Buying an apartment complex is a great way to make a steady monthly income and turn a profit. However, learning how to buy an apartment complex requires time, effort, and cash. I’m breaking down the property types to consider and how to view and evaluate potential properties. Once you find a solid apartment building and secure financing, you’ll be set to go ahead and close the deal on your new investment. Let’s get into the details!

Step 1: Decide if an Apartment Complex Is the Right Investment

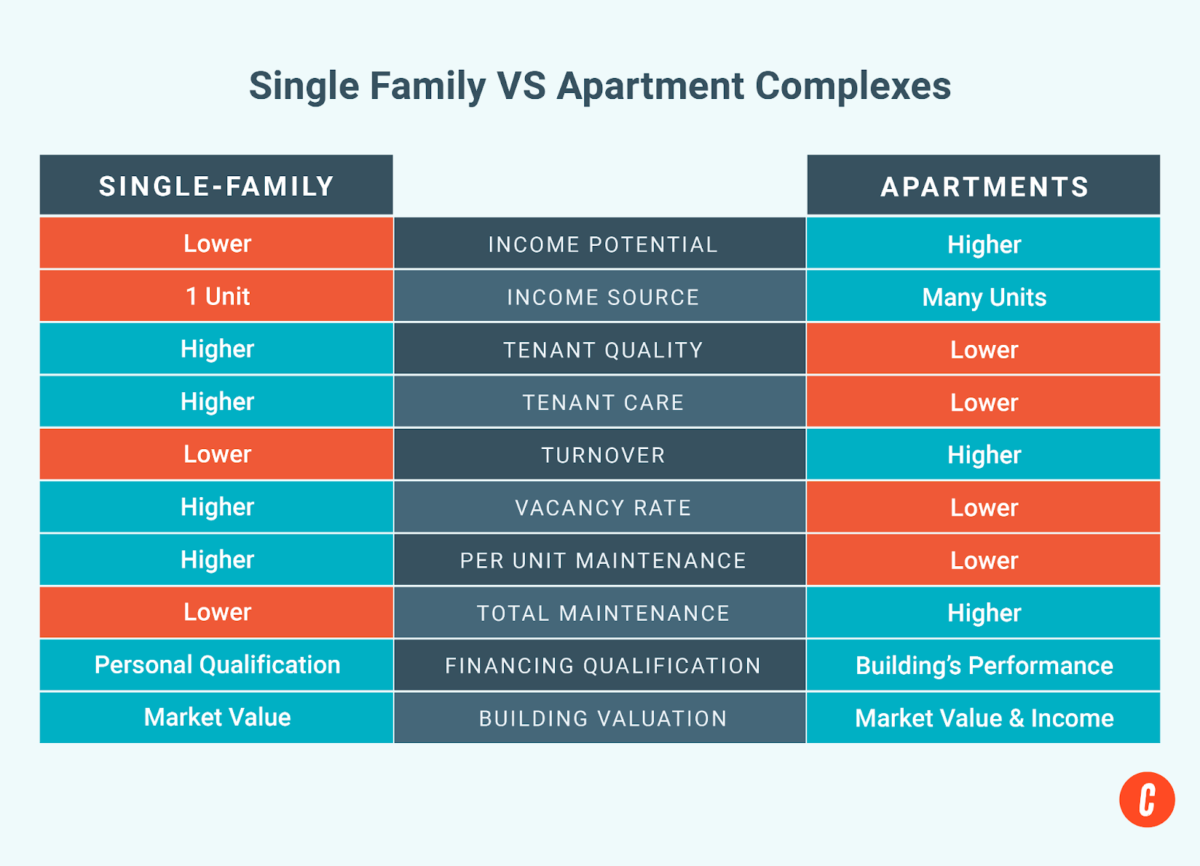

As you begin learning how to buy apartment buildings, make sure it’s what you really want for your real estate goals. Unlike purchasing a single-family home or a smaller multi-unit property, buying an apartment building is a whole different ball game. It usually takes more research and time and often requires more cash.

Start by asking yourself why you want to own one of these buildings and remember the potential risks, rewards, finances, and effort it takes to manage and keep everything running smoothly. Here are some pros and cons to think about:

|

|

|

|

|

|

|

|

|

|

|

Step 2: Learn About the Types of Buildings

If you’ve decided that investing in an apartment complex is the way to go, the next thing to do is figure out what kind of apartment building you’re interested in. There are all sorts of options out there: you’ve got converted houses with several units, those cozy garden apartments, and properties with a dozen or more units in one building. In the U.S., apartments are classified according to a rating scale from A to D. Here’s a quick rundown of the four main types of apartment buildings:

| Class Type | |

|---|---|

| Class “A” | Luxury rentals less than ten (10) years old or older renovated buildings that can be garden, mid-rise, or high-rise buildings. Amenities can include pools, tennis courts, and clubhouses. |

| Class “B” | Up to 20 years old and generally well-maintained. It may have amenities and facilities that are more dated than in Class “A” apartment buildings. |

| Class “C” | Up to 30 years old with limited or no amenities. It may have an apparent need for renovation and repair. |

| Class “D” | Typically, over 30 years old and sometimes low-income, subsidized housing. There are few amenities, and buildings usually need renovations and repairs. |

Important Note: Like all real estate properties, classifying a property depends on its current state and the local market. Finding a complex and learning how to own an apartment building include using the class asset information to identify each building’s benefits and risks. Most first-time investors typically go for class “B” or “C” apartments since they tend to have a higher cap rate. Their costs are usually lower than those of class “A” properties and are less risky and easier to manage than class “D” properties.

Step 3: Evaluate Your Goals

A lot of new investors can pick up the basics of researching properties and making smart investment choices pretty quickly. But it’s just as crucial to look at your own personal and financial goals before jumping into buying an apartment building. There are a bunch of things you should think about for yourself before making such a big investment, starting with these key points:

-

Number of units: The more units in an apartment building, the more time, energy, and money you’ll have to put in. If you’re being cautious and just want to make some extra cash or boost your current income, it’s better to focus on smaller buildings with six units or fewer.

-

Level of ambition: It’s easy to under or overestimate your ambition when you’re just checking out properties, but that can lead to regrets down the line. Before you make any investment moves, take a moment to figure out how much work and time you’re ready to put into it right after closing and over the next few years of owning it.

-

Risk threshold: Investing always comes with some level of risk, but what’s safe for one person might not feel the same for someone who’s not financially stable. Figure out how much risk you’re comfortable taking on, as that will affect the kinds of apartment complexes you can look at.

-

Return on investment (ROI): For investors, figuring out the ROI of an apartment building is often even more crucial than the sale price or monthly costs. A property might have high expenses but still pull in a solid profit, and just because expenses are low doesn’t mean you’ll have good cash flow. It’s important to know how much to charge for rent and to be able to calculate the ROI to make smart choices.

Step 4: Find an Apartment Complex to Buy

When it’s time to seriously look for an apartment building and you’re asking yourself, “How do I buy an apartment complex?” You need multiple reliable strategies to find and evaluate property data. Luckily, there are plenty of people and services that can help.

Real estate agents have access to a huge selection of residential and commercial properties for sale, usually through their local MLS, which lists everything available in the area, including multifamily buildings and apartment complexes. The best agents are experts in their local markets and have the skills and resources to help you find and evaluate data on apartment buildings you may be interested in.

One of the best things about buying a for sale by owner (FSBO) property is that the seller isn’t paying a real estate commission. This could give you a chance to negotiate the price down. Some sellers even list their prices a bit higher, knowing that buyers will deduct commissions from their offer. Plus, FSBO properties often provide more opportunities for favorable terms, like owner financing or less money down upfront.

If you’re on the hunt for apartment buildings by yourself, check out a local real estate investment club. The Real Estate Investors Association (REIA) has various local chapters with tons of resources like news, videos, and their ROI magazine. Joining groups like these gives you access to helpful info, updates, and the chance to connect with other investors.

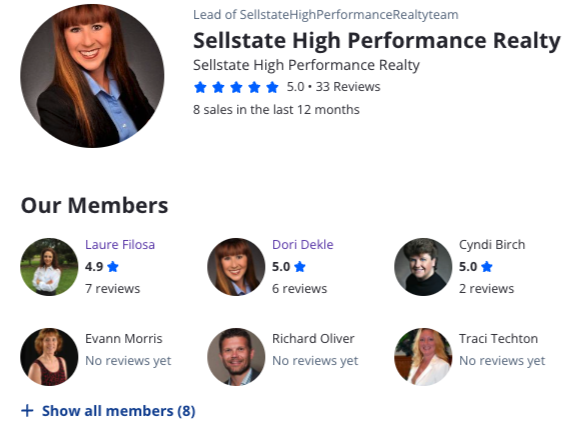

Zillow agent profile example (Source: Zillow)

If you don’t already know of any real estate agents in your area, try using Zillow’s Agent Finder. Many local brokers and agents have a Zillow agent profile, allowing you to evaluate their skills and experience and determine if they are the best fit for your needs. Search for individual agents and teams in your area, view their reviews from past clients, and see what properties they’ve worked with in the past.

Step 5: Evaluate Apartment Complex Features

It’s important to gather info on each property you’re considering to evaluate the benefits and drawbacks. Depending on your personal and financial situation, plus what’s happening in your local real estate market, you’ll want to consider some specific factors. Some of the big ones to consider are the location of the building, its size, and construction details.

Location or Neighborhood

I’m sure you’ve heard this before, but when it comes to buying real estate, it’s all about location, location, location. For apartments, a great spot could mean being close to local amenities, having easy access to public transport, being in a specific school district, or being near growing and thriving businesses. In general, properties in better locations have the capability to attract more tenants, demand higher rents, and have a greater chance of increasing in value over time.

Number & Size of Units

If you’re looking to buy an apartment complex for the first time, it’s super important to think about how many units you’ll actually be able to manage and which types of units will bring in the most rent. Studio apartments can be tough to rent out unless they’re near a college or in a busy area. One and two-bedroom units are usually a lot easier to fill.

Complex Amenities

Amenities can attract interest in your property and can also significantly increase your monthly expenses. Some common examples include in-unit washers and dryers, dedicated laundry rooms, covered parking or garages, vending machines, pools, and gyms. Particular amenities are attractive to tenants, which can help you charge higher rent. But keep in mind that all these extras can add up to a lot of extra expenses each month. Be sure to do your research on the costs of each amenity and its financial return.

Construction Details

Amenities are pretty obvious and easy for investors and tenants to spot, but the construction details can tell you a lot about potential issues with the property. Some building features are more prone to problems that could lead to hefty repair and renovation bills for owners. If you find a property that has one or two of the following issues, it doesn’t mean you should write it off completely. However, being aware of these potential problem areas is key to assessing the property’s overall value. Some of the most common problem areas in apartment buildings include:

- Wood frames: Houses built entirely with wood framing tend to be more prone to rotting than brick homes, which can increase insurance costs. Plus, these wood houses usually have siding that requires regular painting and upkeep.

- Flat roofs: Flat roofs tend to have more issues than sloped or slanted roofs, like leaks, overexposure, and deterioration. They can be tricky to deal with, but it’s important to keep them in good shape to avoid bigger and pricier problems down the line.

- Plumbing: If the plumbing in an apartment complex is 20 to 30 years old, you can bet there will be plumbing problems in the future. Old pipes leak and deteriorate over time, and emergency plumbing repair costs can be expensive.

- Shared utilities: Older apartments typically have shared heat and electricity, which can present challenges for landlords. They have to determine how tenants will contribute to these costs, whether through splitting the utilities or adjusting the rent accordingly.

- Asbestos and lead paint: Buildings built before 1978 often have asbestos in the insulation, HVAC systems, or exterior siding, as well as lead-based paint. Fixing these issues can be costly and cause inconveniences if you’ve got tenants in the building.

Step 6: Understand the Full Financial Picture

When going through the steps of how to buy an apartment complex, understanding the financials is crucial. Even if a property looks like a great deal, the only way to really figure out if it’s worth the investment is to look at the financial details for the last one to five years. These figures will give you a quick peek at how much an apartment complex costs before diving deeper into its financials.

Profit & Loss Statement

You should be provided with a cash flow statement, income statement, or profit and loss statement, which are essentially the same thing. They give a complete picture by itemizing all income and expenses, which allows you to examine each expense category instead of one combined sum.

Expenses

It’s important to know what the property’s total expenses are for the year, as well as the patterns of expenses each month. Some months will have higher expenses than others, such as heating and snow removal in winter months and cooling and landscaping in warm months. Possible expenses when buying apartment buildings include:

- Mortgage

- Interest

- Insurance

- Advertising

- Maintenance

- Repairs

- Utilities

- Municipal costs

- Property taxes and fees

- Management expenses

- Business expenses

- Professional services

Basic Numbers

- Rent roll: This is the current amount of rent collected for every unit in the building. Gather the total and multiply the sum by 12 to get the gross annual rent.

- Occupancy and vacancy rates: The occupancy rate tells you how many units in a building are occupied, while the vacancy rate tells you how many units are vacant in a building.

- Cost per unit: To calculate the cost per unit, divide the purchase price by the total number of units in the building.

Complicated Financial Calculations

After you’ve gathered the basic numbers, you’ll have a general understanding of the profitability of an apartment complex. However, to get a more accurate picture of the property’s financial performance, you need to calculate more detailed financials to truly feel comfortable making an informed decision on a property purchase.

| Gross Operating Income (GOI) | The total rent and other income collected from the property minus vacancy, but before additional expenses. *If you are buying a vacant apartment building, you may need to perform a potential rental income (PRI) analysis based on a rental market analysis. | |

| Net Operating Income (NOI) | The amount of money left after all expenses are paid; also known as cash flow. Positive cash flow: You made money during a designated period of time. Negative cash flow: The property costs money during that period of time. | OR NOI = GOI - Total operating expenses *Make sure to calculate the NOI monthly and annually. |

| Capitalization Rate | The rate of return on investment (ROI). The cap rate does not include mortgage debt. |

Pro Tip: If you are working with a real estate agent, they should be able to provide you with these calculations to help guide your decision.

Step 7: Perform Due Diligence

If you’ve decided to move forward with the purchase after checking the finances, there are a few more things you’ll want to look into. Some of these factors should be written into your offer and subject to your approval, like a review of leases, the profit and loss statement, and property inspections. Due diligence should include:

-

Seller’s circumstances: Determining why the owner is selling is an important consideration when negotiating a deal. For example, a seller who wants to retire and move has vastly different motivations than a seller faced with a property needing major repairs or preforeclosure.

-

Viewing current leases: Leases contain rent amounts, terms of the lease, pet policies, security deposits, and who pays for utilities. If you keep the existing tenants after you take ownership, you inherit the existing leases. It’s vital that you know what the tenants expect and have agreed to.

-

Tax returns: Request the property accounting records and tax returns and further investigate any discrepancies. For example, if the seller shows $12,000 in net operating income in their accounting records but counts $9,500 on the tax return, you’ll need further explanation.

-

Conducting inspections: Make sure you have a licensed building inspector perform a thorough inspection of the property. Apartment buildings frequently have shared systems, various condition levels in each unit, and potential issues with common areas and amenities. You’ll want a detailed inspection report of what needs to be repaired.

Step 8: Obtain Financing

Buying apartments and investment properties is a whole different ball game compared to residential homes. You’ll likely use commercial lending instead of the usual residential lending because of the size and price point of the building purchase. Financing options include:

- Government-backed apartment loans

- Bank balance sheet apartment loans

- Short-term apartment loans

A few other areas to consider when you finance the purchase of an apartment building are:

- Lender-required reserves: Lenders usually want you to have one or two types of reserves set aside to get your financing approved: interest reserves and cash reserves. These help make sure you can cover your operating costs, insurance, taxes, and repairs. All in all, the total reserves might end up being around six months’ worth of payments.

- Key items considered by lenders: Since net operating income is important in real estate investing, lenders usually prefer properties that have great market potential, high occupancy rates, and long-term tenants. That’s why it’s really smart to do your homework upfront by evaluating income, expenses, vacancy rates, and the property’s condition.

- Recourse vs. non-recourse loans: A recourse loan means that if you default on payments, the lender can go after more than just the property to recover their money. On the other hand, with a non-recourse loan, they can only take the property itself. Non-recourse loans are usually the preferable choice, but they can be harder to get because they often need a bigger down payment and usually come with higher interest rates.

Pro Tip: If the lender allows it, it’s usually a better idea to avoid buying an apartment building in your own name. There are a lot of complexities and risks that come with owning an apartment, so it’s smarter to buy it through a business entity. Your accountant and lawyer can help you figure out if an LLC or a corporation would work better for you.

Step 9: Make an Offer on the Apartment Complex

Making a solid offer on a property means you need to know the current market value for similar properties in the area and how much profit you might make. Start with a market analysis by checking out recently sold homes, properties that are currently on the market, and listings that didn’t sell. Plus, getting an appraisal can give you even more insight into what the property is really worth. There are three methods used together to determine the current market value for apartment buildings:

- Market value approach: Market value basically looks at similar properties and how much they sold for. So, if you’re thinking about buying a six-unit building with six two-bedroom apartments, the appraiser will check out other similar buildings and what they sold for within the past year. They also consider the market value per unit in this process.

- Replacement cost approach: Replacement cost looks at how much it would cost per square foot to build a similar building. If you are looking at a four-unit building with 4,000 square feet, and construction costs in your area run $100 per square foot, the replacement cost will be valued at $400,000.

- Income Approach: The income approach is all about figuring out an investment’s value using the net operating income and the local cap rates. You take the net operating income and divide it by the cap rate. For instance, if a building’s net operating income is $46,000 and the cap rate in your area is 10%, the value would come out to $460,000.

It’s finally time! You’ve put in the work, and you’re ready to submit your offer to the seller or have your agent do it for you. The seller will either accept it, turn it down, or send back a counteroffer. After that, you can negotiate the details and sign a contract to get everything in writing so you can move forward to closing the deal.

Step 10: Close on the Purchase of the Apartment Complex

Now that you’ve learned how to buy an apartment complex and found the right property, you’re ready to close. For many residential home buyers, closing just means signing some papers and getting the keys. But for those buying an apartment building, there are a few more steps to handle.

- Choose an escrow agent or title company with experience in apartment building transactions. This will prevent any mistakes from slowing down or complicating the process.

- Strategically schedule the closing day on either the last few days or the first few days of the month—after rent is collected. This provides almost a full month of cushion before the next mortgage payment is due.

- Make sure security deposits are turned over at closing and get them into separate escrow accounts for each tenant.

FAQs

Is owning an apartment complex profitable?

If you’re wondering “how much does it cost to buy an apartment complex” and whether or not it will be profitable for you, you’re in luck. Owning an apartment building can be very profitable; however, the cost of each apartment building investment is different. Both are based on multiple factors, such as property debt, location, operating costs, and market conditions.

Is it better to buy or build an apartment building?

Purchasing a building can offer many benefits, such as lower construction costs and time, reduced upfront expenses, favorable location options, and the benefit of inherited tenants, which generates immediate income. On the other hand, building a new property has its own benefits, like the ability to select a specific location, create a custom design, and potentially enjoy lower maintenance costs due to the newness of the construction. Ultimately, the decision to buy versus build depends on your goals as an investor. If you are more inclined toward building, you might want to explore how to become a developer.

Bringing It All Together

When it comes down to it, figuring out how much an apartment complex is to buyisn’t all that different from getting a single-family home or a small multi-family property. But it does mean you’ll need to dive a bit deeper into the financial side of things. This step-by-step guide is meant to give you the tools you need to decide if apartment complexes are the right investment for you.

What type of property are you considering?

Add comment