Real estate remains a top choice for savvy investors in today’s changing investment landscape. While the current market may seem unpredictable, downturns often present unique opportunities unavailable during booming times. Many people ask themselves, is it good to invest in real estate? And why invest in real estate now? As we look ahead to 2025, there are plenty of reasons to consider it. With factors like stability and long-term growth, real estate is historically one of the best investment choices. Let’s break down the reasons why you should invest in real estate.

Reason #1: Value Appreciation

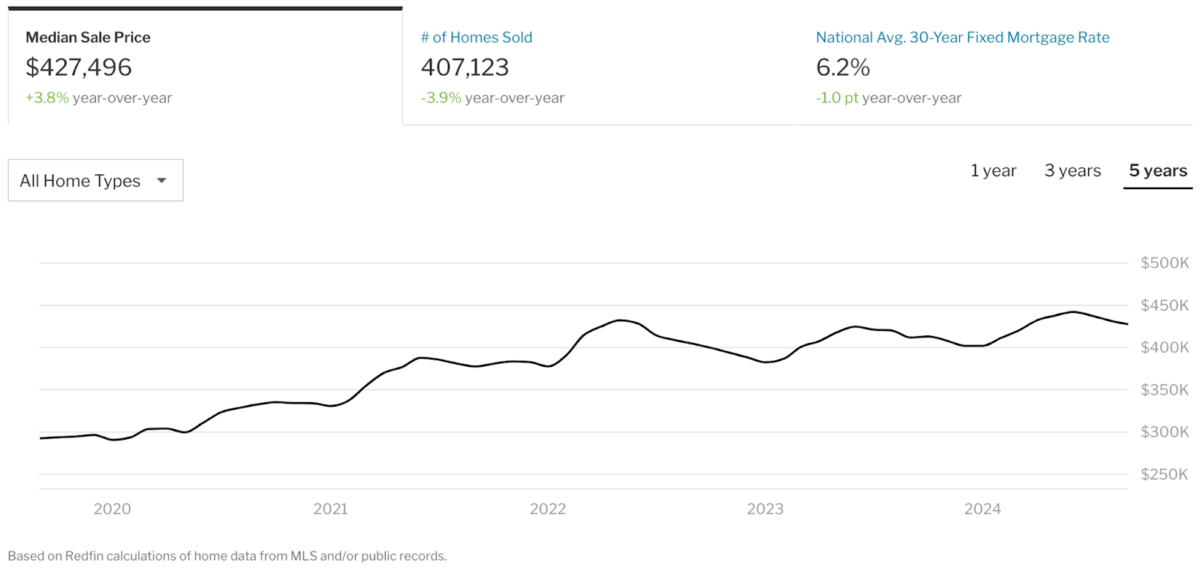

Real estate is a great way to grow your money over time. Properties usually increase in value, which helps you build equity and allows you to make a profit when you sell. If you stick with it long-term, you can really cash in. Redfin says US home prices have shot up by about 37.52% over the past five years. The median home sale price went from $292,430 in September 2019 to $427,496 by September 2024.1 That’s some serious growth! It’s all about making smart moves and being patient with your investments.

You can also turn that appreciation into cash flow. One way to do this is by refinancing to access the equity in your property, or you can sell the property when its value has increased. For example, buying a property for $400,000 and selling it for $500,000 could mean walking away with $100,000 in profit before dealing with capital gains and depreciation recapture taxes and closing costs.

Reason #2: Steady Rental Cash Flow

| Source: iPropertyManagement | ||

Rental properties have the potential to generate a reliable stream of income each month, positioning real estate as a highly attractive avenue for investors. There has been a remarkable rise in average rent prices, climbing 27.86% from the onset of the pandemic in 2019, where the average rent was $1,149, to its current level of $1,521 in 2024.2 It’s a great sign for property owners, as there’s a solid chance to enjoy reliable and consistent rental income.

Reason #3: Hedge Against Inflation

Inflation happens when the dollar’s value decreases compared with what we buy. Generally, when more money is injected into the economy, prices for goods and services tend to rise. Because of this, smart investors often look to real estate to protect their savings. Buying properties is a great way to shield yourself from inflation since real estate keeps up with the decreasing value of money, even when the economy slows down.

As inflation goes up, property values and rental prices usually follow suit. This means landlords can earn more from rent and equity over time, allowing them to stay ahead of inflation. That’s why many believe that real estate income is one of the best ways to ensure a balanced investment portfolio, especially during inflationary times.

Reason #4: Enjoy Tax Benefits

Real estate investors use tax perks that boost their profits by treating their investments as legitimate business ventures. The IRS allows deductions for expenses tied to real estate activities as long as investors can show that they’re actively involved, which is called material participation. It’s wise for investors to chat with a tax advisor who knows the ropes to help them make the most of these benefits and increase their investment gains.

The expenses you may be eligible to deduct include the following:

-

Mortgage interest: If you’re financing investment properties, deduct the interest you pay. That’s a nice little perk.

-

Depreciation: As a real estate investor, deduct depreciation on residential and commercial properties. This typically spans 27.5 years for residential properties, and for commercial ones, it’s 39 years.

-

Business expenses: If you actively participate in managing your investment property, you can often deduct the costs associated with owning, operating, and managing it.

-

1031 Exchange: The 1031 exchange rule can come in handy. It allows you to defer taxes on capital gains when you sell an investment property. You sell one property, and within 180 days, you close on another one. It’s a great way to keep your money working for you while postponing those tax payments until you eventually sell your final property and realize the capital gains.

Reason #5: Financing Options

One of the best things about investing in real estate is the ability to leverage your investments. Unlike stocks or bonds, you don’t need all the cash upfront to buy a property. If you qualify, you can finance the purchase and only need to put down a percentage of the property’s value. Plus, many real estate investors find it possible to finance multiple properties, leading to more cash flow and significant profits.

It’s quite common to make a down payment as low as 20% on a property, while the rest can be covered by a mortgage. This means you can take control of larger assets without needing a huge pile of cash. For instance, think about a property worth $300,000—you could buy it with just $60,000 down. This strategy boosts your chances of a great return on your investment.

Reason #6: Diversification

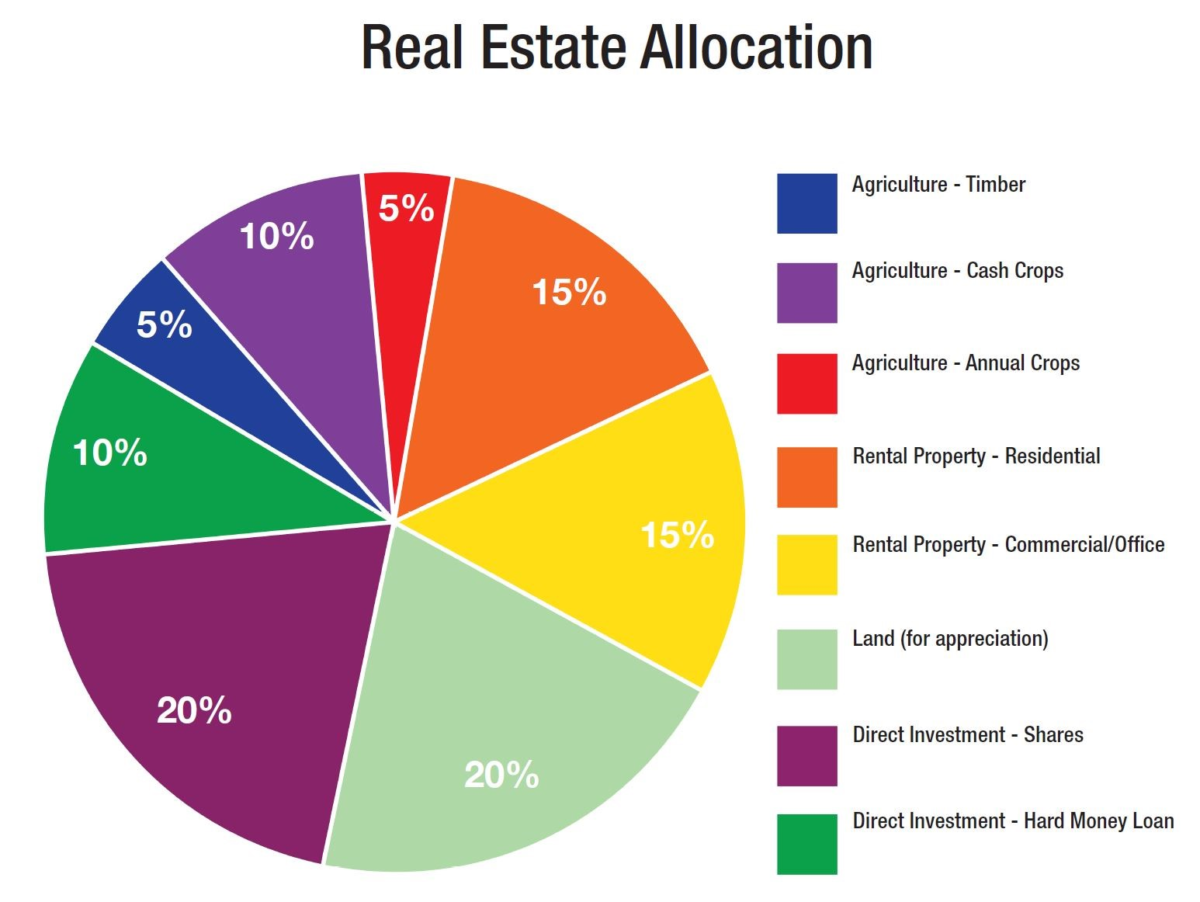

A diverse investment portfolio is a smart way to lower the risk of losing everything simultaneously. If you were to put all your money into stocks and the market took a big hit, you could end up facing some severe losses. However, by spreading your investments across different asset classes—like real estate—you’ll give your capital some protection since real estate doesn’t always follow the stock market’s ups and downs.

It’s also a great idea to invest in different locations or states. This way, if one market isn’t doing so well, your other investments might still hold strong. When it comes to real estate, think about mixing things up with different types of investments. Go for rental properties for a steady income, try your hand at fix-and-flip projects for quicker returns, or invest in real estate investment trusts (REITs) that let you profit without the hassle of managing properties yourself. This well-rounded strategy will help keep your portfolio safe from significant losses.

Reason #7: Control Over Investments

Compared with stocks and bonds, real estate gives investors a unique opportunity for direct involvement and control over their investments. This allows them to take an active role in essential decisions related to property management, renovations, and leasing strategies. Unlike the often passive nature of stock investments, real estate investors can implement tangible changes that significantly impact the value of their properties.

For example, by renovating a property, an investor will improve its aesthetic appeal and functionality, increasing its market value. Additionally, effective management practices optimize rental income, further enhancing the financial success of their real estate ventures. This level of control empowers investors and presents opportunities for rewards that are directly linked to their efforts and decisions.

If you’re a DIY landlord looking for robust property management software, Avail is the perfect tool for you! Its free plan lets you find tenants, sign leases, check credit histories, and collect rent all in one place. If you need more features, you can upgrade for things like applicant screening and online payments. Plus, Avail offers helpful resources to make managing your properties easier.

Reason #8: Tangible Asset

Real estate stands out as a tangible asset that one can see and actively manage, offering a distinctive sense of security that contrasts sharply with the intangible nature of investments such as stocks. The data from the third quarter of 2024 shows that around 65.6% of Americans have chosen to own their homes.3

This statistic highlights a notable preference for physical investments, emphasizing real estate’s stability and reliability in more volatile markets. It reinforces the concept of real estate as a formidable choice for investors seeking solid returns and a grounded investment strategy.

Reason #9: Generational Wealth

Real estate can be a fantastic way to build long-term financial security for you and your family. Did you know that homeowners tend to accumulate 40 times more wealth than renters?4 That’s amazing and highlights how crucial real estate can be for creating lasting wealth across generations. Many choose to set up a family business by starting an LLC to manage their investment properties. This way, they can pass it down to their loved ones, keeping the family legacy alive for years!

Frequently Asked Questions (FAQs)

Is real estate the best way to invest?

Why is real estate a good investment? Because of its potential for appreciation, steady rental income, and tax benefits. Unlike stocks or bonds, it offers a physical asset that can serve as a hedge against inflation. Investors can leverage loans to acquire properties, allowing for larger investments with less upfront cash. While it requires careful management and involves risks, many find real estate a reliable and profitable component of their investment strategy.

What are the pros and cons of real estate?

Here are the disadvantages and advantages of investing in real estate:

|

|

What type of property has the highest ROI?

The properties that typically offer the highest ROI are multifamily units, which generate multiple rental incomes, and commercial properties with long-term leases for higher rates. Single-family rentals provide steady income and appreciation, while vacation rentals can yield significant returns during peak seasons. Fix-and-flip properties can also be profitable if managed well. Real estate investment trusts (REITs) offer attractive dividends for a more passive approach. Ultimately, the best choice depends on individual goals, market conditions, and management expertise.

Is it better to save or invest in real estate?

Choosing between saving and investing in real estate hinges on your financial goals. Savings offer safety and liquidity for emergencies, while real estate can yield higher long-term returns through appreciation and rental income. While it serves as a tangible asset and inflation hedge with potential tax benefits, real estate also involves market risks and requires significant upfront capital. If you prefer stability, saving is best; investing in real estate may be more advantageous if you seek growth and can tolerate risk.

Sources

Bringing It All Together

Why invest in real estate? There are many reasons, and it comes down to what you’re after. Many people love the sweet tax breaks, a solid hedge against inflation, and the chance to earn somewhat passive income. Plus, you could score some nice appreciation on your property. Just a heads-up: nobody can see the future for sure. But I’m optimistic that house values will keep cruising along, and rents should keep rising, even when the economy throws us some curveballs. 📈

It can be a crazy ride, but real estate has the potential to be a big win! 💸 I hope the points I’ve outlined helped you see why now is a good time to invest in real estate. If you have more questions, comment down below!