Thinking about investing in mobile homes? This budget-friendly option is perfect for real estate investors looking for alternative properties, as they often provide higher rental yields than traditional homes. Depending on size and condition, prices typically range from $10,000 to over $100,000. Remember the distinct mortgage and land regulations that apply to mobile homes. To help you navigate this market, I’ve outlined nine key steps, including understanding mobile home investments and choosing prime locations. This guide will empower you to make informed decisions and optimize your investment potential.

Step 1. Understand the Differences Between Mobile, Manufacture & Modular Homes

Investing in mobile homes offers a unique opportunity in the real estate market. Manufactured in a factory and placed on a chassis, mobile homes can be set on owned or rented land, providing flexibility for investors looking for affordable housing solutions. It’s important to differentiate mobile homes from RVs and camping trailers; mobile homes are intended for long-term living, while RVs cater to temporary use. This makes mobile homes a stable investment choice, particularly as many camping trailers can exceed $100K.

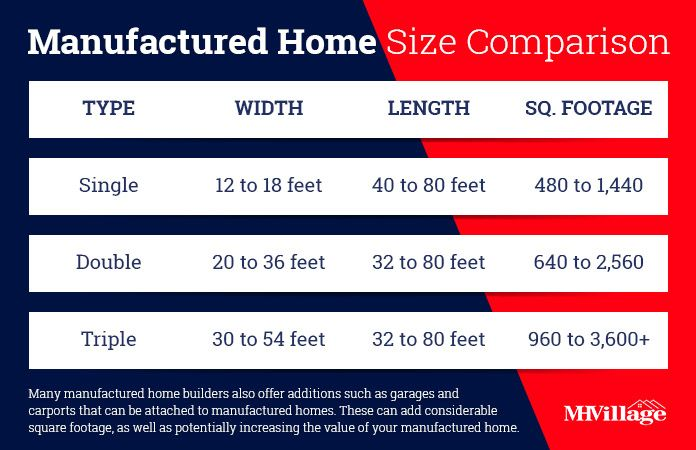

There are three primary sizes of mobile homes:

- Single-wide: 500 to 1,100 square feet, ideal for smaller lots.

- Double-wide: 1,200 to 2,000 square feet, suitable for families.

- Triple-wide: Over 2,000 square feet, appealing for larger families and higher rental rates.

Investing in mobile homes addresses the demand for affordable housing while offering the potential for rental income and appreciation.

For investors looking at housing opportunities, it’s vital to understand the differences between mobile, manufactured, and modular homes. Each type has unique characteristics that can affect investment potential. These distinctions will help investors make informed decisions and identify lucrative opportunities while minimizing risks.

|

|

|

Investors should note that manufactured and mobile homes are regulated by the Department of Housing and Urban Development (HUD), while modular homes follow local codes. Mobile homes built before a specific date often require chattel mortgages instead of traditional ones, which is key for investment planning.

Step 2. Know the Costs of Buying a Mobile Home

Investing in mobile homes can be lucrative, with prices ranging from about $10,000 to over $100,000 based on size, style, condition, and location. New models or those with amenities typically range from $40,000 to $250,000, while used homes can be found for $10,000 to $50,000. Investors need to consider additional costs like transportation and setup. Investors can effectively capitalize on this unique asset class by understanding market dynamics and potential returns.

- Land or plot purchase: In addition to buying the property, you may also need to buy or lease the land on which the home will sit. The costs depend on the area where the mobile home will be.

- Park association fees: These cover park maintenance and common areas, similar to condominium fees. They can be around $200 per month.

- Foundation: This can range from $8,000 to more than $20,000, depending on the size of your mobile home and the kind of foundation you get, such as a finished basement, concrete pit, or pier and beam foundation.

- Delivery and installation: You must decide whether to use a transport-only or a full-service move service. If you choose transport-only moves, they range from $700 to $3,500. In contrast, a full-service move may cost between $3,000 and $14,000.

- Utility hookups: Add up what you’ll pay for internet and cable service and hook up water, sewage, and other utilities. This can go from around $300 to more than $1,000.

- Taxes and insurance: The price of the house and any related taxes and levies must be paid. You must also account for insurance, which is often more expensive for mobile homes than conventional homes.

When investing in mobile homes, add up all costs, including purchase price, transportation, installation, insurance, maintenance, and land leasing. Calculating the total cost helps you assess the investment’s viability. Research local rental or selling prices to set competitive rates and predict potential income. Understanding costs and earnings enables you to make informed decisions for a successful mobile home investment.

Step 3. Decide if Buying a Mobile Home Is for You

Once you’ve got a handle on how mobile homes are built and what they cost, it’s time to think about the ups and downs of buying one. Mobile homes present a strong investment opportunity because of their affordability and flexibility as primary residences or rental properties. They can attract diverse tenants, and enhancements like additional sections can boost rental income. With lower maintenance costs, investing in mobile homes can lead to significant cash flow and diversify your real estate portfolio.

If you’re considering buying a trailer home, evaluate the benefits and downsides.

|

|

|

|

|

|

|

|

Step 4. Choose a Location for Your Mobile Home

When investing in a mobile home, the first critical step is choosing the right location. Consider options like established mobile home parks for community benefits or private land you own or rent for greater control. The location affects both your living experience and the potential appreciation of your investment, making it essential for maximizing returns.

Mobile Home Park

Investing in a mobile home park is smart as it caters to mobile home needs. Each lot offers essential utilities and space, providing convenience for residents. Investors can rent or sell the land, creating diverse revenue streams in a growing affordable housing market.

Additional considerations:

- What is included in the park, like communal amenities and security

- If there’s a homeowner’s association (HOA); if so, you’ll need to determine how much it costs and what it provides

- If the lot is large enough to accommodate your desired mobile home

- Whether the land has to be leased or purchased

Private Land

Owning land is key to achieving the American Dream for investors looking to thrive in real estate. Setting up a mobile home on your property offers privacy and freedom from homeowners’ association rules. Ensure you have the funds ready to purchase land and research local zoning laws to confirm that mobile homes are permitted in your desired area, as this can impact your investment potential.

Additional considerations:

- The annual taxes for the land need to be determined.

- It is important to understand the local community.

- The proximity to conveniences such as groceries, fire departments, and other essential services is a consideration.

- Availability of internet connection, power, water, and sewer should be assessed.

If you buy land, read our How to Buy Land In 8 Steps article to learn how to purchase land, what to look for and avoid, and how to profit from land ownership.

Step 5. Search for a New or a Used Mobile Home

After choosing a location for your mobile home, find the right unit to buy. For new homes, consider manufacturers like Champion Home Builders or Clayton Homes. For used homes, inspect the foundation, walls, and plumbing. Look for insulation quality and energy efficiency issues. Hire a local inspector experienced with mobile homes to protect your investment.

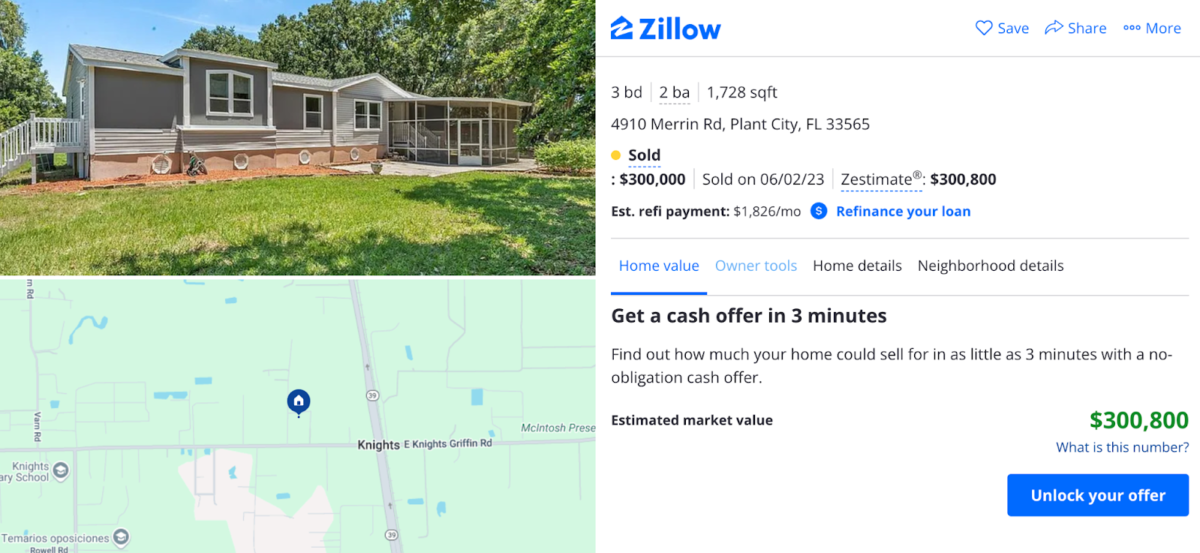

Check out real estate sites like Zillow if you’re house hunting for a manufactured or mobile home. It has tons of listings for both new and used trailer homes. You can quickly narrow your search using filters for price, number of bedrooms and bathrooms, and type of home, making finding what you want much quicker. Plus, it gets its listings from MLS (multiple listing services) and other sources.

Step 6. Secure Financing for Buying a Mobile Home

Even though mobile homes usually cost less than regular houses, you might still need some financing, especially if you’re on a tight budget. Here are five ways you can get the funds you need:

Personal Loan

Personal loans are an excellent option if you only want to finance the mobile home, not the land. Since mobile homes are less expensive than traditional homes, you might still get a loan big enough to pay for mobile home costs, even though overnight personal loans typically have smaller loan capacities and higher interest rates.

Conventional Mortgage Programs

Government agencies don’t back conventional mortgages. You get them through government-sponsored companies like Freddie Mac or Fannie Mae. They’re not lenders, so you must go to a lender for the mortgage. These programs help reduce lender’s risk because of specific guidelines.

Government-backed Mortgage Programs

There are three main government-backed mortgage programs to finance the costs of purchasing a mobile home. First is the Federal Housing Administration (FHA). Its terms range from 25 to 30 years, depending on which option you choose between Title I and II. The second choice is for the veterans to look into a mortgage loan through the US Department of Veteran Affairs. If a buyer’s mobile home is regarded as real property, the site is categorized as rural, and the home is less than a year old, they may also consider the US Department of Agriculture Rural Development.

Chattel Mortgage Loan

The term “chattel” means movable stuff, which fits since this investment property loan is specifically for mobile homes. It deals with the price of mobile homes set by the buyer and is more similar to a personal loan than a mortgage. Because the repayment terms are shorter—around 15 to 20 years—you’ll have higher monthly payments than traditional homes. However, it’s still cheaper than a personal loan despite the higher interest rate.

Installment Agreement

Consider dealing directly with sellers or mobile home manufacturers who provide financing. When purchasing from a private vendor, you can negotiate a price and installment contract based on their plans. If buying a used mobile home, ensure the property’s title is free of judgments or liens beforehand.

Also Read: The Best Hard Money Lenders of 2024 (Interest Rates, Fees & More)

Step 7. Sign Up for Home Insurance or Warranty

When investing in properties with appliances, select manufacturers with solid warranties to protect against defects. Ensure you have homeowner’s insurance and comply with local occupancy and maintenance regulations to safeguard your investment and enhance marketability.

Mobile home insurance policies generally cover these standard protections:

Step 8. Prepare the Home Site for Delivery & Installation

Investing in mobile homes offers immediate occupancy potential, especially with used models. Work closely with your manufacturer or retailer to ensure proper site preparation and engage a contractor for any necessary excavation for new mobile homes.

Secure essential permits, including building and utility connection permits. Plan for septic tanks and water wells in rural areas and confirm utility availability for hookups. Contact local utility companies for service coordination, using registered contractors. Be aware of any additional land use permits based on zoning regulations. Efficiently manage foundation preparation, delivery schedules, and utility hookups to enhance the viability and profitability of your mobile home investment.

Step 9: Develop Your Business Plan & Next Steps

After buying your mobile home, create a solid business plan that aligns with your goals. Decide whether to rent, flip, or live in it. Do some homework on the market to get a feel for rental prices and trends in the area so you know your investment is in demand. Make a budget that includes possible repairs, maintenance costs, property taxes, and any management fees if you hire someone to help. If you need to make some updates, sketch out a plan to boost the place’s value and make it more appealing.

Also Read: The Essential Rental Property Maintenance Checklist for Landlords

Additionally, consider your property management approach. Decide if you’ll manage rentals yourself or hire a property management company. Develop a marketing strategy to attract tenants or buyers using online listings and social media. Review local zoning laws related to mobile home parks to avoid legal issues. Lastly, consider your long-term vision for scaling your investment, whether acquiring more mobile homes or exploring other real estate opportunities. These steps will help you manage your property effectively and maximize your investment.

Also Read: 6 Best Property Management Software for Small Business

Frequently Asked Questions (FAQs)

What factors must be considered before purchasing a mobile home in a park?

Mobile home living can be customized based on your preferences, like adding space or a bedroom. To ensure you choose the suitable park or community, consider the homeowner’s association (HOA) or park fees and what amenities it includes, such as gated security, common areas, and maintenance.

What is the average useful life of a mobile home?

Mobile home construction adheres to strict standards and rules to ensure that the foundation will last for at least 35 years. A mobile home can last longer; its typical usable life is 30 to 55 years if maintained.

What credit score do I need to buy a mobile home?

For most types of loans, including those backed by the government and those secured by personal property, a credit score of 580 to 620 is needed. In most circumstances, a credit score of 580 is required for prefabricated home loans; however, you may still be eligible for financing through a unique program even with a lower score, although you might have to put down a bigger deposit.

Bringing It All Together

Getting a mobile home can be great, but knowing the risks is also essential. It’s all about taking your time and being thoughtful throughout the process. So, the next time you consider buying a mobile home as an investment, keep this friendly advice in mind to guide you in making a wise and informed decision!

If you have any experiences or tips on how to buy a mobile home for the first time, please share your thoughts in the comments! 😉

Add comment