan will help make that dream a reality. Aside from the startup costs of opening a brokerage, consider the following factors:

Pro Tip: Take some time to put together a statement that outlines your mission (why you’re doing this), vision (what success looks like), and values (the principles you’ll stick to). It might feel like a small thing, but it’s super important for building a successful business. Every decision you make, every person you bring on board, and how others see your brokerage should all reflect the quality of that statement.

Step 3: Understand the Full Financial Picture

The expenses associated with starting your own independent brokerage can fluctuate. So, check your state’s specific rules and fees for starting a business, as these can differ significantly. Here are some typical expenses when forming a brokerage.

| Expense | What It Is |

|---|---|

| Filing Fee | To create an LLC, you must file articles of organization with your state's Secretary of State office. |

| Business License | Allows you to conduct business activities within a specific area |

| Annual Report Fee | A required fee in some states to maintain the legal status of a business entity |

| EIN Application | A request for a unique identification number for a business |

| Marketing & Advertising | Business cards, print or online advertising, website development |

| MLS Membership Fees | Typically paid to your local real estate association to access the Multiple Listing Service (MLS) |

| Errors & Omissions Insurance | Professional liability insurance that protects your company and agents against claims made by clients |

| Office Staff | Administrative support, including front desk, management, transaction coordinator, or marketing support |

| Operating Expenses | Digital or brick & mortar office space and the costs associated with keeping them running |

| Software Subscriptions | Any platform needed to support agent and office operations, including CRM and lead gen software or marketing tools |

| Recruiting | The money you allocate to bring in top-producing agents |

Important Note: These costs are just an example. Once you open your office, you’ll encounter additional expenses. It’s important to budget for ongoing expenses and factor them into your investment strategy for the long-term financial health of your business. Charging agents various fees to offset some of these expenses is also not uncommon.

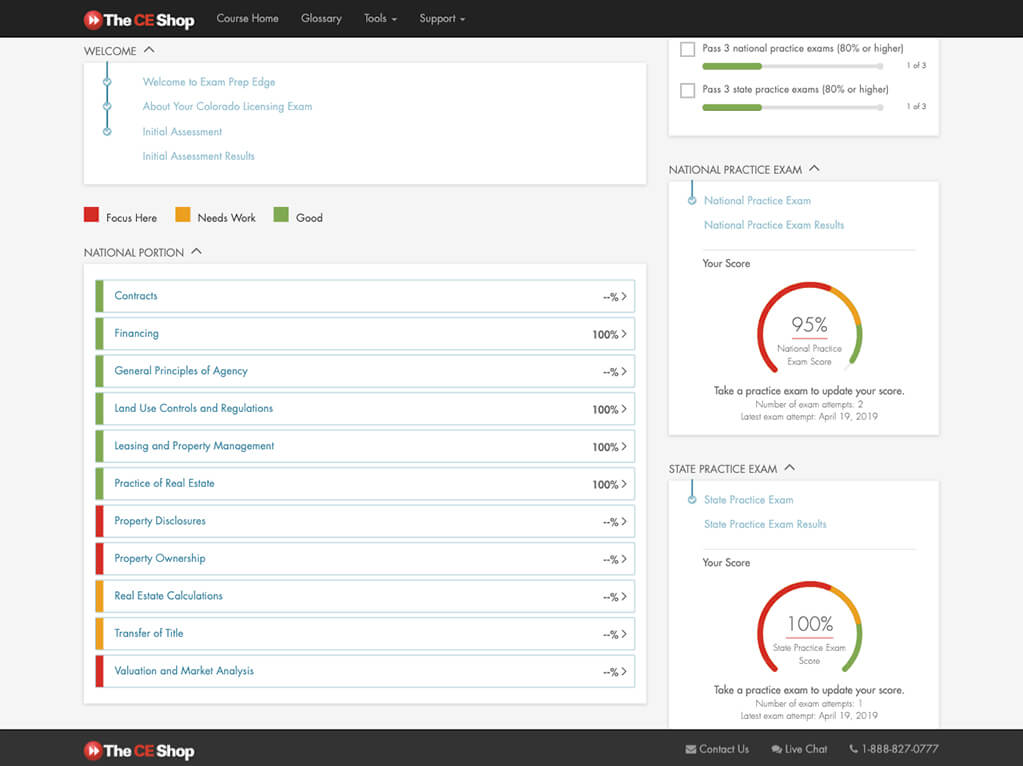

If you need to upgrade to a real estate broker’s license or need continuing education, check out The CE Shop. This online education platform offers broker licensing in 21 states and continuing education for all 50 states and the District of Columbia. The CE Shop is known for its user-friendly interactive dashboards and outstanding learning tools. It also offers a pass guarantee.

Step 4: Learn About the Types of Brokerages

It was the norm for every real estate brokerage to have a physical office. But with the rise of the internet, most agents work remotely. With this change, we’ve seen an increase in virtual real estate companies. Let’s take a look at some of the different brokerage options.

|

|

|

Real estate companies operate in many different ways. Therefore, it’s up to you to decide which of these styles you want to invest in. Some key considerations when deciding which office type best matches your operational goals are your location’s visibility, the local market activity and trends, and your competition. Also consider the cost and size of office space you need and what your ideal clients need in terms of location, conference rooms for closings, and accessibility.

Step 5: Conduct a Market Analysis

The next step is to see if your dream brokerage fits into your chosen market. To do that, you must analyze the competition by evaluating the local firms’ market share. Look for gaps in their marketing and branding you can fill. Assess what the successful brokerages are doing right and what you could improve in their model and culture. Consider what’s missing that could add value to attract top agents, including technology, lead generation options, team-building assistance, and training and mentoring.

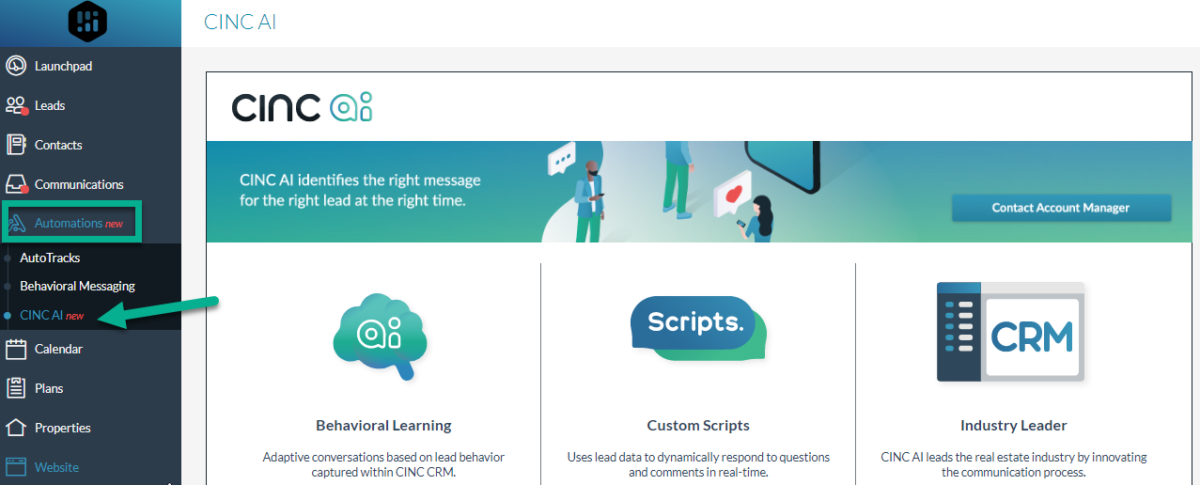

Do you need lead generation tools for your brokerage and agents? Look no further than CINC. Its AI assistant, Alex, is available 24/7 and will reach out to leads at the right time with a message that meets their needs. It also offers location-specific IDX websites for your listings which drives highly-targeted traffic to you. It also tracks where leads are in the buying cycle.

Step 6: Create a Business Plan for Your Brokerage

The next step is to create a business plan for your real estate brokerage. This is one of the most essential documents you’ll write for your business. Your plan should be thought out and researched. In addition to the steps in your real estate investment business plan, include commission splits and fees, agent training and services, and your talent recruitment strategy. Consider if you’ll add lead generation, technology, and your marketing and advertising resources.

Also, weigh your commission split plan with what tools your brokerage will pay for. Your office plan, management structure, and policies and procedures should all be defined in the business plan.

Pro Tip: Figure out how much money you’ll need to keep the business afloat for at least two to six months without revenue—longer, if possible. Keep in mind that this is separate from your personal financial cushion that supports your life in the interim.

Step 7: Build Your Brand

When going through the process of how to start a brokerage for real estate, building your brand is an essential part. This gives you a chance to have some fun and get creative. Here are the core components of any strong brand:

-

Your brokerage’s name: What you name your business is one of the most important decisions you’ll make. It’s the key to every great brand and will help drive brand recognition.

-

Your brokerage’s logo: As a visual representation of everything your brand stands for, your brokerage’s logo is the second-most important element of your brand. This helps people recognize your brokerage even without hearing or seeing the name.

-

Your brokerage’s slogan: A memorable slogan, also known as a tagline, can help get more leads and close more deals. This gives your audience an indication of how you operate and what it would be like to work with your brokerage.

Step 8: Finalize Business Essentials

There are a few remaining essentials before opening your real estate brokerage. These include securing financing, obtaining necessary licenses and permits, and opening bank accounts. These steps are crucial before you can officially open your doors. Once everything is in order, you’ll be ready to launch your business!

Secure Financing

Unless you own the real estate for a brick-and-mortar business, financing can be tricky in this industry since real estate brokerages don’t have large assets to lend against. If you are opening a virtual brokerage, without a proven track record or assets that you can put up for collateral, it can get tricky. Some franchises help secure or provide financing to their franchisees.

Other funding avenues include bank and small business loans, private equity, and hard money lenders. Without a track record of operating a successful business, you can also seek startup funding from friends and family, bootstrapping through personal savings and reinvesting business revenue, and real estate crowdfunding.

Obtain Required Licenses & Permits

Review your state-specific requirements for licenses and permits for operating a brokerage as they vary from state to state. Aside from general business licenses and permits, you need to be compliant within the real estate industry. Reach out to your local and state associations and work with them to fill out the proper paperwork and pay the required bond and fees.

Open Business Banking Accounts

Every business requires a bank account, but real estate companies also need escrow accounts for transaction deposits. These accounts help keep business funds separate from client funds, ensuring compliance for your brokerage. The escrow or earnest money deposits require separate accounts for each transaction.

Cover Your Legal Bases

If you’re working with partners, it’s important to agree on revenue shares. Also, keep in mind that everyone is responsible for any expenses or losses that come up. Setting up as a limited liability company (LLC) could be a good option for your business, but check with a lawyer and CPA to figure out what’s best for your specific situation.

Buy or Lease Office Space

If you’ve opted to go the brick-and-mortar route, you’ll need office space. The cost of office space varies significantly based on location and whether you rent or buy. Here are a few tips to help you find a space that works. Start small. Consider coworking spaces or subleasing in offices with some technology infrastructure, such as internet access. Pay attention to aesthetics and make sure your space is well-furnished and professional. Choose a location that is convenient for agents and customers.

Step 9: Recruit & Retain Agents

Try to get a decent mix of buyers and listing agents. Recruiting listing agents is more difficult than buyers agents or newbies. Investing the time, effort, and money into recruiting is worth it. Every new listing agent you recruit helps build your brand. Consider these tips as you get started:

|

|

Pro Tip: Review your non-compete agreement if you came from leadership in another brokerage. It may prevent you from reaching out to agents at your previous company for a period of time.

FAQs

What is a real estate brokerage earning potential?

The earning potential in real estate can vary significantly, whether you are working as an agent or own a brokerage. As a brokerage owner, your income largely depends on the sales performance of your agents. The national average salary for a real estate broker-owner is $98,791.

What are some obstacles when opening a brokerage?

When considering how to start a brokerage for real estate, it’s important to keep in mind the challenges you’ll likely face. Besides needing to get all the right business licenses and permits, you may deal with a lot of competition, making it tough to attract agents and get your brand out there. Plus, real estate markets can be unpredictable, so the timing of when you launch your brokerage could add some extra hurdles.

What is the difference between a broker and a brokerage?

A real estate broker is a professional who has passed a real estate licensing exam and is licensed to assist in facilitating real estate transactions. Real estate brokers earn a commission for their services. A real estate brokerage is where a real estate agent or broker holds their license and operates their business.

Bringing It All Together

We’re just scratching the surface here but with this guide and the right motivation, financing, planning, and vision, you now know how to start a real estate brokerage firm. Have you been down this road before? Or maybe you have specific questions about your market or situation. Let us know in the comment section!