A comparative market analysis (CMA) helps estimate the value of a property based on comparisons to current active listings and homes that recently sold. It also involves assigning monetary values to differences in characteristics between homes — such as the gross living area, age of the home, number of bedrooms and bathrooms, etc. — to give you an objective view of what a property is worth.

Key takeaways:

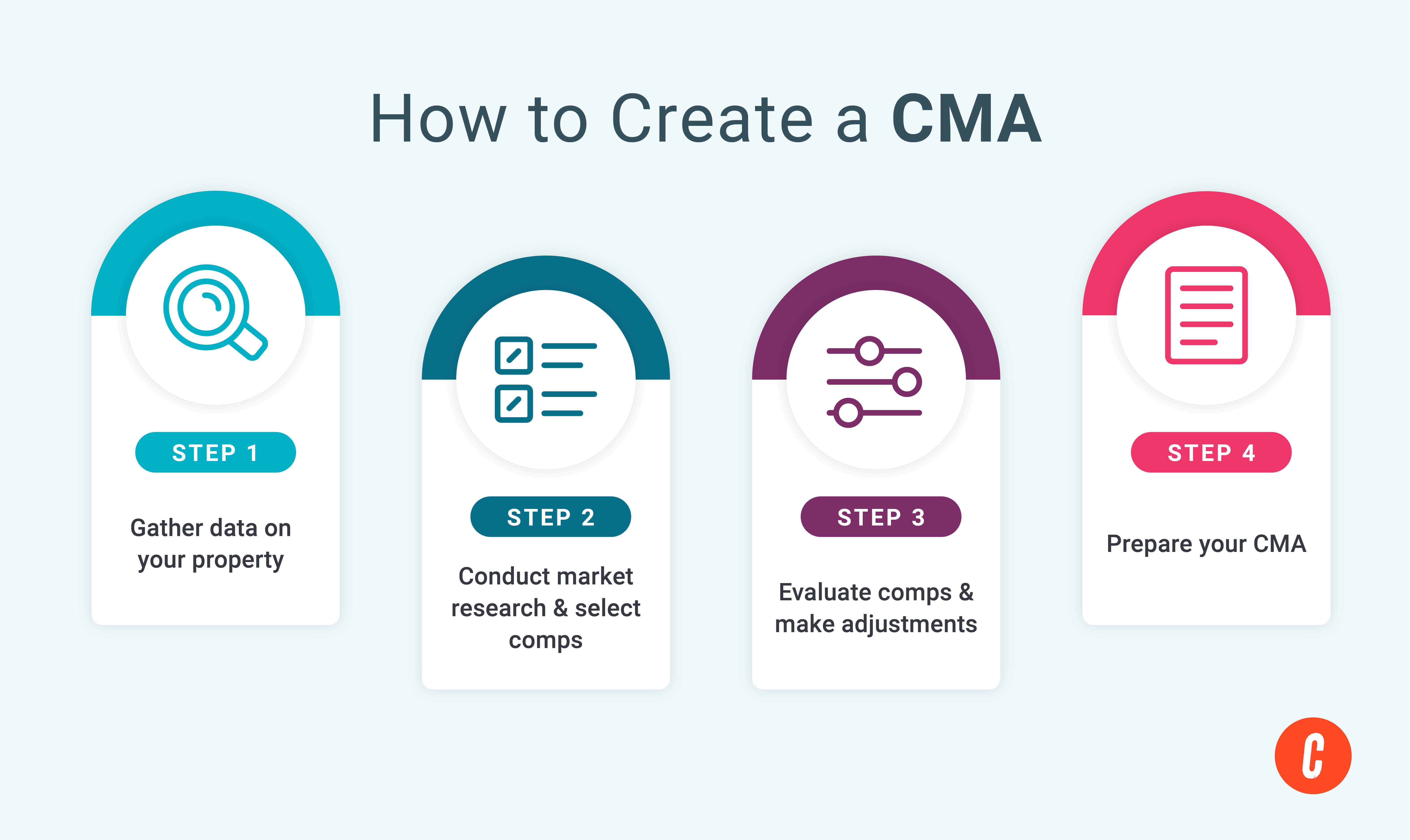

- The process of completing a CMA involves four steps:

- Gathering data on the main property

- Researching the market & choose comparable homes

- Evaluating comps and adjust for differences in characteristics

- Preparing the CMA report

- The most basic characteristics to look into include:

- Location

- Property type and size

- Property amenities & special characteristics

- Neighborhood trends and statistics

To follow along with the steps involved with completing a CMA, you can use our free CMA worksheet template and fill in each section as you move through this guide.

Step 1: Gather data on your subject property

Completing a CMA involves thorough data analytics to get a good understanding of the property you’re evaluating. This includes gathering data like when the property was built, its gross living area, and how many bedrooms and bathrooms it has. If you’re a listing agent, this is a crucial step because being knowledgeable about the home’s characteristics is a key in having an effective marketing plan for the property.

I recommend using public records in researching the property, as these likely have the most accurate and updated information. Many MLSs have the ability to retrieve this data from public records for you, like Corelogic’s Realist or Propertyradar. Once you’ve gathered this data, I also strongly recommend an in-person visit to the property to see if there are any notable discrepancies.

Below is a list of items you should consider when preparing your CMA:

1. Property location

Consider where the property is located in relation to things like shopping and entertainment centers, grocery stores, and places of employment. Is it located in an urban, suburban, or rural area? The idea here is that having quick, convenient access to certain amenities and resources is something that’s generally valued highly by prospective buyers.

I also recommend taking note of whether the property is located in a flood zone. All things being equal, most buyers are likely to view this as a slight negative.

2. Year built

Depending on the market you’re located in, newer properties are generally viewed more favorably. This is because the homes are more likely to be built to comply with the most up-to-date building and safety codes, as well as utilize more modern materials. Some buyers may also consider the fact that newer homes are less likely to require repairs or maintenance in the near-term.

3. Property type

Make note of the type of property you’re evaluating, such as whether it’s a single family home, condominium, multi-unit property, townhome, attached versus detached property, and whether it’s located in a planned unit development (PUD).

This will be important when you’re looking for comparable homes because in most instances, a buyer won’t be interested in anything that’s too drastically different from what they initially had in mind. In other words, someone looking to buy a 1-unit single family home probably won’t be interested in buying a 4-unit property.

4. Property design, style, and use

This might require a physical inspection of the property, but you’ll want to determine what the architectural design of the home is like. The idea here is that when you look for comparable properties, you’ll want to select those that are similar in design as those are the properties most likely to appeal to the same type of buyer. You’ll also want to ensure that the design is typical and conforms to the neighborhood.

5. Square footage

This can be broken down into the gross living area, total square footage to include things like an unfinished basement, as well as the total lot size to include things like a backyard or other outside areas.

6. Room count

The number of bedrooms and bathrooms is a critical factor that will impact the price of a home. In addition to the number of rooms, however, you should also consider the type and features of each. For instance, a bedroom with a five-piece en suite bathroom is something that would be considered more valuable than a standard bedroom. Similarly, full bathrooms that have a toilet, sink, and shower, are considered more valuable than half bathrooms that may not have a shower or bathtub.

7. Amenities & special features

Amenities and special features that can add value to a property can include things like solar panels, fireplaces, patios, decks, and pools. If the property is located in a homeowner’s association, it can also include things like tennis courts, basketball courts, and an on-site gym.

8. Car storage

Car storage can include things like a carport, assigned parking space, or a garage. In addition to the type of storage available, take note of whether it is attached or detached to the property, and how large it is. Generally speaking, attached garages add the most value to a home, followed by a carport and assigned parking space.

9. Utilities and appliances

Having standard utility connections for things like internet, water, electric, and gas is something that can easily be taken for granted, but it’s still worth checking, especially for rural or older properties. Verifying that the property has the proper hookups for appliances, such as a refrigerator, oven, dishwasher, microwave, and washer/dryer can also avoid any last-minute surprises when showing the property to prospective buyers.

10. View

All things being equal, properties with a beneficial view have the ability to fetch a higher purchase price. Typical examples of a beneficial view can include a property that overlooks a city, park, golf course, lake, or mountain. Adverse views are often regarded as properties that only have a view of a parking lot, street, railroad tracks, high tension wires, garbage dumps, or commercial buildings.

11. Property rights and zoning

Property rights can either be fee simple or leasehold. Fee simple is the most common and grants full permanent ownership of the property and any buildings on it to the owner. A leasehold, on the other hand, grants only temporary use of the land.

For homeowners, fee simple is considered more desirable, and is something that will provide more value versus a similar property offered as a leasehold.

12. Amount of homeowner’s associated (HOA) dues and property taxes

The amount of HOA dues and property taxes affect a home’s affordability. All things being equal, higher taxes and HOA dues tend to correlate to lower sales prices for the home. HOA dues may also include special assessments, something that can further detract from a home’s value.

While paying more fees is not ideal, do keep in mind that the cost of HOA dues can sometimes be offset by the amenities offered. Common examples include a pool, tennis courts, basketball courts, and gym facilities.

13. Neighborhood trends

A home’s value is often tied to market trends in the specific neighborhood it’s located in. Completing a thorough CMA should include an evaluation of the trend of property values, supply and demand of homes in the area, and total marketing time.

- Property value trends: Look to see whether property values have been increasing, decreasing, or have been stable for the past 3, 6, and 12 months. You can take a look at closed sales as well as current active listings. I also recommend researching any external factors that might explain fluctuations in property values.

- Supply and demand: Here, you’ll want to determine whether there is a shortage or over supply of homes. In markets that have a shortage of homes for sale, buyers should expect to pay more. On the other hand, markets that have an over supply of homes for sale will see buyers being able to more easily negotiate prices.

- Marketing time: This is the amount of time needed to close a home after listing it for sale. Neighborhoods exhibiting shorter marketing times, typically under 3 months, are a good indicator that it’s easy to find buyers. Neighborhoods with longer marketing times, 6 months or longer, could be an indicator that there’s a shortage of buyers or an over supply of homes for sale.

14. Property condition, age, & other adverse items

While it might seem silly to say, homes in better condition typically fetch a higher sales price. If you’re doing a CMA, check to see if there are obvious repairs needed to the property. This includes the presence of any health or safety hazards, as well as other physical deficiencies that could impact the livability or structural integrity of the home. These are items that could also be tied to the property’s age.

Other adverse items may include environmental conditions, easements, or encroachments that limit or restrict the use of the property.

Step 2: Research the market & choose comparable properties

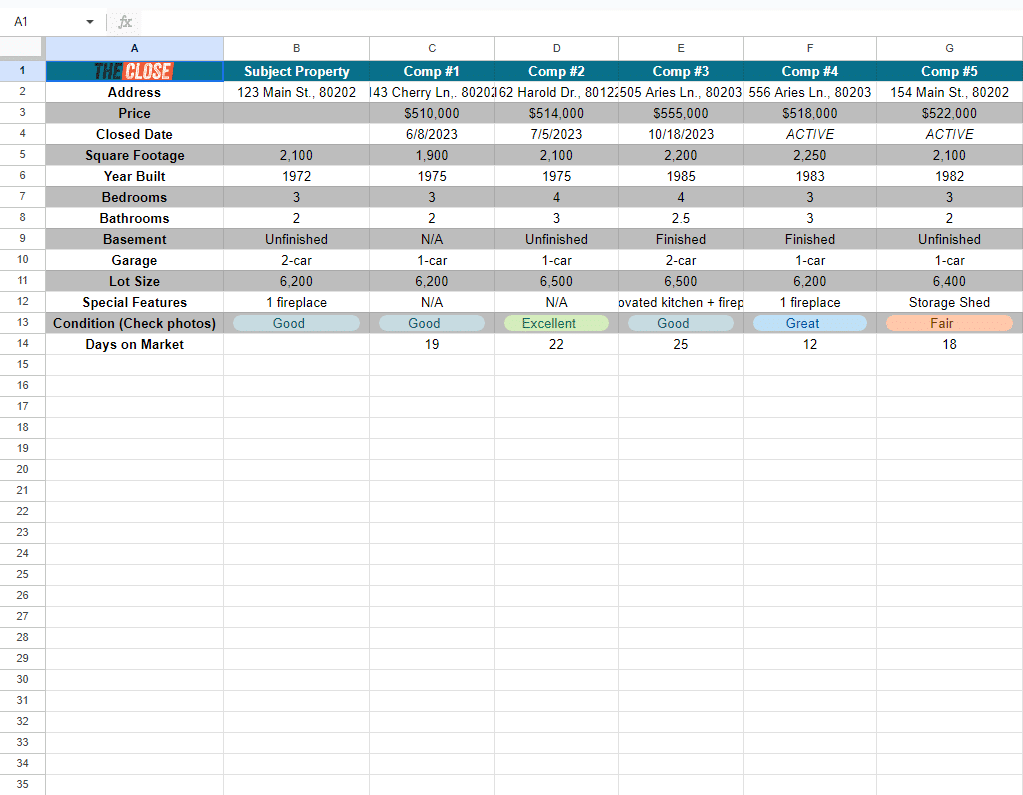

Once you’ve gathered data on your subject property, the next step is to find similar homes as your comparables to support your home’s value. You can use the free CMA worksheet template linked above to follow the steps outlined below, where I go over how you can start the process of finding good comps, as well as key features to take note of.

Finding good comps

It might be tempting to try and find comps based on specific characteristics, like whether a home has a pool, or how many bedrooms and bathrooms it has. However, I recommend starting at a high level by narrowing down your geographic area and specific neighborhoods. Location is a key factor for buyers, and is arguably one of the most important items when it comes to selecting a home.

Various resources, such as your MLS, offer map drawing tools and filters to allow you to begin this step of finding your comps.

- Distance: The closer a property is to yours, the more likely it is to appeal to the same type of buyer looking to purchase a home in that area. A good rule of thumb for well-populated areas is to limit comps to a 1 mile radius. Rural areas will obviously require a larger radius, which can vary from market to market.

- Location to amenities: Good comps should have a similar distance to amenities, such as shopping centers, entertainment areas, and places of employment.

- Neighborhood boundaries: Depending on the market, there may be physical markers that identify separate neighborhoods. Freeways and major busy roads are common examples, as properties located past these boundaries don’t generally make for good comps due to differences in architectural design and lot size.

Key features to analyze

Once you’ve narrowed down the area for your comps, you can start to focus on specific features and characteristics. Using our free CMA worksheet template or the list of features we listed above in step 1, you’ll want to find properties as similar as possible to your subject property.

You’ll also want to consider the following in selecting your comps:

- Date of sale: Markets can change rather quickly, so choosing comps that have recently sold can provide a better indication of your subject property’s home versus a more dated comp. A rule of thumb is to choose homes that have sold no more than 6 months ago.

- Sales or financing concessions: To get a good apples to apples comparison, it can be a good idea to figure out if there were any seller concessions provided as part of a sale. For instance, a property could have sold for more than normal if the seller agreed to pay for some of the buyer’s loan closing costs. Similarly, a home in need of repairs but was sold as-is could explain a lower-than-expected sales price.

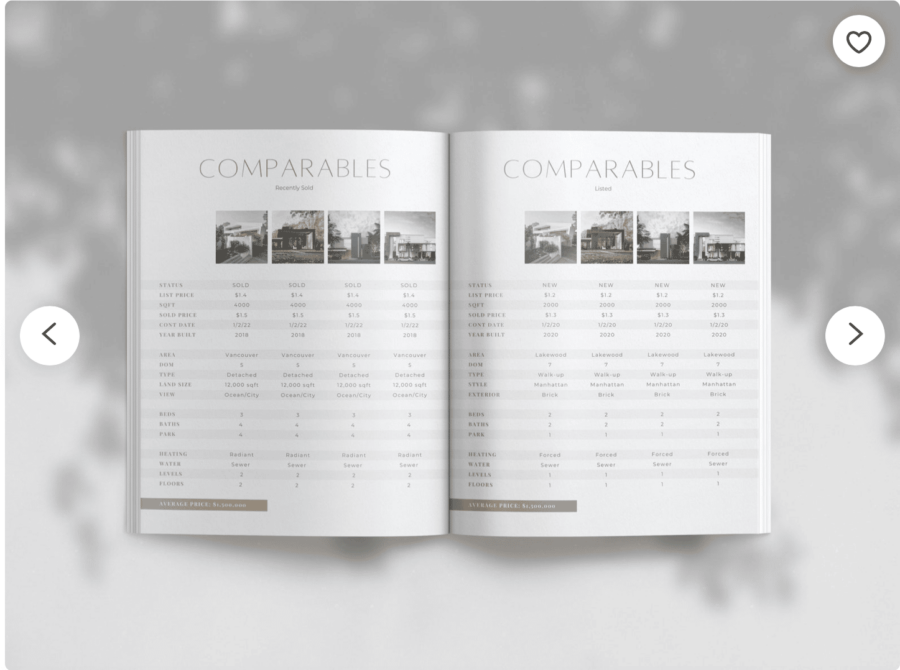

Step 3: Evaluate the comps & adjust for differences

Once you’ve selected your comps, the next step will be to adjust for any differences in features between your subject property and the comps. This will be something you should expect to do for most of your comps, since it’s rare to find two identical properties.

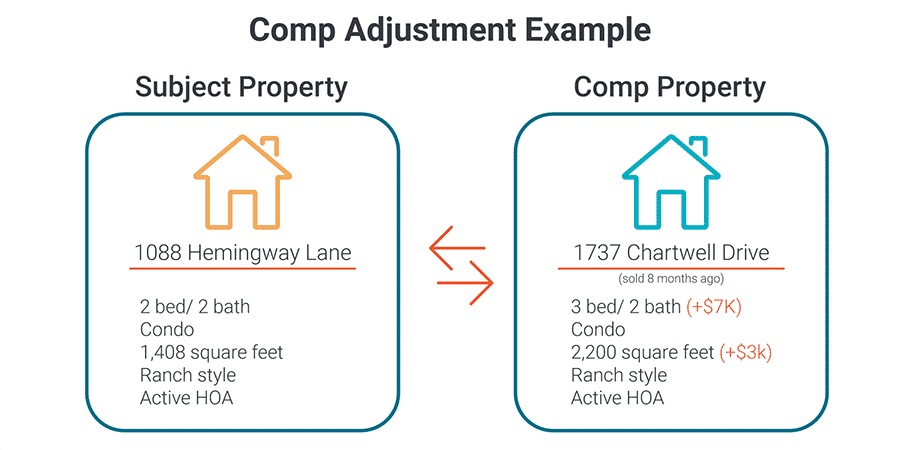

For example, in the image below, we can see that our comp property has 1 extra bedroom and is larger by almost 800 square feet. We’ve estimated that the extra bedroom is worth $7,000 in value, with the additional square footage being worth $3,000 in value. In order to see what our subject property is worth based on these differences, we need to adjust the comp property to be as similar as possible.

This can be done by removing the value of the comp’s extra bedroom and square footage. We take the sales price of the comp, and subtract the corresponding values of $7,000 and $3,000. By subtracting these figures, we can see what the comp would have sold for assuming it did not have the extra bedroom and square footage, and subsequently, the market value of our subject property. The same adjustments can be made across the board for all of a property’s features such as its view, location, age, condition, and other items we’ve mentioned previously.

Determining the amount of adjustments

So how would you know what the appropriate adjustment amount is? For instance, how would you know whether a buyer values an extra bedroom at $5,000 or $10,000? I’ll be the first to say that you should let the data drive the math. You’ll need to look at other comparables where the primary difference is the bedroom count, and use that difference in sales price to determine the dollar amount to attach to the value of a single bedroom.

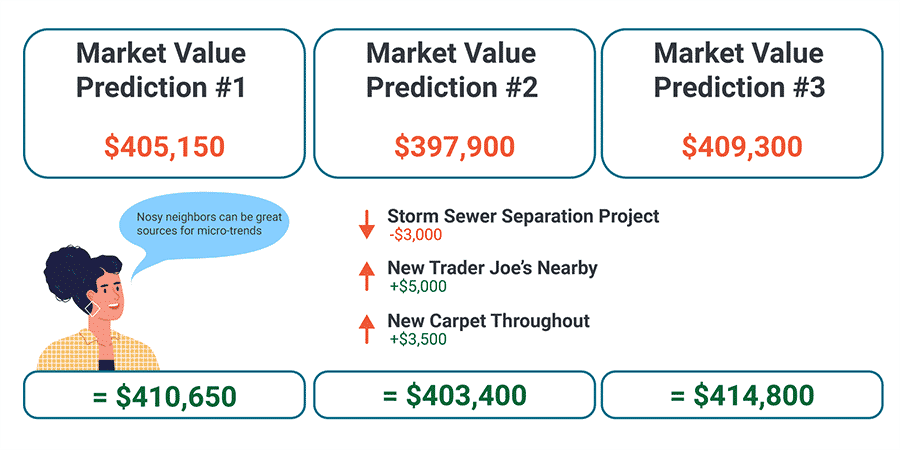

Market trend analysis and value range

Your CMA report can include a range for how much a property is worth. This range can help capture differences in how buyers might value certain items differently. It can also help you account for future changes in the local market that could impact the value of the home.

For example, construction for a nearby grocery store could help increase the future value of a home, while a city construction project for storm sewers could negatively impact the short-term value due to the anticipated increase in noise.

Step 4: Prepare your CMA report

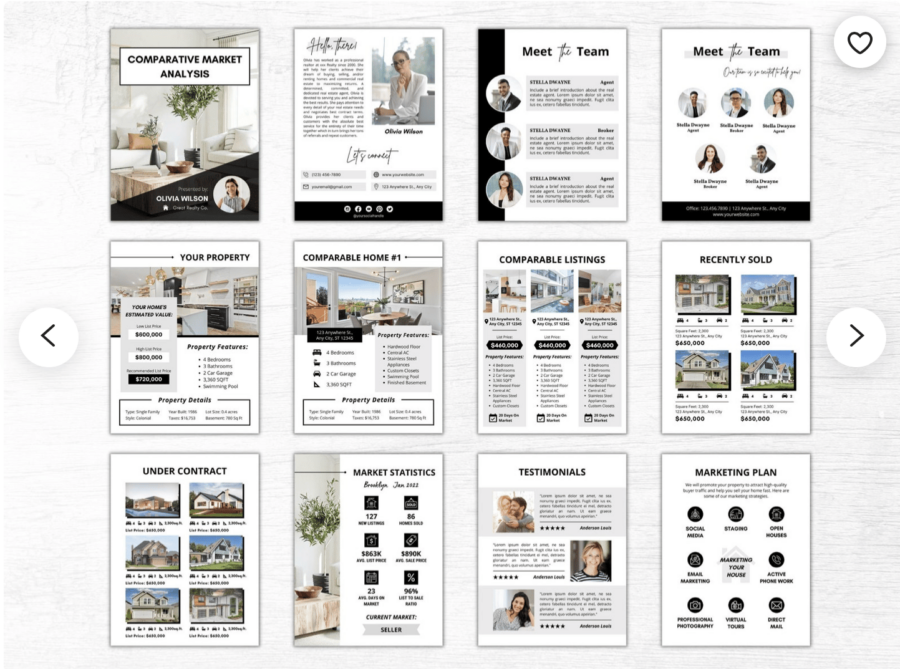

Now that you’ve got all of the data for your CMA, you’ll need to put it into a format that will be easy to understand and visually appealing. This is a great marketing opportunity for you to really stand apart from other real estate agents, and it’s a chance for you to show your knowledge and expertise in this market.

In addition to the items listed below, you can include elements from our CMA worksheet as well as our guide for listing presentations.

- Your bio and how to contact you

- Highlights of the subject property (e.g. features, bedrooms, bathrooms, etc.)

- Top comparable homes

- Highlights of homes that recently sold (you can also include homes currently under contract)

- Neighborhood profile

- Market statistics (average days on market, price per square foot)

- Marketing plan

- Testimonials from your previous clients

CMA templates

For some help in making your CMA report visually pop and be easy on the eyes, you can use software like Cloud CMA or use templates on Canva and Etsy. If you’re looking for some inspiration, below are some examples of aesthetically pleasing CMAs. If you’re using a CMA as part of your prospecting strategy, feel free to also take a look at our prospecting letter templates.

CMA frequently asked questions (FAQs)

Is it a problem if my CMA is different from another agent?

Not necessarily. Determining a property’s value is part art, part science. Different buyers place a different value on certain features and characteristics. Because of this, it’s not uncommon to come to a slightly different conclusion on a property’s value.

What is the purpose of a CMA?

A CMA helps determine what a property is worth. If you are a listing agent, this can help you figure out what sales price to set in order to attract the largest number of buyers. As a buyer’s agent, this can help you determine whether a property is within your client’s price range, and what would be considered a competitive offer that a seller is likely to accept.

How many comps should I use in my CMA?

This can vary by market, but I recommend at least 3 closed sales within the last 0 to 12 months, and at least 1 or 2 active listings. If you’re not able to find similar properties or homes that have recently sold, you may want to up the number of comps to support your opinion of value in the CMA report.

What’s the difference between a CMA and an appraisal?

The main difference between a CMA and an appraisal is the intended purpose. A CMA is used primarily to determine a home’s listing price to attract as many buyers, as well as an appropriate offer price to increase the likelihood of being selected by the seller. An appraisal is performed by a licensed appraiser, typically for the purposes of determining the value of the property from a lending and insurance perspective.

What’s the most important factor to consider in my CMA?

The location of your comps is perhaps the single most important factor in ensuring an accurate CMA. Location determines how close it is to schools, shopping centers, employment areas, and more. These are items that most buyers place a high value on, and will therefore have a large impact on the value of the home.

Bringing it all together

As a listing agent, a properly researched CMA can help ensure you price a property just right to attract the most buyers and get the highest sales price. As a buyer’s agent, you can ensure your clients place competitive offers to maximize the odds of getting accepted by the seller. While it may be a time-consuming process, conducting the proper due diligence in preparing a CMA can allow you to have a large payoff at the end of the day.

Have any tips or specific questions? Leave them in the comment section below!