The real estate market is unpredictable and sometimes volatile. However, tracking trends and learning from the past can help forecast major shifts in the future. Real estate charts are a great tool for painting a picture of the current market, identifying trends, and predicting where we might be headed. Here are 19 housing market charts that will help you understand the market as it is now and what might be lurking down the road.

Plus, understanding these real estate charts and gleaning their insights will give you the bonus of looking like a superhero in front of clients. You’ll shine as the local expert when you confidently address your buyers’ and sellers’ concerns.

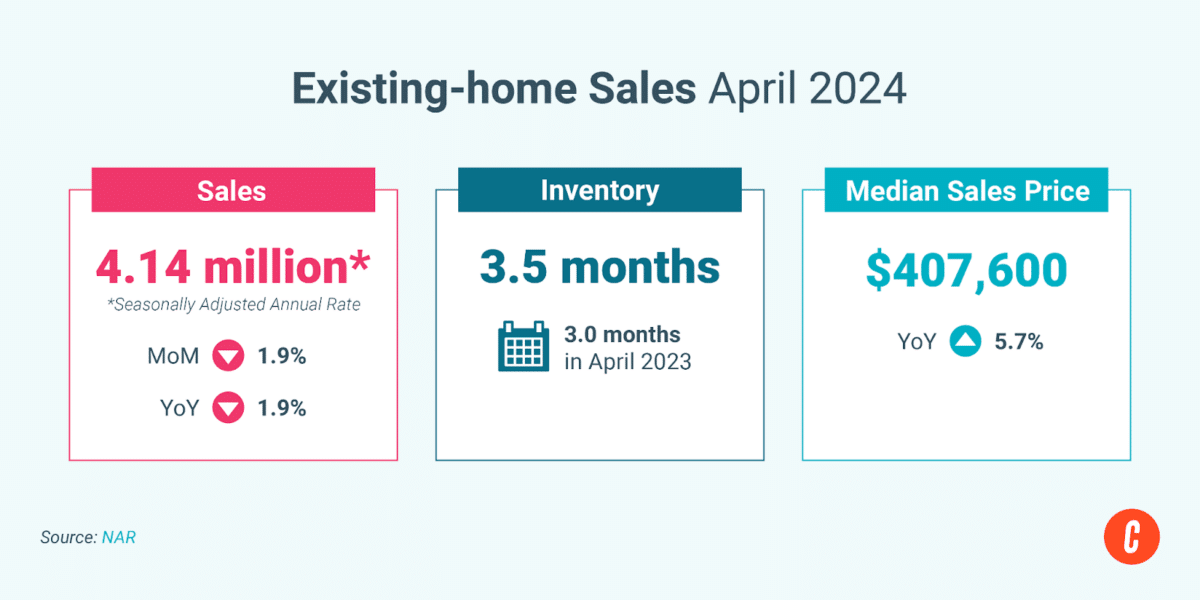

1. Home Sales Are Normalizing

Home buying has slowed to a much more normal pace because of escalating home prices and stubborn mortgage rates. I know what you’re thinking—the real estate market feels like it’s crashing! But truthfully, based on decades of data, the market is just normalizing. Homes didn’t sell within hours of listing and with multiple offers before the chaotic frenzy of 2020 through early 2022. That crazy real estate era has passed, and we probably won’t see it again, barring another exceptional event that affects everything.

So, when you look at this real estate market graph and see 3.5 months of inventory, remember that six months of inventory indicates a healthy, stable market. Let your clients know there are plenty of buyers and sellers in the current real estate market.

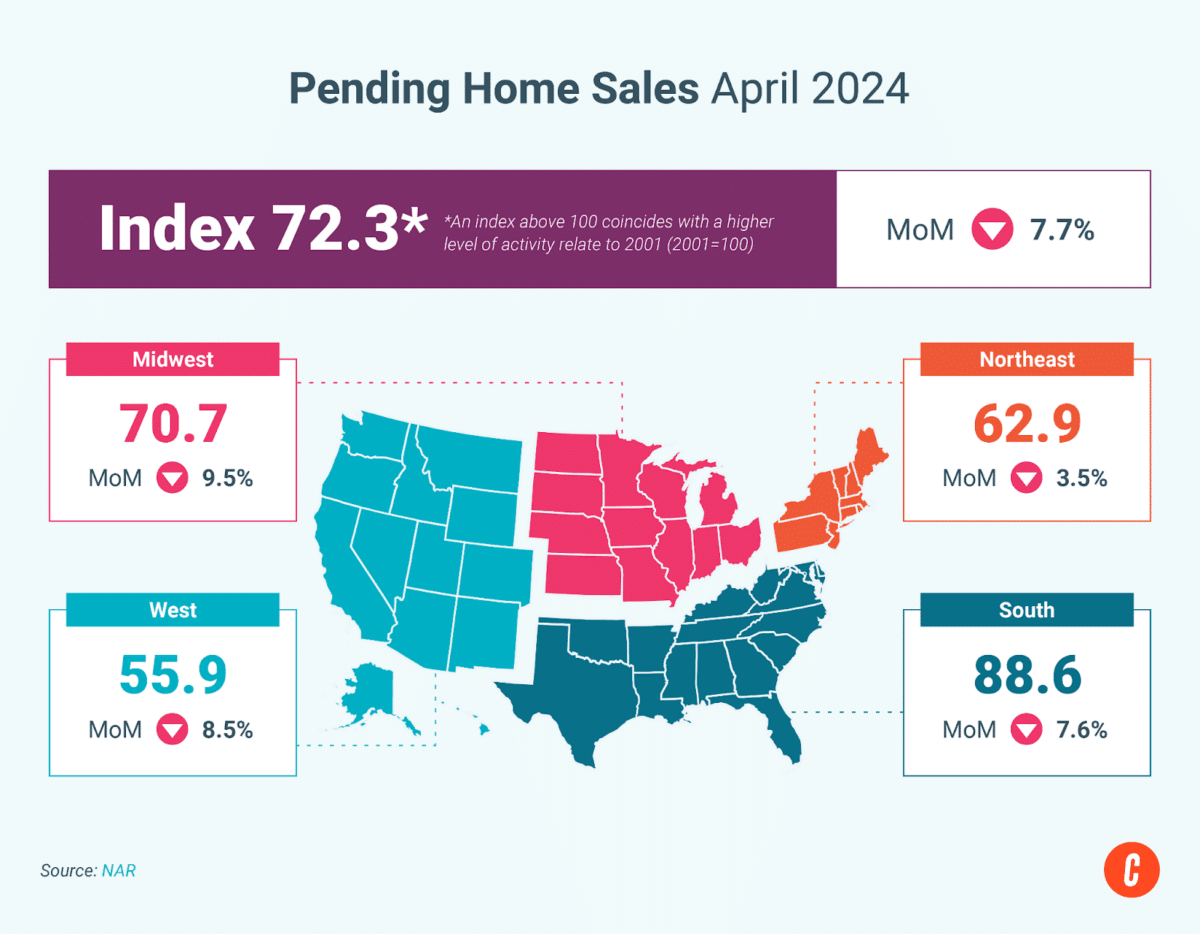

2. Home Sales Are Slowing

And now a statement from Captain Obvious: Home sales are slowing down. This housing market graph from April 2024 states that an index above 100 reflects a higher level of activity relative to 2001. The overall index for April 2024 is 72.3. The graph shows that the indexes for four different regions of the country have been down since March 2024, showing that activity is slowing. A lot has happened in the past few years, sending sales off the charts. But today, we’re starting to see things settle down.

The good news for buyers is that they don’t have to make snap decisions on whether or not to put in a compelling offer. During the frenzy, poor buyers didn’t have time to ruminate on their choices. If they tried, they were outbid and too late every time. With a slower, more sustainable pace, home shoppers, especially first-time homebuyers, can compare homes, discuss options, and make more informed decisions when putting in offers, most likely leading to a much more enjoyable experience.

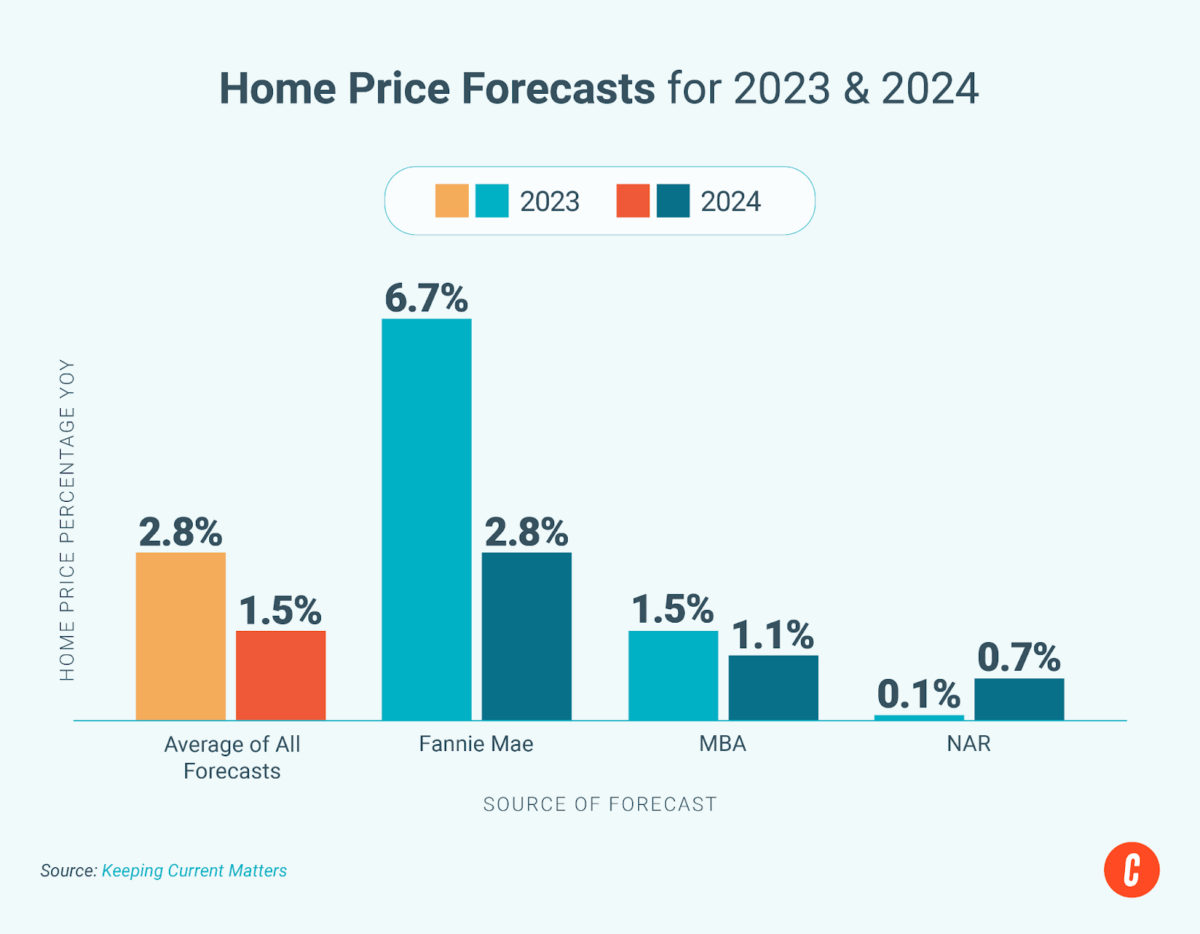

3. Will Prices Lower?

For buyers still sitting on the sidelines waiting for home prices to return to Earth, they may be waiting quite a long time. This housing market chart shows the pace of home price escalation between this year’s and last year’s predictions by Fannie Mae (2.8% vs 6.7%), MBA (1.1% vs 1.5%), and NAR (0.7% vs 0.1%). The average forecast sits at a 1.5% increase for 2024 vs a 2.8% escalation for 2023. Sure, home price escalation has slowed somewhat, but overall, home prices will continue to appreciate. But that’s normal—homeowners want appreciation on their investment.

During the pandemic, equity shot up at a record pace we’ll probably never experience again in our lifetimes, but those days are far behind us. Today, home prices are still inching upward, but at a much more normal pace. So, get your buyers off the sidelines! They must be in the game if they want to win in real estate.

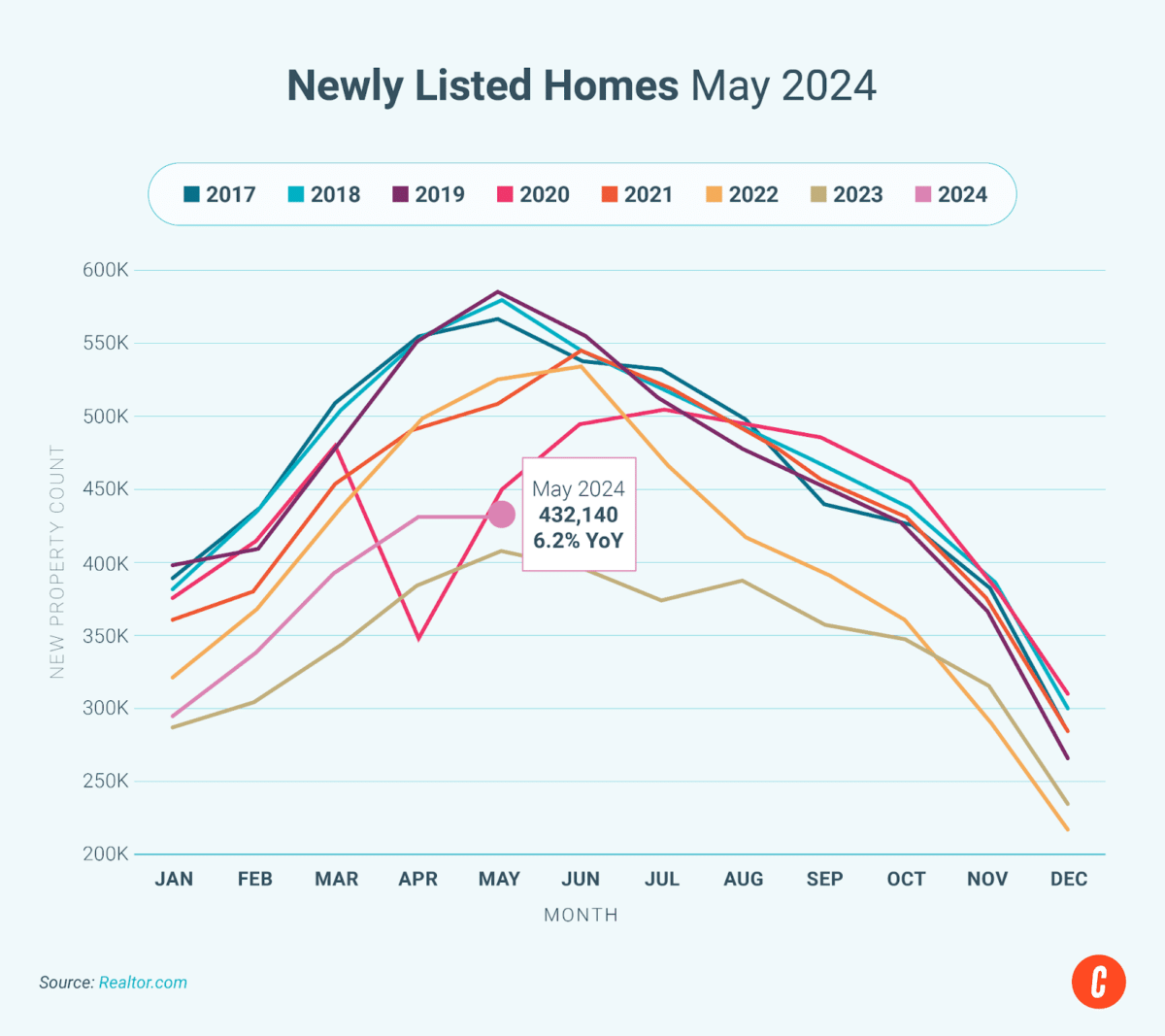

4. Listings Are Harder to Come By

Homeowners are still bearish about listing their homes, but things are actually looking up. This real estate market chart shows that 6.2% more homes were listed in May 2024 than last year. We still haven’t reached prepandemic levels, but the outlook is good. 2024 will be a strong year, even though we still won’t see the number of listings we did before 2020.

But here’s the caveat—your days of showing up at a listing appointment and signing a listing agreement are probably also a thing of the past. Expect to do a little more work to show your value, negotiate your terms, and prove your marketing prowess to get the deal. There will be more competition for fewer listings, so now is the time to prepare your listing presentation and ensure you’re up to the task.

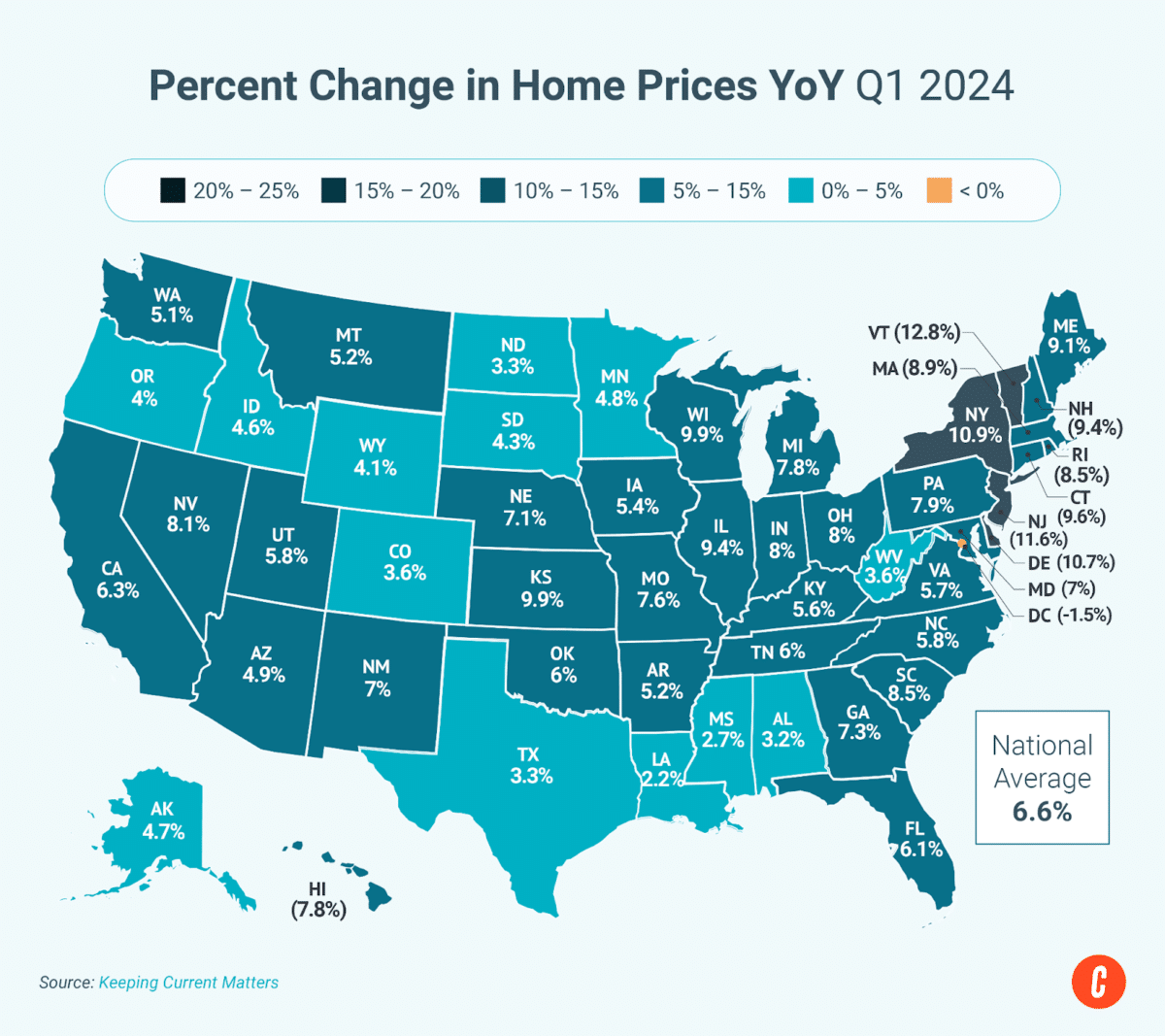

5. House Prices Aren’t Declining

Some news headlines may have you believe the real estate market is headed for a crash. Nothing could be farther from the truth. While some states have more robust markets than others, the nation holds strong overall. This housing market trends graph shows the average percent increase in home prices by state, with a national average of 6.6% increase year over year. Some areas, particularly in the Upper Peninsula, have seen increases of upwards of 10%!

The takeaway here is that you should consume headlines with a grain of salt. If you’ve ever read anything from Mike DelPrete, he talks about the fact that boring news doesn’t grab readers’ attention. So, often, outlets will grab something from the “possibility” quadrant and talk about that, even though it’s not probable. Things will probably remain the same—stable, healthy, and steady—not chaotic and certainly not crashing.

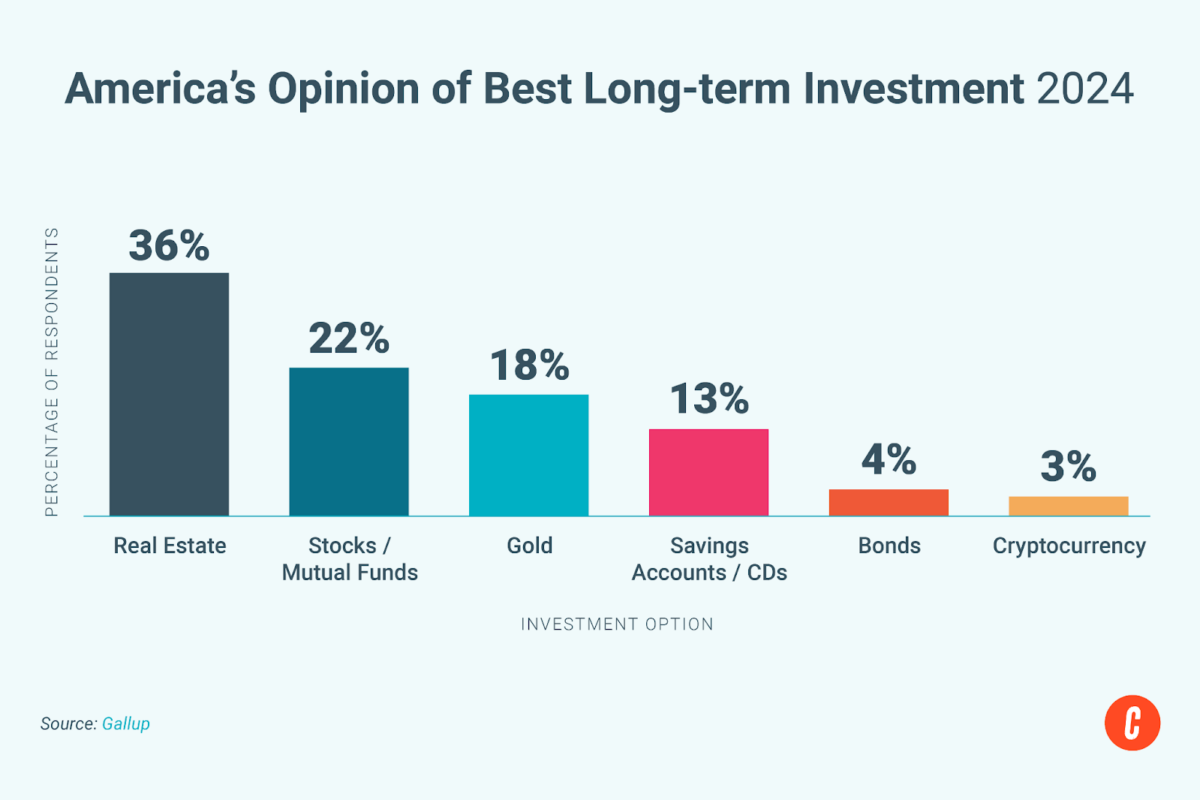

6. Cryptocurrency Who?

Remember before the Sam Bankman-Fried debacle when everyone jumped on the cryptocurrency bandwagon as if it were the next big thing? It certainly had its moment in the sun. But at the end of the day, most people, including long-term and non-investors, believe in the investing power of real estate. That perception has fully rebounded from the hit of the 2008 crash and gained traction over every other investment vehicle. And as this real estate chart shows, it’s by a lot—today, 36% believe real estate is a great investment, while only 3% of people like cryptocurrency.

What does that mean for you as a real estate professional? Simple. It’s always a good idea to invest in real estate. So, when you’re talking to your clients, particularly your first-time homebuyers who are facing an uphill battle to get into the market right now, show them the positive dividends they could start earning as soon as they close on their first property.

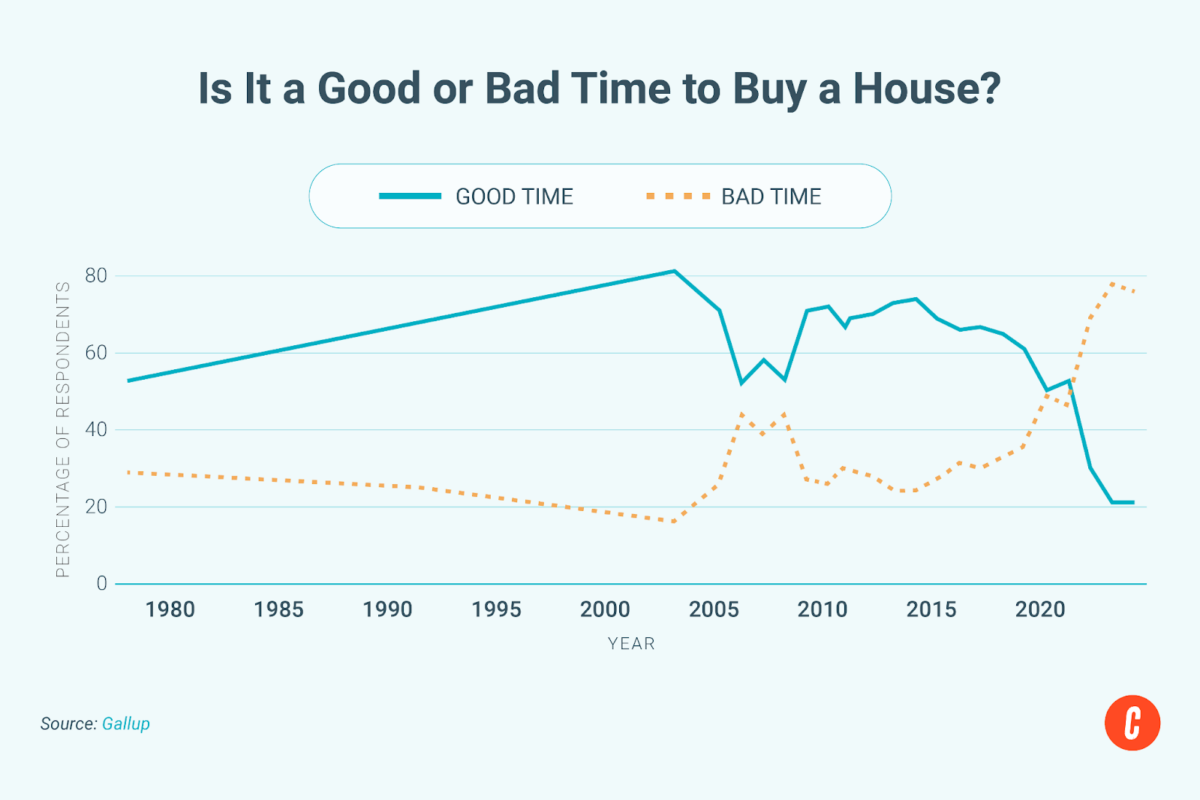

7. When Is a Good Time to Buy Real Estate?

It’s obvious that the pollsters from Gallup didn’t ask real estate professionals this question. This real estate graph shows that 76% of respondents, the highest since just before the 2008 crash, believe that now is a bad time to buy a house. But you and I know better! Sure, there are obstacles to buying in the current market, but it’s never a bad time to invest in real estate. The sooner your buyers start creating equity, the sooner they can get a foothold on their investment portfolio and start building for their futures.

So, when you have clients who start to pull back on the idea of owning, remind them that there’s no better time to buy than now, except maybe yesterday. But each day that goes by is another missed opportunity to earn equity. The barriers are real, but so are the opportunities for buyers who can exercise patience during the shopping process, negotiate terms like a boss, and trust the system. And you, as their agent, are here to get them through it.

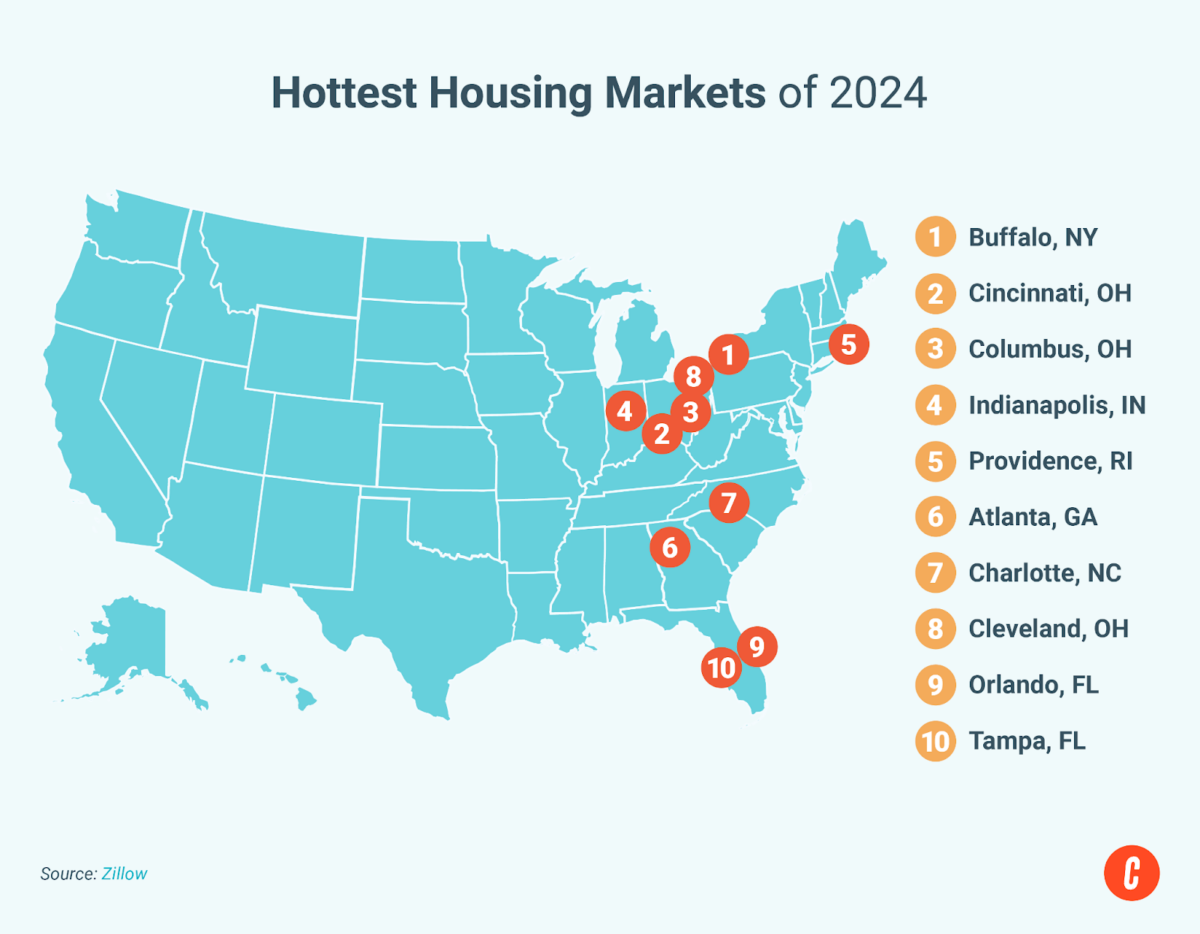

8. Go East, They Said!

As an agent in Florida, I can attest to the accuracy of this real estate market trend graph—at least in Florida. Zillow’s predictions for the hottest housing markets of 2024 cover the Midwest, Great Lakes, and South. Part of the criteria for Zillow’s prediction is the affordability and home value increase stabilization predicted for these areas. All that means is that the housing market in these cities is stable and more affordable than many markets to the West, employment metrics are solid, and demand is steady.

But what if you don’t work in one of the “best” cities? Don’t worry—there is still plenty of opportunity for savvy agents in practically any market. This moment might be a great time to find a real estate niche and become a local expert. Becoming an expert in a specific type of real estate will help you stand out from the rest of the competition and earn you the lion’s share of that particular market.

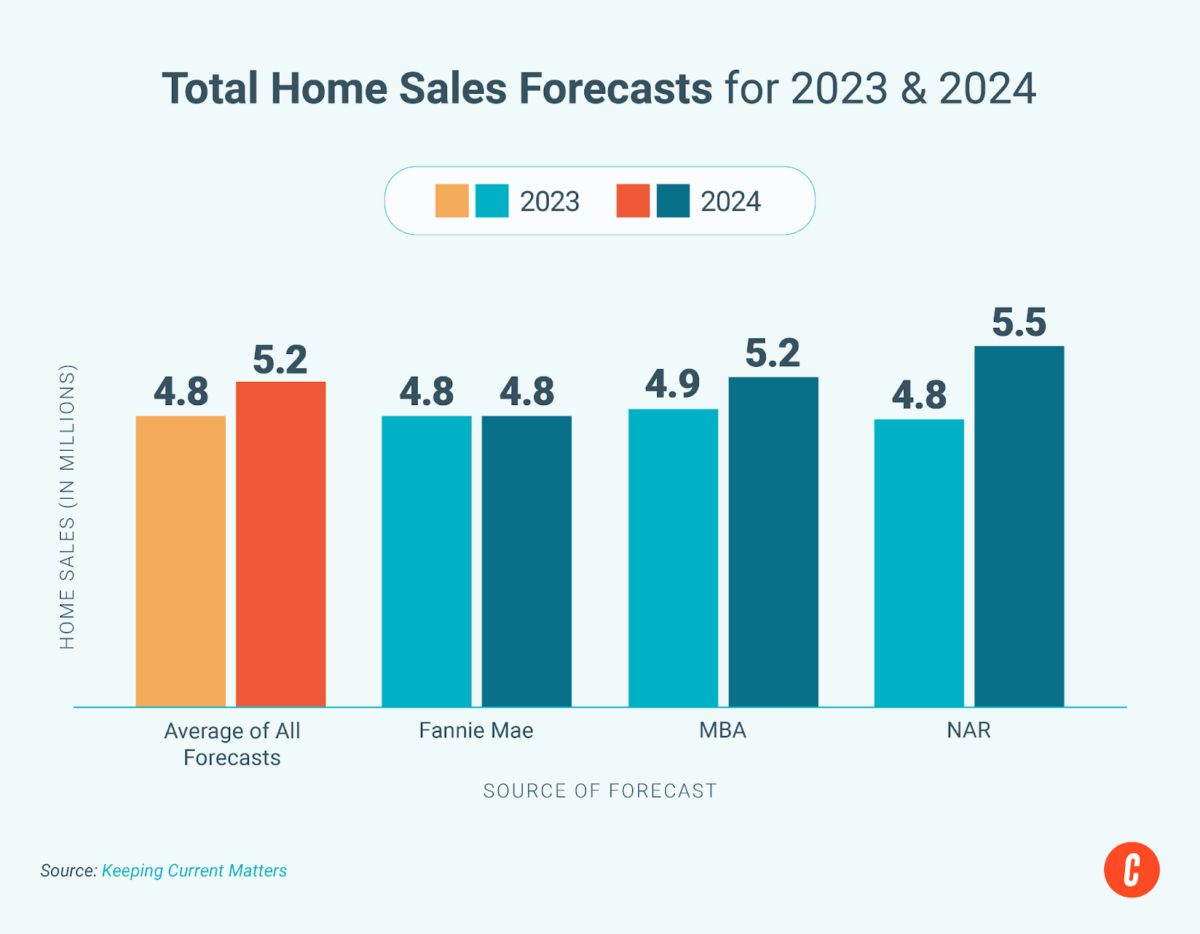

9. Home Sales Are Looking Up

If headlines and talking heads have you believing that the real estate market is tanking, you’ve been misled. Forecasters predict a higher rate of home sales for 2024 over 2023, including the Mortgage Banker Association (MBA) at 5.2 million and the National Association of Realtors (NAR) predicting 5.5 million. The average for all forecasts is 5.2 million for 2024 and 4.8 million for 2023. That means the industry is reaching back up to very normal levels. When comparing year-over-year sales, it’s important to remember that those “unicorn years” were abnormal. They were an anomaly, the likes of which we will probably never see again in this lifetime. Looking back at housing market graphs from the prepandemic days, we’re not so far away from those numbers.

Overall, real estate will continue because there will always be people who want or need to move. And there are myriad reasons for initiating real estate transactions—death, divorce, downsizing, investing, upsizing, military moves, employment moves, etc.—that are unavoidable. The difference is that you’ll need to be on top of your game and demonstrate your real estate expertise and marketing prowess to succeed.

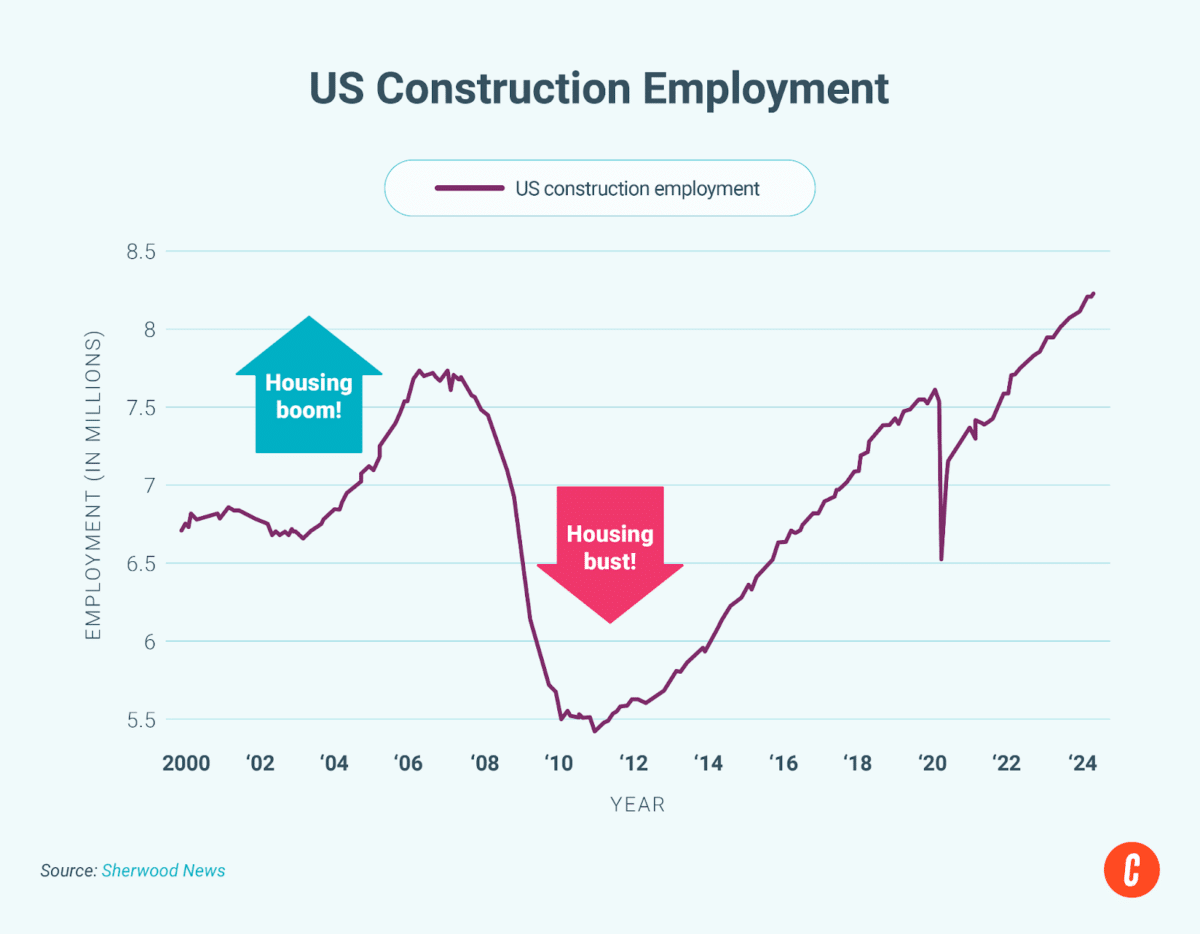

10. Construction Finally Recovered from the Housing Bust

One of the factors affecting the current market conditions is the lack of inventory. Since the crash in 2008, new home construction has struggled to regain its foothold. That is until last year when it finally surpassed the precrash levels. And in the last year, new construction jobs increased by 250,000. So, over the next year or two, I expect the new construction real estate trend to provide a leveling off of home prices and constraints on inventory.

I know that new construction was a big player when I recently sold a property as we competed head-to-head with several new developments in the area. Homebuilders have the ability to offer deep discounts and lower mortgage rates making them extremely competitive to get those new homes filled. I expect that to be the trend over the next few years, keeping resale prices down.

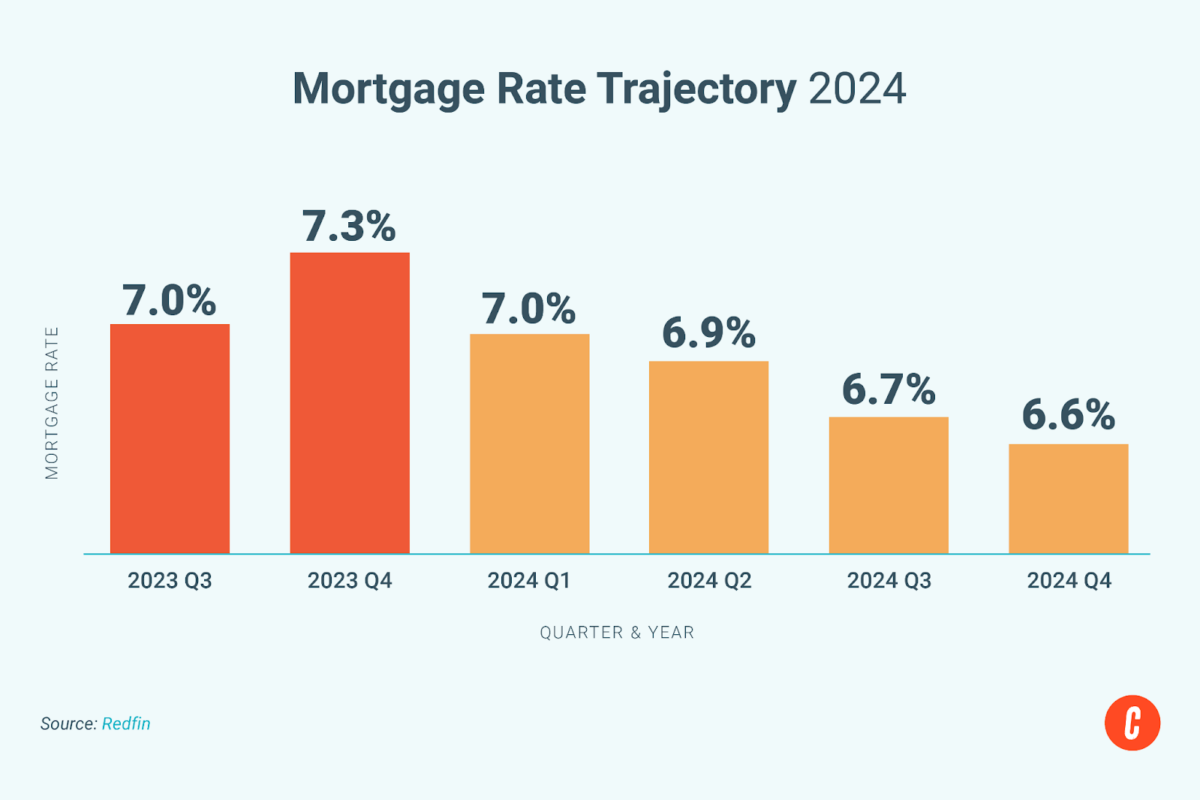

11. Mortgage Rates Are Finally Cooling Off

Another break for homebuyers is the leveling off of mortgage rates. As this housing market trend graph shows, it’s coming down slowly, but the rates are at least moving in the right direction. Many forecasters predict the rates will be around 6.6% by the end of 2024—a much more reasonable rate that might entice some sideline sitters to jump back into the home-buying process.

If you’re working with skittish buyers, keep reaching out to them. Nurture those buyers because they could jump back into the market in the next few months. This is a great time to preach about a good CRM—if you don’t have one to help you nurture your leads, you’re really making your life more difficult and possibly losing leads. Check out our article on the best CRMs to find the best fit for your needs.

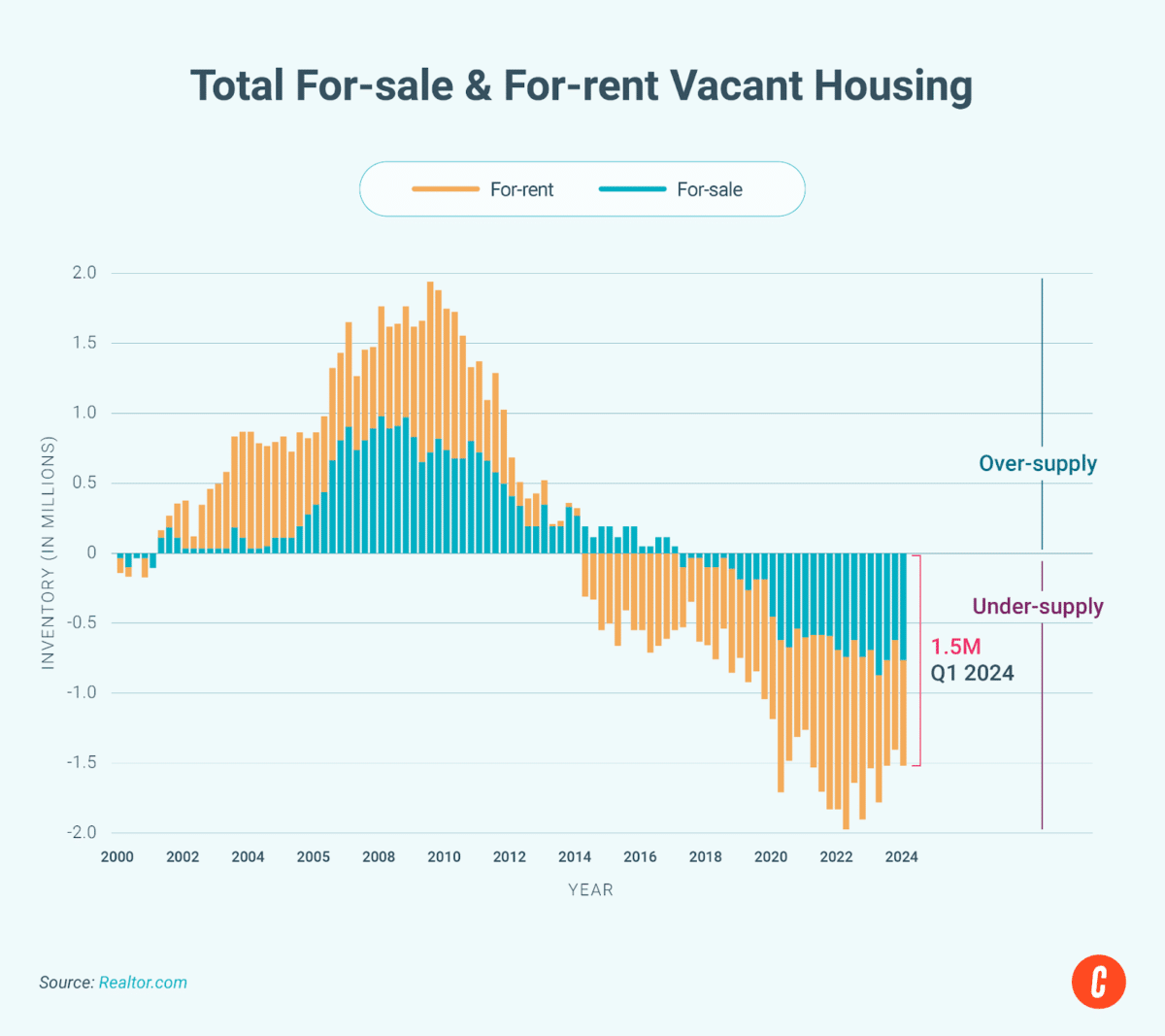

12. We Still Need More Inventory

It’s true. We still need 1.5 million more homes to balance out the market. That number includes both for-sale and for-rent properties. We’ve been in a housing shortage since before 2018, especially for rental properties. New construction has yet to catch up to the market’s current needs, but it’s getting better.

What does that mean for you? This is a great time to start working with real estate investors, so make sure you’re talking to your sphere of influence about creating more rental properties. With the current status of home sales, more people will need to rent before they can afford to buy. So, if you have investors in your database, work with them to help create more of these spaces.

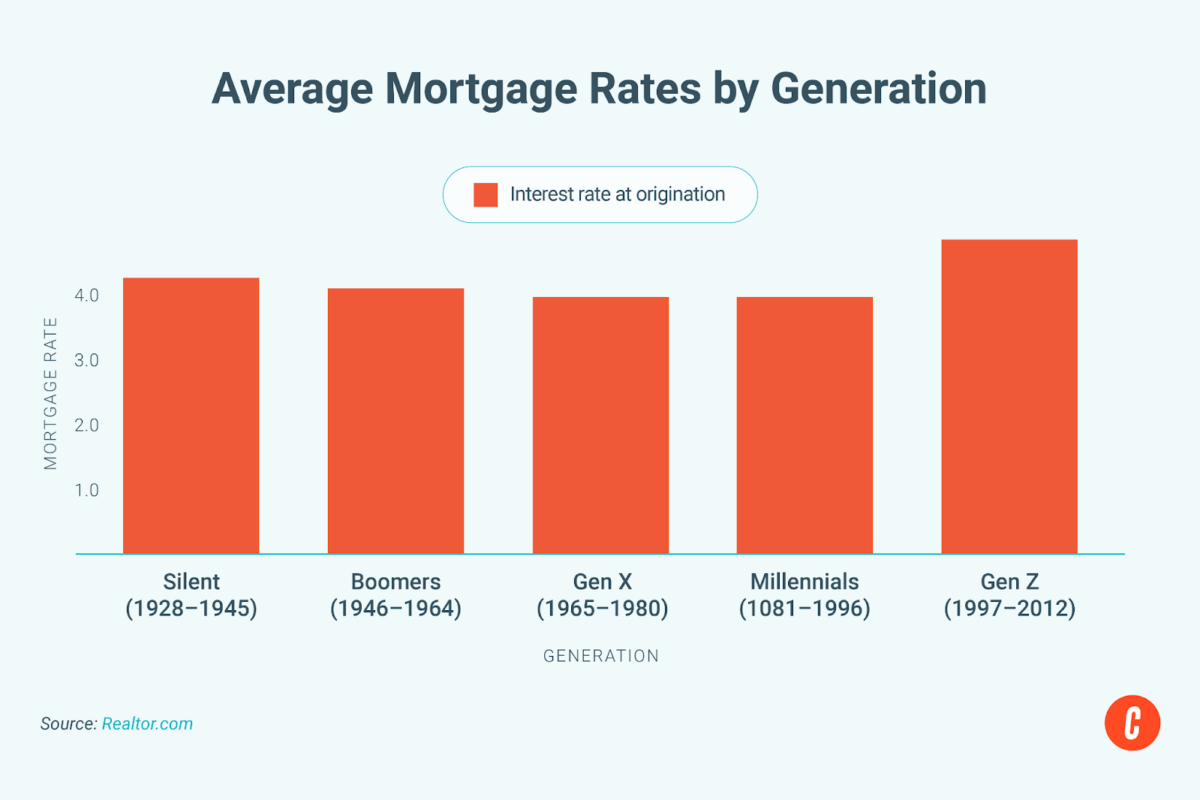

13. Generations With the Lowest Interest Rate

You might be surprised that Gen X and millennials locked in the best rates over the past few years at 4%. That’s great news for millennials who are coming into an age where upsizing from their starter homes might be a factor. millennials, as they come into their prime earning years, are actually making more money than any of the previous generations did at the same age.

When you talk to your millennial clients, show them some hard numbers demonstrating their market power. Work with a lender to host classes on refinancing, investing, and even purchasing a second home. Millennials may not realize how much purchasing power they have, and you could be the key to unlocking their real estate potential.

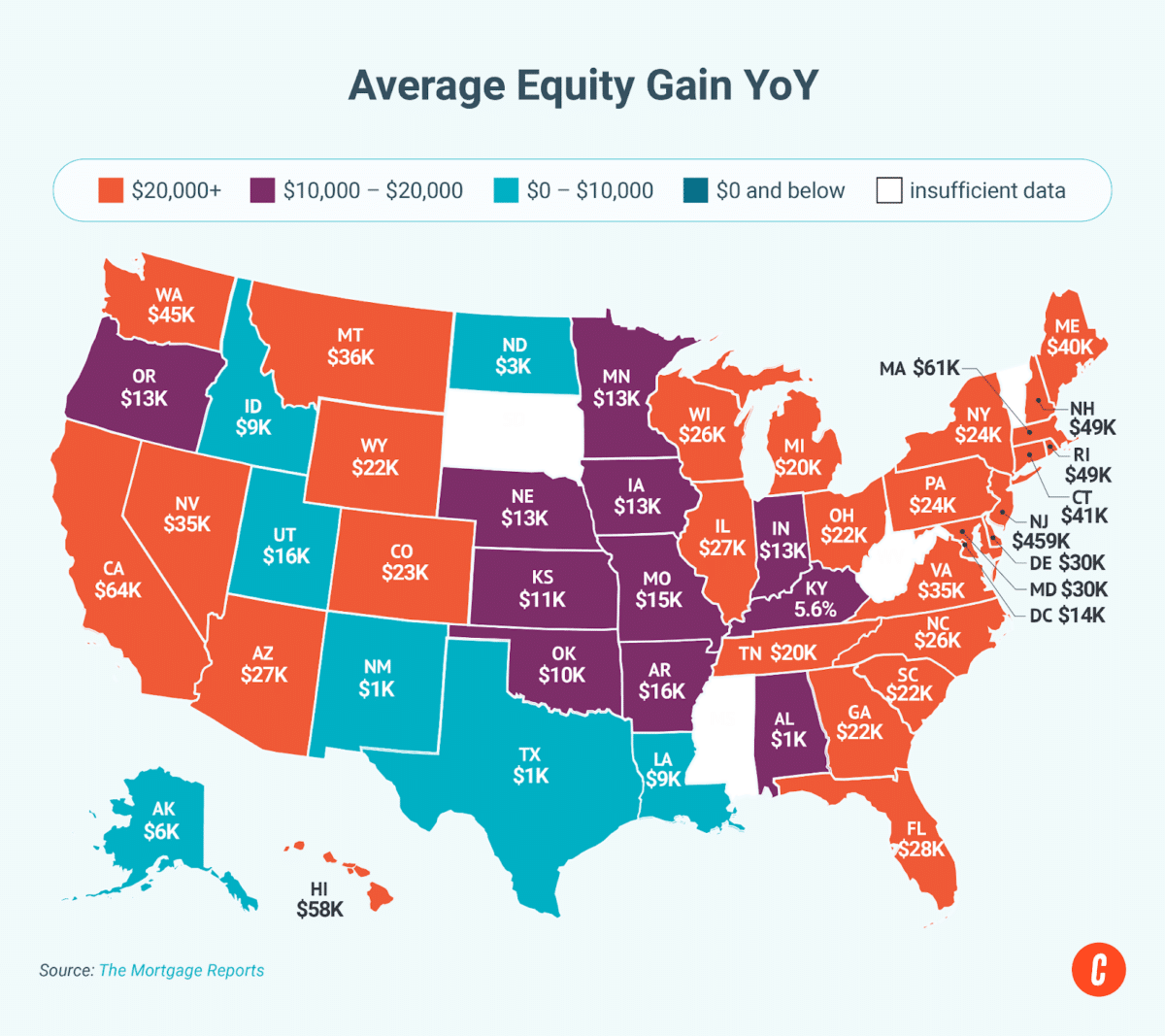

14. Show Me the Equity

Still think the housing market is on the decline? Take a look at this chart—it shows how much homeowners have gained in just the first quarter of 2024 from the equity in their homes. Some markets gained more than $60,000 in equity for their homeowners. That’s a lot of moolah!

What you can do, as a savvy real estate pro, is share these numbers with your potential buyers. Show them the path to building wealth for themselves. Most of the wealthiest people in the world are real estate investors, and they’ve amassed a large part of their wealth through those investments. But it all starts with the first real estate purchase.

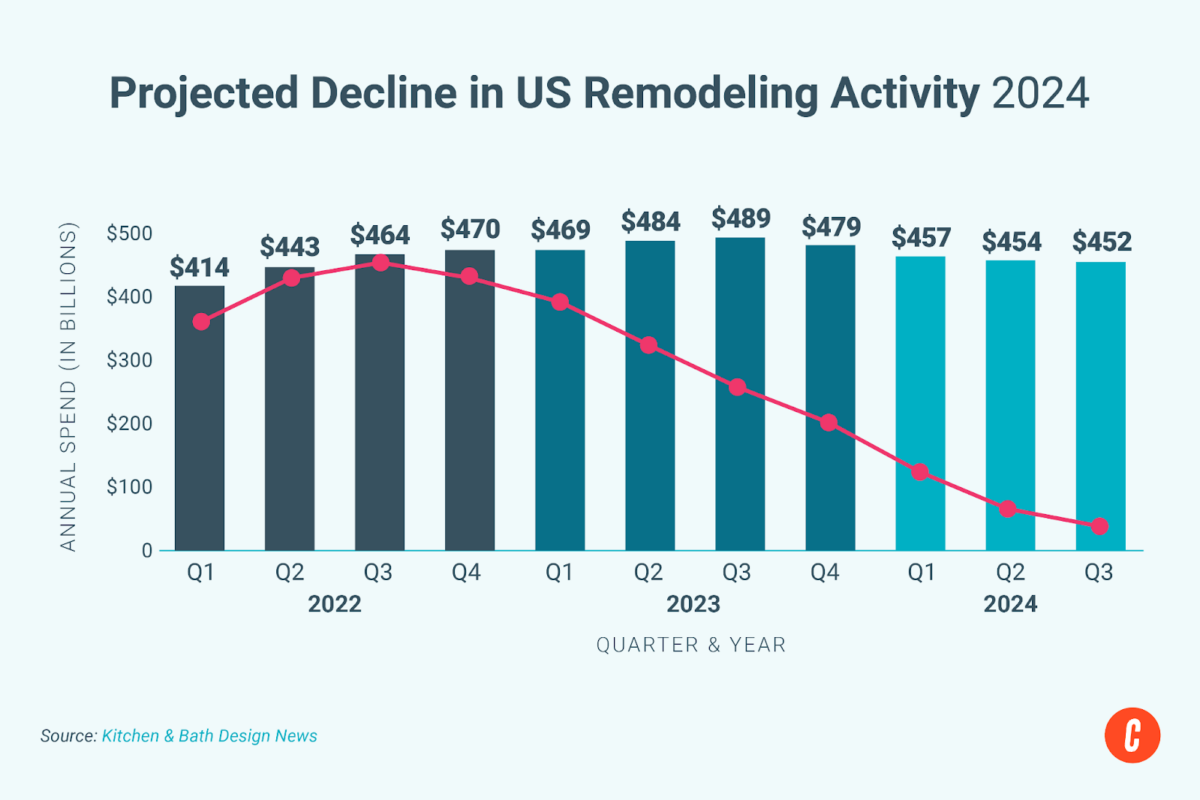

15. Remodels on Hold

With home sales slowing, naturally, remodeling is down too. That doesn’t mean it’s dropping off the charts completely. As fewer homeowners look to sell, they’ll be less likely to invest in remodels. But there will always be a need for remodels, repairs, and makeovers, no matter what the real estate market looks like.

Obviously, the unicorn years brought adjacent businesses a lot of businesses along with the real estate sales boom. Today, these levels are returning to normal. It only looks like a sharp decline because it’s happening at a rapid pace. But truthfully, most industries, along with the real estate market, are leveling out and coming back to a normal level.

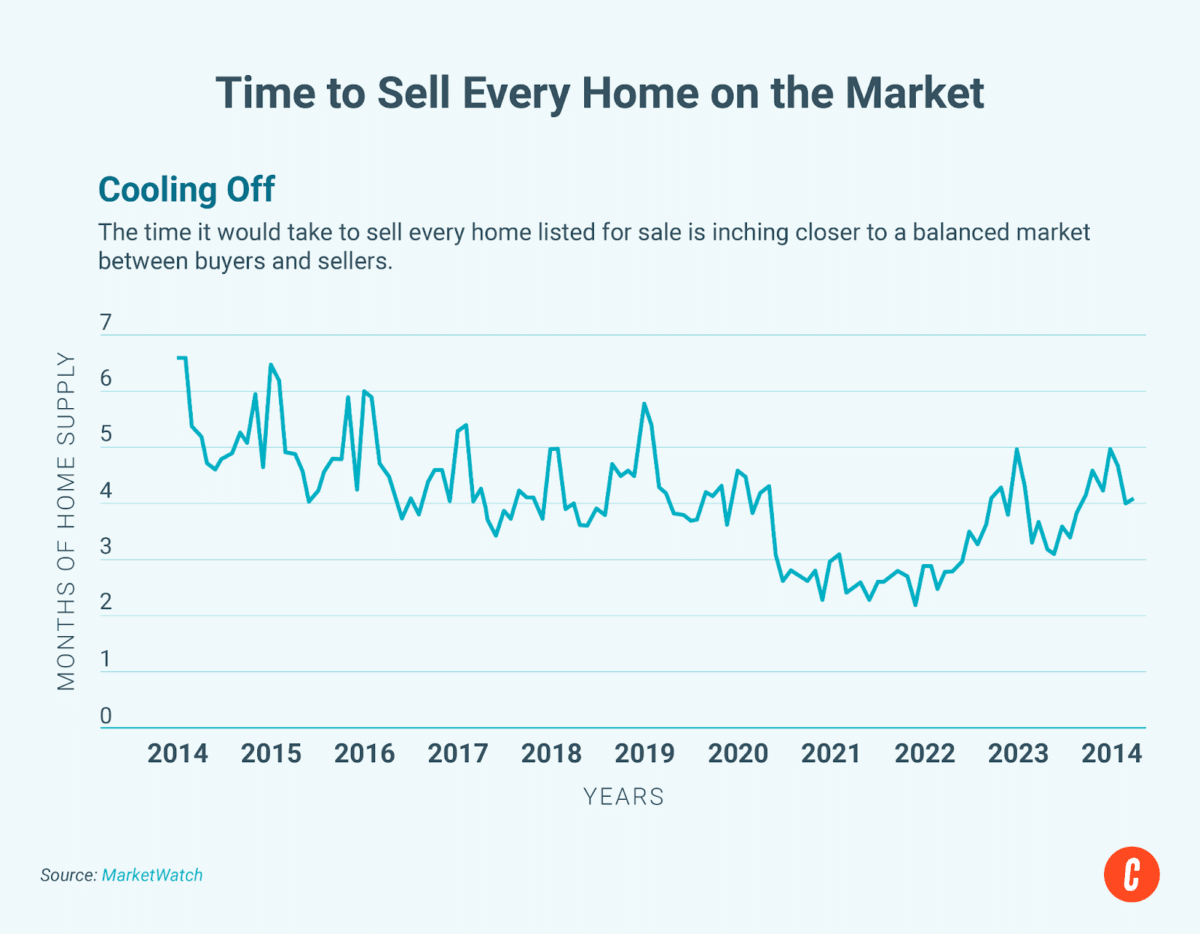

16. A Cooling Market

This chart shows how long it would take to sell every currently listed home, which is an indicator of the health of the market. As I mentioned earlier, when you have six months of inventory on the market, that shows a healthy and balanced market. The current market is inching ever closer to that benchmark. The last time we saw a six-month supply was in 2016.

This is your opportunity to shine by educating your clients on what a healthy and balanced market should look like. We’re currently still in a seller’s market, which gives home sellers a slight advantage over buyers. But the circumstances are shifting to give rise to more equal and mutually beneficial negotiations for both sides. Demonstrate your stellar ability to negotiate like a boss to assure your clients you’ve got their backs.

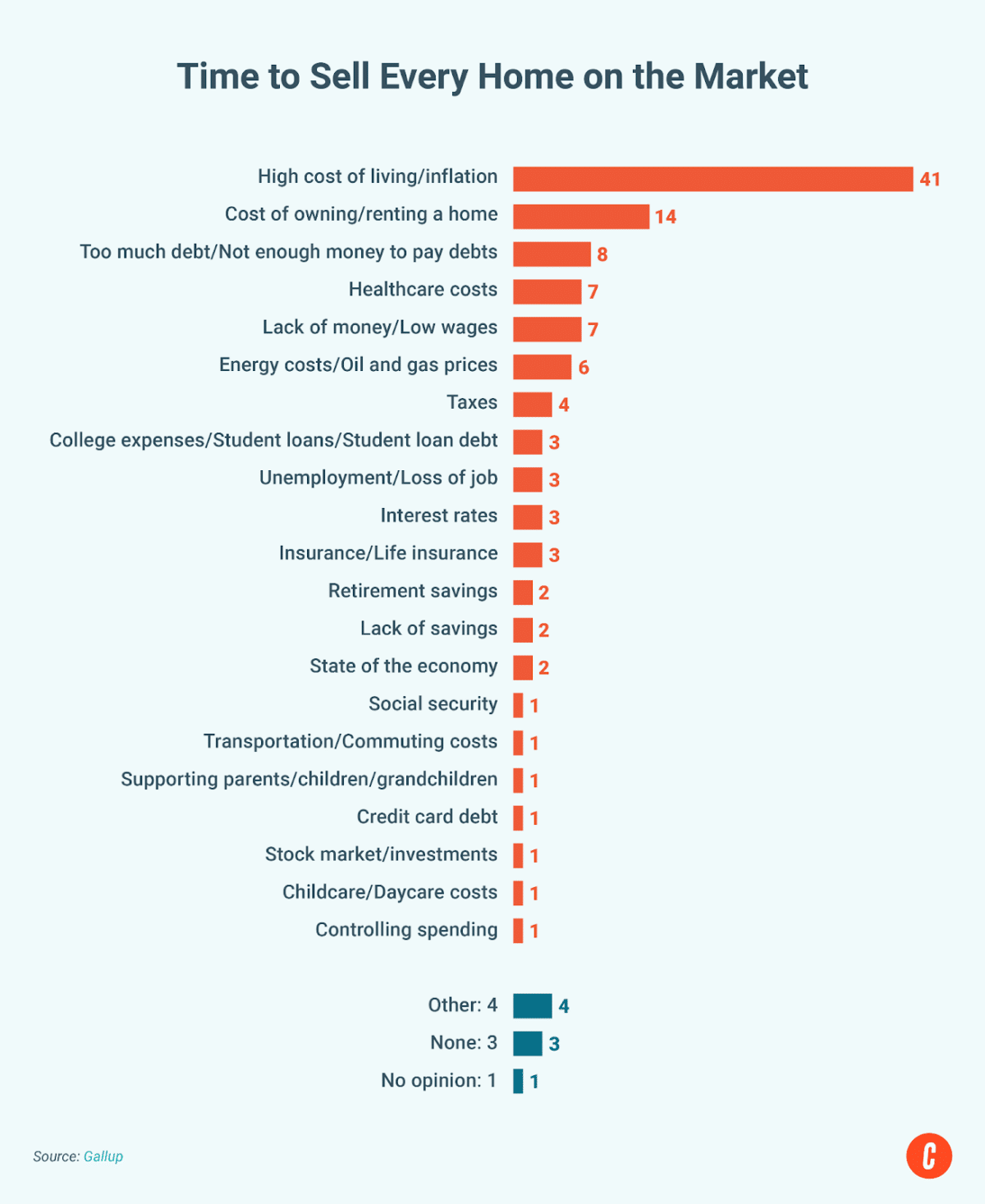

17. Inflation & Cost of Housing Biggest Problems

We all feel the current inflation, cost of living, and cost of owning or renting a home. This chart affirms those beliefs around the most important financial struggles everyone faces today, with the high cost of living/inflation topping the chart at 41% of respondents mentioning it and the cost of owning/renting a home second at 14%. It gives you some valuable insight into where your clients are coming from. Their fears and struggles are not invalid.

Be an active listener when your clients are working through their struggles. Be the agent who can empathize with their pain points, offer solutions, and guide them through their process to realize their dream without running head-first into reality’s unforgiving wall. Find answers to their questions by providing your expertise and outside-the-box thinking.

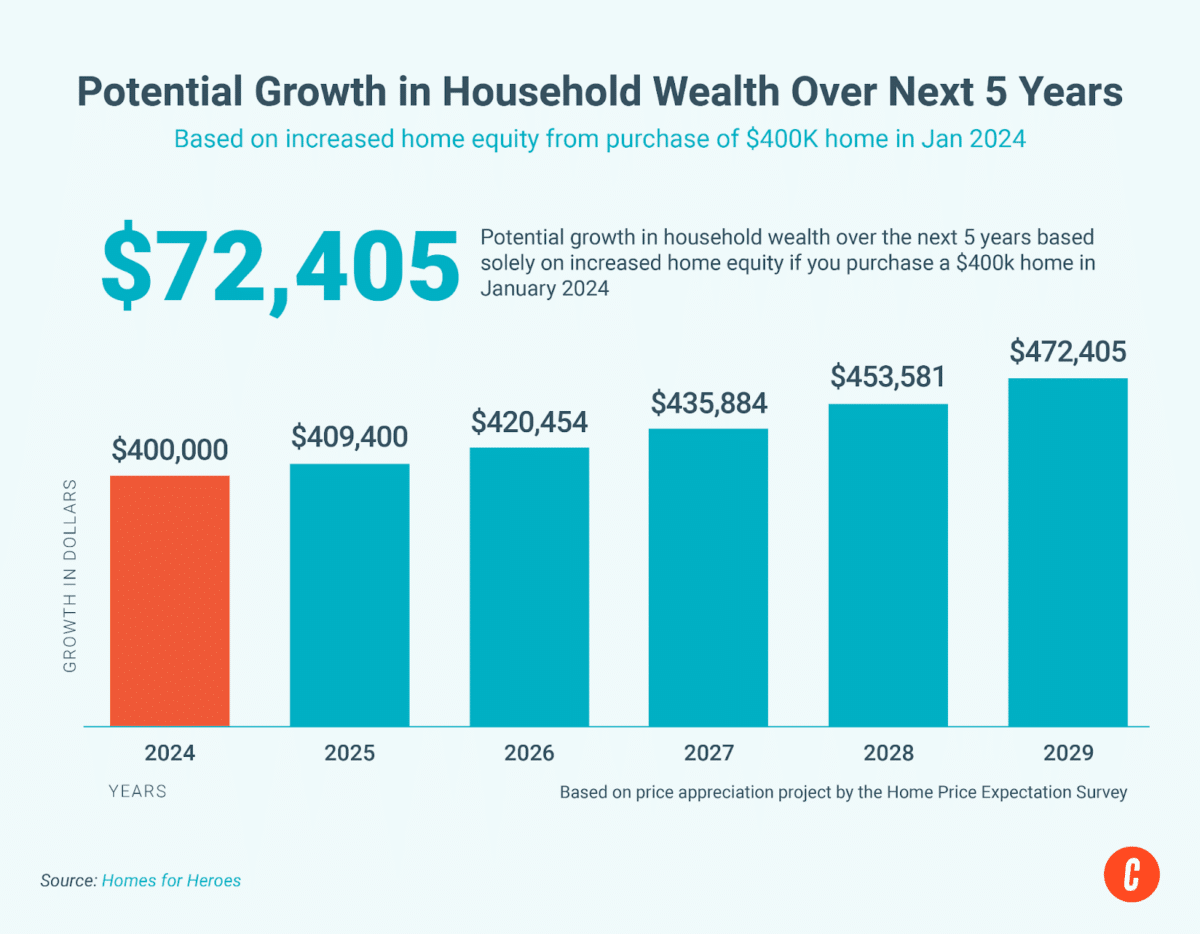

18. Check Out That Equity

I love this chart because it visually demonstrates what real estate investing can do for buyers and sellers. If someone purchased a home at $400,000 in 2024, they would potentially earn $72,405 in equity in just five years. When your clients can see the actual dollars, as in this chart, it makes real estate equity real.

Show your clients something like this when you’re discussing their appreciation potential. You can use numbers reflective of your local market if you know what your annual appreciation percentage is. Get in touch with a lender if you need some help putting these numbers together. You can work up a few charts like this at multiple price points to use in your listing presentations.

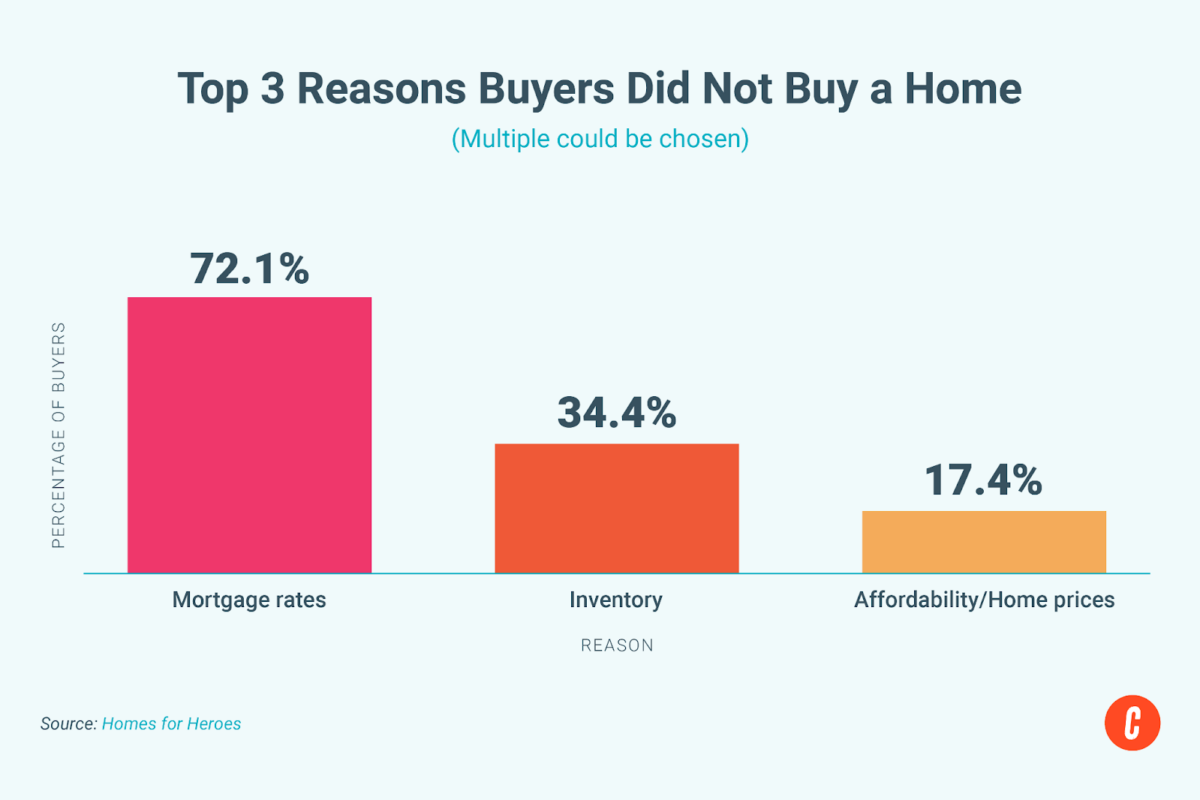

19. Why Buyers Didn’t Buy

This chart is very telling—buyers didn’t get out of the market solely because of home prices, they got out more often because of high mortgage rates, which tops this chart with 72.1% of respondents giving it as their reason. Both are important to home buyers in a cooling market, but I’m impressed with the fact that home prices were the least given factor.

That’s good news for you because you can work with your buyers to come up with creative ways around higher mortgage rates. Work with your favorite lender to give your buyers options to help them find the path to home-buying success. There are tons of options available through different types of mortgages, larger down payments, and even some assistance programs that you can educate your buyers on. Open the doors of possibility for your clients, and they will thank you again and again.

Your Take

Real estate is a fascinating industry, complete with shifts that can happen overnight and peaks and valleys that can shake up even the most seasoned veteran agents. So when buyers and sellers can come together to complete a transaction without someone curling up in a fetal position, it’s a win. Arm yourself with the information in these real estate market charts, dispel common home-selling myths, and facilitate more wins for your clients and yourself.

Looking at these real estate charts, what do you see? Do you see a return to normal in the market? Have you seen real estate charts that contradict these ones? What can you take away from these real estate charts and the trajectories they portray? How can you use these real estate charts to help your clients make more informed decisions?

I would love to hear your ideas about the market and where it’s headed. Let me know your thoughts in the comments.