Working with first-time homebuyers can be the most rewarding experience for a real estate professional. Teaching them how to buy a house for the first time and seeing those smiles at the closing table gives you those warm fuzzies you’ll remember years later.

But, for all its perks, working with first-time homebuyers can also be tricky. There are many obstacles, and you’ll probably have to spend a lot of time educating your buyers. I’ve put together this list of 17 first-time homebuyer tips to share with your clients so they can avoid the mistakes that can cost them their dream home.

Before Your First-time Homebuyers Start House Shopping

More than likely, your clients, dreaming of buying a house for the first time, have scrolled through Zillow like a social media feed for quite a while before contacting you. Prepare them for the process by helping them tackle these steps, so you don’t waste time showing properties they’re not interested in or qualified for.

1. Determine If They’ve Saved Enough Money

There are so many costs involved in purchasing a home that most first-time homebuyers aren’t even aware of. Want to share some excellent advice for first-time home buyers? Sit down and explain these costs to them:

- Down payment: Unless they’re using one of the few loan programs that don’t require it, they’ll most likely need a substantial amount for a down payment, typically 5%–20% of the purchase price. If they need it, there are some available down payment assistance programs that you can educate them on.

- Closing costs: Buyers should plan to pay 3%–4% of the home purchase price for closing costs. You can help your buyers by negotiating a seller’s concession to pay part of the closing costs.

- Realtor fees: Ensure your buyers understand their responsibilities for covering commissions and fees. Explain the recent changes in transparency on agent commissions and how you can still negotiate to have the sellers cover these costs along with additional fees.

- Repairs, upgrades, and furnishings: No home will be perfect, and your buyers may need to prepare for the costs of repairs or upgrades. Let them know they may need to customize some things to make their home their own after they close.

Start by sharing this Home Buying Checklist, which lays out the foundations of the homebuying process and is full of first-time home buyer tips. It will help them kick off their homebuying journey the right way.

2. Help Your Buyers Establish How Much House They Can Afford

It’s easy for your buyers to get caught up in the excitement of home ownership without thinking through the realities. As a professional buyer’s agent, you should educate your buyers on how much they’ll actually pay each month—including their loan principal, calculated interest, property taxes, home insurance, private mortgage insurance (PMI), and homeowners association (HOA) fees, if applicable. Their monthly payment should be 25% or less of their monthly income.

Give your buyers access to this mortgage calculator to estimate their monthly expenses.

3. Encourage Them to Check Credit Scores

Let your buyers know credit scores are an important step to home ownership. Most mortgage lenders won’t take a credit score below 600, so your buyers need to know where they stand. If their score isn’t quite where it needs to be, let them know how to improve it and maybe hook them up with a lender who specializes in working with buyers who need guidance.

4. Persuade Them to Shop Around for a Mortgage

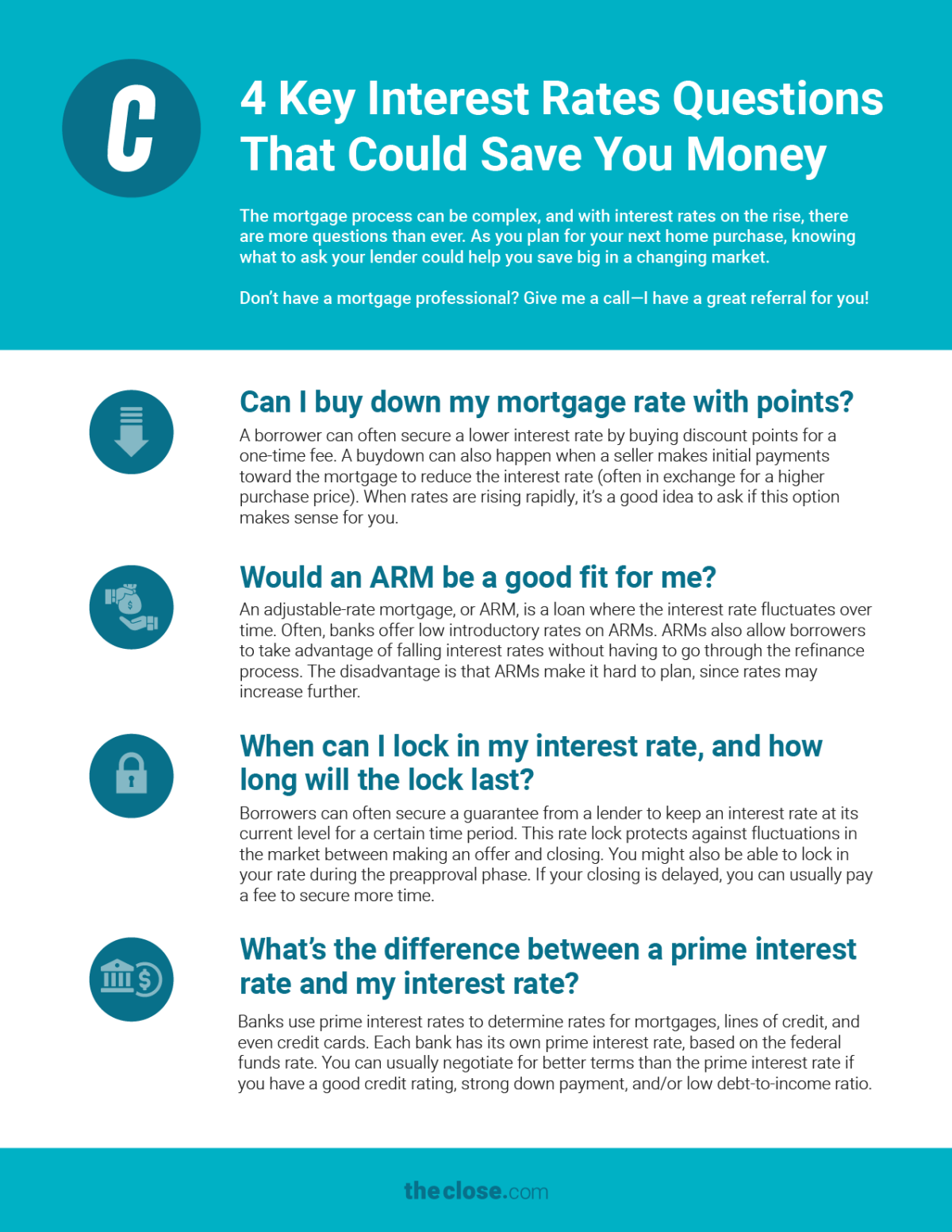

Honestly, one of the best tips for any client buying a house is to shop for the right lender. Keep a list of some of the best lenders. You may have different lenders for different types of clients. For example, you may have a list of lenders great for VA loans but a separate list for first-time buyers or investor clients. Share your favorite lenders to get them started on the right track.

Then, have your buyers contact multiple lenders to compare mortgage fees, rates, and any additional costs to take out a mortgage. Your buyers should consider several different types of mortgages when buying a home. Have them consult with different lenders on their best options.

Types of Mortgages

- Conventional loans: These are the most common type of home loan. The US government does not guarantee them. Some conventional loans allow first-time buyers to purchase a home for as little as 3% down.

- Federal Housing Administration (FHA) loans: These loans are insured by the Federal Housing Administration and allow buyers to purchase a home with less strict financial and credit score requirements than a conventional loan. With an FHA loan, a buyer can qualify with a 580 credit score and down payments as low as 3.5%.

- US Department of Agriculture (USDA) loans: These loans are guaranteed by the US Department of Agriculture. They are for specifically zoned suburban and rural homebuyers and have household income restrictions. They usually require no down payment for those who qualify.

- Veterans Affairs (VA) loans: These loans are guaranteed by the Department of Veterans Affairs. They are exclusively for veterans, active-duty armed forces and National Guard members, and qualified spouses. They allow those who qualify to buy a home with a 0% down payment.

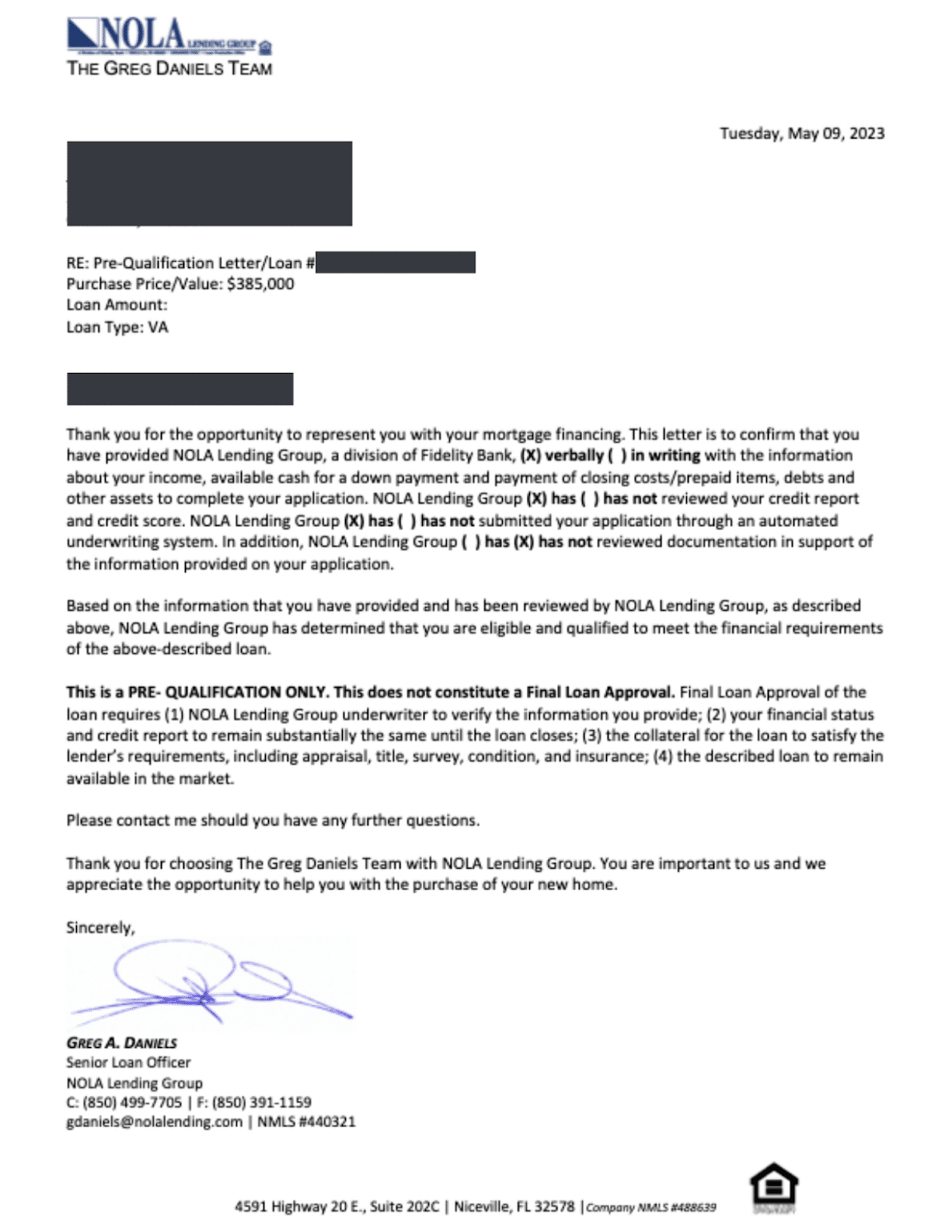

5. Verify They Are Preapproved

No sense in wasting time shopping for homes if your buyers aren’t prepared to make an offer when they find a home they love. Getting that preapproval letter will give them an advantage when it’s time to write up an offer. But it will also help your buyers stay within a set budget. They will know what the lender has tentatively approved them for, so they won’t be tempted to veer off into unaffordable territory.

6. Suggest They Research Neighborhoods Online

One of the best first-time home buyer tips is to encourage clients to research different neighborhoods, schools, and local amenities before looking at homes. If they find a home in a neighborhood or town that doesn’t suit the rest of their needs, they’ll be miserable. No one lives in a bubble. Urge your buyers to explore the areas to ensure they can access things they need, like shopping, restaurants, schools, and work, before deciding which areas suit them best.

House Hunting With Your Buyers

Now that the important foundation work has been done, it’s time for the exciting part—house hunting! But you certainly don’t want to start without a plan in place. When your clients are buying a home for the first time, follow these steps to make sure everyone is making the best use of the time you’ll spend together.

7. Educate Them on Working With a Real Estate Agent

A lot has changed for homebuyers recently, most notably how commissions are paid to their agents. As a buyer’s agent, you now have a more important responsibility to explain your value, break down why your clients need you working for them, and why you’re worth every penny of that commission.

8. Create a List of Needs vs Wants

Sit your clients down with our House Hunting Checklist and review their needs and wants. This checklist is full of tips for first-time home buyers. Be sure to explain what features are true needs (like bedrooms for everyone in the house) vs “nice to haves” like a covered patio in the backyard. Explain that some things will be deal-breakers, but they can be more flexible on other features. Some items can be added after closing if they truly want them.

9. Educate Them to Be Realistic

If you’ve been in real estate for more than five minutes, you know there’s no such thing as a perfect house. That’s called a unicorn. Explain to your clients that they won’t find a house that meets every one of their expectations. But they will find a home they love with most of their preferences. Set their expectations to be open to homes that aren’t quite everything they want. They may just find a truly amazing house that fits them perfectly, even if it’s less than perfect.

10. Find a Home That Fits Their Needs & Budget

As frustrating as it can be to buy a house, first-time buyers may be tempted to bump up their budget if they can’t find the home they really want. And truthfully, this is their first home purchase and probably won’t be their last. If everything they want is out of their price range, then the first step to getting a better home is to start where they are. Work within their budget to find them plenty of well-suited options.

If you’ve set their expectations well, they should be able to see potential in the homes you present. Their first home is supposed to be the starting point—remind them of that. They can enter the market with a starter home, stay in it for three to five years to build some equity, and then level up on their next home purchase.

11. Negotiate With the Sellers

The art of negotiation is a skill you should learn early in your career. This is where you will shine and help buyers present the best terms to get the deal accepted. Go to bat for your buyers to get the most agreeable terms possible.

Negotiate with the sellers to pay some or all of your clients’ closing costs to alleviate some of their stress. However, you can also negotiate the purchase price, repair limits, and closing date with the sellers. The ideal situation is for everyone to leave the negotiations and feel good about the deal.

After Your Buyers Are Under Contract

You’ve scoured the MLS, found your clients their new dream home, and negotiated the deal. Now, you must carefully steer the ship into the harbor without hitting any rocks! Follow these tips to ensure everyone arrives safe and sound at the closing table.

12. Help Them Hire a Home Inspector

Keep a list of reputable home inspectors and some great questions, along with other types of inspectors (wood-destroying organisms, septic tanks, pools, etc.), to help your clients perform the proper inspections to ensure their purchase is sound. Since your buyers are buying a home for the first time, you might need to explain why each inspection is important and worth the extra expense.

Pro Tip: This is a perfect opportunity to share some past experiences where things went terribly wrong. For example, I once had buyers fall in love with a house and helped them make an offer. Once they were under contract, I made sure to help them order a home inspection, which uncovered thousands of dollars of termite damage. Ouch! Stories like that one demonstrate the need for hiring professionals to see the things other people can’t.

13. Make Them Aware of Deal-killing Mistakes to Avoid

Have you heard about a buyer showing up to closing and driving a brand-new car they bought the week before closing, and the deal fell through because of it? Yeah, buyers get so excited about closing on their new home that they make costly mistakes.

Here are some examples:

- Don’t change jobs

- Don’t make any big purchases

- Don’t move your money

- Don’t buy a new car

Thankfully, we’ve put together a whole list of first-time home buyer advice, full of the dos and don’ts while under contract that you can go over with your buyers. You can even print it out and have them post it on their fridge until closing day! This is another great place for anecdotes to drive your point home. (Eh, hem. It’s part of the Home Buyer Checklist!)

14. Help Them Find Quality Home Insurance

I live in Florida, and home insurance is a serious issue here. I like to keep a list of reputable insurance providers to share with my clients to help them get started. There are several sources online to compare rates, but you can also include a broker or two in your list. Another strategy is to get the current insurance provider from the sellers. Sometimes it’s easier to get a good rate for homeowners insurance from the company that already has a solid history with the home.

15. Explain Title Insurance

Title insurance is typically done through the title company running your transaction. But when the buyers see or hear about this charge, they may need help understanding what it is and why they need it. Explain title insurance to your buyer.

Title insurance protects the homebuyer and the lender against potential issues with the property’s ownership or any legal claims like some distant nephew of the deceased seller showing up and laying a claim to the property or boundary issues. Title insurance ensures the buyers can take complete ownership of the house, protecting against any liens, claims of ownership, or other situations that put the buyer’s full ownership at risk.

16. Be Thorough at Your Final Walkthrough

You’re getting down to the wire; the final walkthrough is the last step. Schedule the final walkthrough with the seller’s agent within 24 hours before closing. The final walkthrough is to ensure the home is in the same condition it was when your buyers made the offer.

I can’t begin to tell you how many times I’ve heard agents in my office regale stories of going to a home the day before closing only to discover something major missing—the fridge, the stove, the security system, the plants in the front flower bed—it’s hard to overstate the need for ensuring everything is in its place before your buyers sign the final closing papers. Be thorough!

17. Close & Celebrate With Them

You’ve finally made it! If it’s possible, go to closing with your buyers. This milestone is a HUGE accomplishment, and they will be so excited. You definitely want to be a part of that. Celebrate their win with them. I made it a tradition to take my buyers to lunch after closing to help continue the celebration. The longer I can continue that feeling, the better. I always take a closing gift to the closing and recommend the same to you. This event is a big deal, and they should feel that.

Pro Tip: Bring your smartphone and take video clips and pics of their big day. Ask them if they can give you a video testimonial after signing. I love asking my clients to do video testimonials right after closing when their emotions are the highest. 99.9% of the time, they’re so excited to share their gratitude with a video testimonial. The beautiful part is you’ll get their raw, authentic, emotional endorsement, which really does wonders for your marketing.

Bringing It All Together

Working with first-time homebuyers is a thrilling experience. As agents, it doesn’t get much more emotional than watching your clients sign closing docs on their first home. It’s such a high! But when you’re working with clients buying a home for the first time, you have a responsibility to guide them through the process, help them deal with their emotions along the way, and educate them on all the moving parts of a real estate transaction.

If you get this right, they’ll remember you fondly for years to come. They may even name their child after you! I’m just kidding, but they will refer you to more business down the road. And when they’re ready to level up, guess who they’ll call.