Before diving into the exciting world of house flipping, starting with a solid foundation is essential. This means putting together a detailed business plan that covers everything from getting your operations set up and building your team to evaluating properties and securing funds for your projects. To make this easier, I have a free template and seven essential steps on how to start a house flipping business. This way, you’ll create a robust strategy that sets you up for success! 🏚️🔨🏠

1. Prepare a Real Estate Investment Business Plan

Before you jump into the fun adventure of buying and flipping houses, creating a business plan outlining your specific success strategies is a good idea. This plan will serve as your roadmap, helping you figure out how many projects you want to take on, the profits you aim to make, and the funding details that will keep your journey on track. A clear business plan for flipping houses shows lenders and investors that you’re professional and serious about your goals.

Use our real estate investment business plan and complete the following information to get started:

- Executive summary

- Company description or overview

- Mission and vision statement

- Investment strategy

- Market analysis

- SWOT analysis

- Specific and measurable goals

- Financial plan

- Budget and financial projections

- Marketing plan

- Real estate team members and technology systems

- Exit strategy

However, besides items from a general investment business plan, a strong house flipping business plan includes detailed information about this unique business model. Make sure your plan also includes the following:

- Types of properties: Such as single-family homes, duplexes, or multifamily properties

- Geographic area: The specific locations and neighborhoods where you want to invest

- Who’ll do the work: Decide if a contractor does the job, you hire a team of specialists, or if you’re doing the work yourself

- Project timeline: The projected timeline to complete the flip and a six-month margin for inevitable delays

- Number of projects: How many projects you can realistically manage and complete during the course of one year

- Financial plan and sources: Define your financing sources and include all costs such as materials, labor, carrying costs (taxes, insurance, utilities, mortgage principal, and interest), marketing, and real estate agent commission

- Expected return on investment (ROI): This figure should include actual calculations, not just a goal. It’s common for flippers to aim for an ROI of 20%. However, returns will vary depending on the location, property values, and the current real estate market conditions.

2. Set Up Your House Flipping Business Operations

Many believe flipping houses is just about buying, renovating, and selling. However, laying down a solid business foundation for lasting success is essential! This means picking the proper legal structure, like an LLC, registering your business, and setting up separate bank accounts. Don’t hesitate to contact professionals, such as attorneys and accountants, who help you set everything up right. With exemplary business practices, you’ll keep your venture organized, efficient, and legally compliant.

Choose the Right Business Entity

When starting your house-flipping business, picking the proper legal structure and registering it with your state is vital. This helps keep your personal and business assets separate, which is helpful if any business-related issues arise. For example, if someone gets hurt during a demolition, they could sue your company, which wouldn’t put your personal assets at risk.

When it comes to investing in real estate, there are a few common entity types you might consider, like DBA (doing business as), S corporation (subchapter or small business corporation), or LLC (limited liability company). Chatting with your accountant and attorney while you’re getting the hang of how to start a house flipping business is a good idea. They determine which option suits you best, as everyone’s financial situation differs.

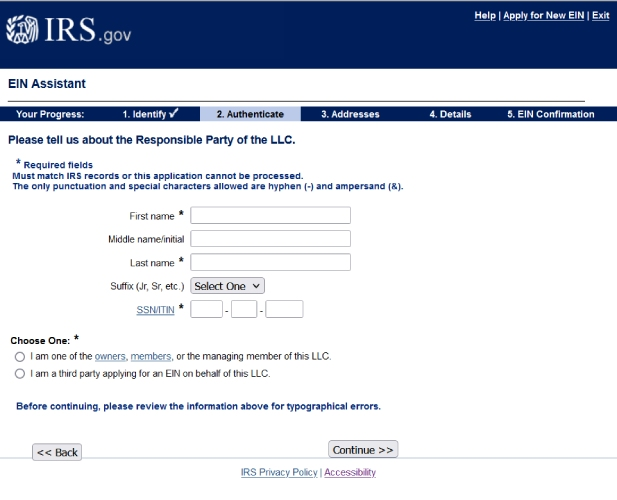

Register Your Business With the IRS & Obtain Permits

If you’re starting your legal business, one of the first steps is registering with the Internal Revenue Service (IRS) and obtaining an Employer Identification Number (EIN). This number will help identify your business entity. Check with your state and local government to see what other licenses or permits you might need, like building permits or any special exceptions regarding zoning.

Open a Business Bank Account

Once you have your EIN, set up a business bank account to separate your personal and business finances. This protects your hard work and helps you stay compliant with the law, especially when starting a flipping business. You’ll use this account for expenses like gas while scouting properties and paying your attorney and accountant. Managing your expenses in one place will simplify tax time and help you avoid any IRS complications.

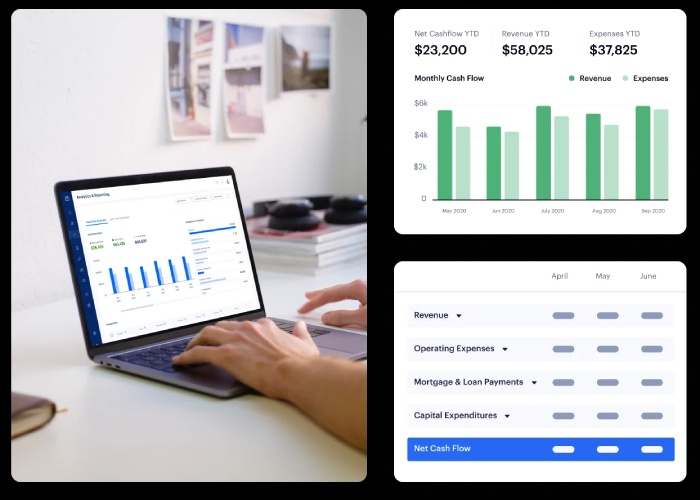

With Baselane’s analytics and reporting tools, you can easily track your property’s performance in real time. Get the scoop on cash flow, profits and losses, capital expenses, carrying costs, and transfers all in one place. It makes it simple to gather your investment property’s financial information from your business bank and other accounts on a single, easy-to-use platform.

Pro Tip: Once your business bank account is up and running, consider applying for a business credit card—a valuable tool for acquiring building materials and office supplies without any upfront costs. Some business credit cards offer perks like cash back, which saves on your upfront costs. Some provide a 30-day to 18-month interest-free period, allowing you to manage expenses more effectively.

3. Find Financing Sources for Your House Flipping Business

Many people wonder how to start a house flipping business without any cash. While you’ll need money to buy properties, most flippers don’t rely solely on their funds. They usually find financing through hard money lenders or loans made just for flipping houses. The two main ways to dive into the house-flipping game are:

- Hard money loans: These loans offer faster approval and funding times than traditional mortgages. The borrower qualifications are more lenient but with shorter loan terms and higher interest rates.

- Rehab loans: These include home equity lines of credit (HELOCs), HomeStyle renovation mortgages, 203(k) rehab loans, or CHOICERenovation loans. They require a lower down payment but also have more extensive criteria and paperwork.

The costs of flipping a house can vary a lot depending on the property, its condition, and the market. Figuring out your budget and potential profits can be tricky, but it’s essential for success. Keeping track of your finances and each project is a must in the house-flipping process.

4. Hire the Right House Flipping Professionals

Remember how important your network is for your house flipping business plan. You won’t be going it alone; you’ll work with lawyers, accountants, real estate agents, and contractors. Their insights are key to turning a profit and avoiding costly mistakes. Some important house-flipping pros to hire include:

- Real estate attorney: Manages legal aspects, ensures compliance with local laws, and drafts contracts

- Accountant: Helps with business structure, filing house flipping taxes, expense tracking, and financial advice

- Real estate agent: Offers industry insights, local connections, and accurate market data

- General contractor (GC): Oversees rehabs, ensuring quality and reducing errors

- Administrative assistant: Assists with tasks and project management as your business grows

- Handyperson: Handles smaller jobs, saving time and costs

- Landscaper: Enhances curb appeal for higher ROI

- Architect (for large projects): Ensures structural integrity and avoids costly issues

The best way to find trustworthy experts is by getting referrals. If other real estate investors or agents you know have had great experiences with someone, chances are you’ll have a smooth ride, too. Still, it’s an excellent idea to do some digging and meet with them to ensure they’re the right fit for you. Ultimately, putting in the time and effort to find the right expert can save you a lot of hassle, cash, and stress down the road.

5. Identify the Right Properties to Fix & Flip

Before making a purchase, evaluate potential properties to flip. Run a comparative market analysis (CMA) on properties or have a real estate agent run one to determine their value and calculate the return on investment (ROI). When learning how to find houses to flip, some essential factors to evaluate include:

-

Location: Pick nearby properties for easy site visits

-

Neighborhood: Choose desirable neighborhoods for curb appeal

-

Amenities: Houses near parks, schools, and other establishments attract buyers

-

Structural issues: Avoid costly structural problems

-

Value-add repairs: Research profitable upgrades like kitchens and bathrooms

-

Property size: Focus on square footage over the floor plan

-

Outdoor space: Properties with outdoor areas tend to yield higher returns

Did You Know? A house-flipping business’s potential return on investment (ROI) can be significant. Investors purchase distressed properties at a lower cost, renovate them to increase their market value, and then sell them at a higher price, resulting in a profit. ROI percentages vary widely, but successful flips can yield returns ranging from 10% to 100% or even more of the initial investment, depending on location and other factors. However, house flipping comes with risks, such as unexpected renovation costs or market fluctuations, so thorough research and proper planning are crucial to maximize ROI and minimize potential losses.

6. Create a Marketing & Lead Generation Plan

Setting up a successful house-flipping business involves some marketing and real estate branding. While a complex marketing funnel isn’t necessary initially, a well-crafted marketing strategy ensures a steady influx of new projects for your house-flipping business.

Marketing Your Fix & Flip Business

Having foundational marketing elements is crucial for projecting professionalism, building your reputation as a reliable home flipper, and marketing your newly renovated properties, especially if you seek funding. Lenders see your professionalism and experience as favorable. Consider starting your business with these marketing elements:

- Logo: A quality logo distinguishes your brand and is useful across future marketing materials.

- Business cards: Affordable and handy for networking; consider adding QR codes for website access.

- Website: A simple one-page site effectively communicates your identity, services, and contact information.

- Business email: Use your website domain for a professional email address, boosting your image.

Lead Generation Strategies for Your Business

To find renovation projects and motivated sellers, beginners often utilize platforms like Zillow with versatile filters for property searches. In addition, Foreclosure.com is a valuable website for finding discounted properties for foreclosures. Start generating leads and learn how to find cheap houses to flip using these resources:

| ||||

|

7. Buy, Rehab, Market & Sell Properties

Once you’ve nailed down the right business strategies and sorted the structures out, most of your work as a house flipper boils down to buying, fixing, and selling properties. After you close on a property, you’ll start racking up monthly carrying costs, which can really add to your planned expenses. So, the quicker and smoother you can get the flip done, the more profit you’ll make.

The process of making money flipping houses goes like this:

- Close on the investment property: Buying an investment property differs from purchasing a primary home, so make sure you know how to determine a budget, evaluate properties, and choose the right lender. Depending on your financing, closing on the property can take 15 to 45 days.

- Make all repairs, renovations, and upgrades: Repairing a fix-and-flip property will take the most time. You or your general contractor should manage the timeline, remembering that delays increase your carrying costs.

- Market the property for sale: There are endless ways to generate excitement about your property and increase the sale price. For some ideas, read our Clever Real Estate Marketing Ideas. Although these strategies are aimed at agents, they are equally effective for home flippers.

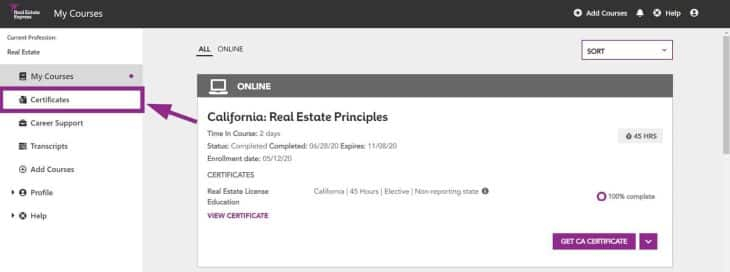

- Sell the property: Working with a real estate agent is often the most efficient way for flippers to sell their properties since they manage communications with the buyer’s agent and lender and often schedule the necessary appointments. However, many flippers choose to get a real estate license to gain access to the MLS and save even more on fees.

Experienced house flippers often handle their property transactions to reduce expenses. Pursue a real estate license through online schools like Colibri Real Estate, which offers comprehensive courses, instructor support, ebooks, live Q&A sessions, and exam prep tools with a pass guarantee. Colibri Real Estate, an accredited education provider, has assisted countless agents and brokers nationwide in obtaining their licenses, enhancing profit opportunities.

Mistakes to Avoid When Starting a House Flipping Business

Everyone starting out in the business is bound to mess up a bit. For house flippers, there are some real learning curves, and each new project comes with its unique challenges. But if you can steer clear of some common mistakes right off the bat, you’ll find it a lot easier to grow your flipping business and rake in the profits. Some mistakes to avoid when flipping houses include:

- Overestimating your abilities: Avoid taking on major electrical work or plumbing tasks if you lack the necessary skills. It can lead to costly mistakes.

- Lacking a team: House flipping often requires collaboration with contractors, real estate agents, and other professionals. Trying to do it all alone can lead to delays and errors.

- Overspending on renovations: Going over budget can eat into your profits. Plan carefully and prioritize cost-effective improvements.

- Buying a flip far away: Distance can make managing the project effectively and promptly responding to issues challenging.

- Not understanding the numbers: Accurate financial calculations are crucial. Failing to grasp costs and potential profits can result in financial setbacks.

- Being unprepared for the unexpected: House flips often encounter unexpected issues, such as hidden structural problems. Have a contingency plan and budget for surprises.

FAQs

What is the 70% rule in house flipping?

Real estate investors use the 70% rule in house flipping to determine the maximum purchase price for a property to ensure a profitable flip. According to this rule, investors should not pay more than 70% of the property’s after-repair value (ARV) minus the estimated repair and carrying costs.

How much money do you need to start flipping houses?

The initial capital needed for house flipping varies due to location, property type, and your specific house flipping business plan. Generally, having access to $20,000 to $50,000 is a good starting point. This budget should encompass property purchase, renovation, carrying costs (like taxes and utilities), and contingencies for surprises. Access to financing options, such as loans or partnerships, can also affect your capital requirements.

How many houses a year can you flip?

The number of houses you can reasonably flip in a year depends on various factors, including your experience, team, resources, and local market conditions. On average, experienced house flippers may aim for 2 to 5 flips yearly. Beginners may start with one to two flips annually. Scaling beyond these numbers often requires a well-established operation, access to financing, and efficient project management.

What do you need to flip houses?

Successfully flipping houses takes a good grip on the real estate scene, a solid game plan, and enough cash for buying and fixing up properties. You’ll want to build a trustworthy crew, including real estate agents and contractors, and make sure you can dedicate some time to the whole process. Having smart marketing tactics for selling the house and knowing the local rules is super important, too. Plus, connecting with folks in the industry can open up some great opportunities and insights.

Bringing It All Together

Learning how to start a house flipping business begins with a strong business plan. It also starts by setting up the right legal and financial systems to set yourself up for success as the business grows. Successful home flippers also create a network of professionals to get their flips done correctly and implement strategic marketing and lead generation systems. After following this step-by-step guide, your house-flipping business will be ready to generate substantial profits.

Please comment below if you have any tips or experiences about your house-flipping journey!

Add comment