In real estate lingo, “contingent” is a big deal. Whether you’re in the middle of negotiations or aiming to close on time, it can significantly impact your buyers and sellers. I will walk you through what contingent means in real estate in all its forms, including a house being contingent, the different types and common contingencies, different contingent statuses, and the pros and cons of contingencies in real estate deals.

What Does Contingent Mean in Real Estate?

Contingent meaning in real estate is when an offer has been accepted, but certain conditions must be met before the deal is finalized. Below are just a couple of examples of contingency meanings:

- Example 1—Contingent real estate contract: Your buyer has a contingency real estate contract when they agree to buy the house as long as the home inspection doesn’t uncover any major issues. In other words, the sale depends on the inspection going well.

- Example 2—Buyer financing contingency: When the buyer needs financing and it doesn’t work out, they won’t be able to finalize the deal without getting a mortgage. These conditions have to be included in the purchase agreement and agreed upon by both the homeowner and the buyer.

There are also real estate contingencies related to the seller’s needs, such as a home purchase contingency where the seller will only close on the deal if they’re given time to secure suitable housing.

How Does a Contingent Offer Work?

When you make a contingent offer, you state that a specific condition must be met before the sale can go through, like the examples above. If the condition is not met, the contract becomes void, voidable, or open to further negotiation, and the seller may be able to consider other offers.

Contingencies are often used to protect the buyer from issues with the home or unexpected problems in the real estate transaction. Still, sellers can have contingencies such as selling a property “as-is” without further money put into repairs. Sellers also may have contingencies about closing and moving dates. Ideally, agents want to encourage that contingencies are kept at a minimum. Too many contingency requests can weaken a buyer’s offer.

Making a contingent offer on a property is easier if your buyers have already found a lender to work with and have a preapproval. This can ease the seller’s concerns about the sale falling through because of a lack of financing or the buyer not qualifying for a mortgage. Start the approval process when you are ready to buy a home. This will increase your chances of the seller accepting your offer, including contingencies.

💡Pro Tip: Knowing how to negotiate is crucial in real estate deals. Our guide, How to Make Your Offer Stand Out: 8 Tips for Savvy Agents, offers essential tips on how to use contingencies to slam dunk your competition. Mastering these techniques and learning from real-life examples can help agents ensure buyers and sellers reach mutually beneficial agreements.

Common Contingencies in Real Estate

As a real estate agent, it’s important to know what contingent means in real estate and the common contingencies in real estate transactions. This helps you assist your clients in making good choices and ensuring everything goes smoothly through the buying or selling process. Here are some common real estate contingencies that are regularly included in purchase and sale agreements:

House Inspection Contingency

The home inspection contingency allows a home inspector to check the home’s condition, looking at all the parts that may not be easy to see or that the current buyer might not have considered, like roof condition or plumbing issues. Depending on what the contract says, the buyer might be able to cancel the purchase if there’s a problem with the home’s condition, or the buyer and seller might talk about who will pay for repairs.

As part of working with buyers, be sure to provide a home buying checklist so they can stay informed on the process the entire way through. Giving this checklist in the initial stages of working together further shows your value.

Appraisal Contingency

An appraisal contingency is commonly used when your clients buy a home with a mortgage. This means a licensed home appraiser will determine the property’s fair market value. If the appraiser finds the property worth less than the agreed-upon price and the difference can’t be bridged, the buyer can back out of the deal. They also have the option to negotiate a new price or proceed with the purchase, knowing they might be paying more than the property’s value.

If the buyer still wants to proceed despite the low appraisal, they may have to contribute the extra cash. This ensures that the lender isn’t taking on more risk by lending for a property that might be overpriced.

Financing or Mortgage Contingency

When helping clients buy a property, explaining the financing contingency is important. This helps buyers get funding and protects them if they can’t secure a loan, giving them the option to back out of the deal. I’d also recommend clients start by getting a preapproval instead of just getting prequalified. This way, they’ll have a more accurate idea of how much they can borrow and reduce the chances of the deal falling through because of financing issues.

It’s super important for your clients to understand what preapproval means in the mortgage process. Getting preapproved shows that they’re making progress in getting a mortgage by taking a close look at their finances. But it’s important to know that being preapproved doesn’t guarantee that they’ll actually qualify for the mortgage. When your clients are ready to make an offer, they should talk to their lender to make sure they’re eligible.

Pro Tip: As a real estate agent, our license does not cover mortgages. So when working with buyers, be sure to refer your clients to a licensed mortgage lender for all things preapproval to get the proper support and most accurate information on their financing questions.

Title Contingency

It’s crucial to make sure the property title is clear and free of any issues that could affect the transfer of ownership—and title contingency does just that. Things like property easement problems or existing mortgage liens can cause complications, so it’s important to stay aware of these potential issues.

This contingency also allows the buyer to withdraw from the agreement if there are concerns about the property’s ownership. Conducting a thorough title search before closing the deal is crucial to mitigate these risks. Even if you can resolve any title issues, obtaining title insurance is advisable, as it provides coverage for future claims.

Home Sale Contingency

When working with buyers who need to sell their current home before making a purchase, a home sale contingency will need to be in the purchase contract. This contingency gives buyers the option to delay or back out of the deal if they are unable to find a buyer for their current property. However, in a seller’s market, it’s common for sellers to be hesitant about accepting this contingency since they may have the option to work with a buyer who doesn’t have this limitation.

Types of Contingent Statutes in Real Estate

Contingent properties have various statuses that meet the contingent criteria. Along with that, the Multiple Listing Service (MLS) uses different terminology to describe these statuses, as shown in the table below:

Continue to Show (CCS) | |

Sale Contingent | |

Probate |

Pros & Cons of Contingencies in Real Estate

When it comes to contingent real estate transactions, there are various advantages and disadvantages to consider. Check out the table below to get a better understanding of the pros and cons:

Pros | Cons |

|---|---|

|

|

|

|

|

|

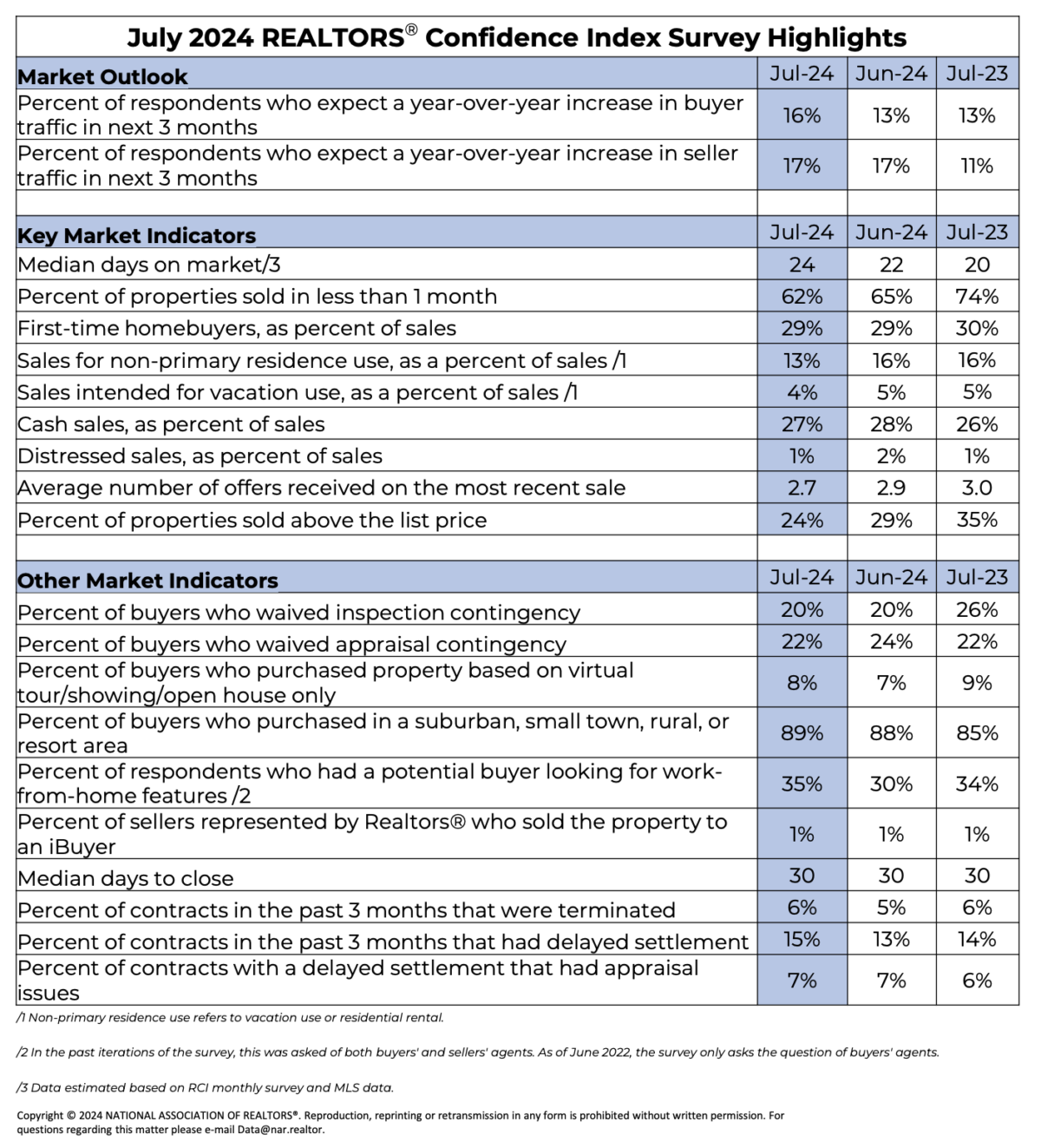

How Often Do Contingent Real Estate Offers Fall Through?

Now that we’ve answered the question, “What does contingent mean in real estate,” let’s explore how offers fall through. Potential risks are associated with making a contingent offer, so knowing how to use them is important to lessen the possibility of it affecting the deal. According to a survey by the National Association of Realtors (NAR), only 6% of all offers resulted in a failed deal. As a real estate agent, remember that the likelihood of an offer falling through after initial acceptance is relatively low, whether contingent or not.

Frequently Asked Questions (FAQs)

What does contingent mean on a house for sale?

Buyers include a contingency home sale clause when making an offer on a home, and they still have to sell their home. This allows them to back out of buying the house if the clause’s terms aren’t met. Buyers risk forfeiting their earnest money deposit if they choose not to proceed with the home purchase without a contingency in place.

Is it ever a good idea to waive contingencies?

In a seller’s market with more buyers than available homes, waiving contingencies can be a good move to strengthen your offer. This will help your offer stand out from others the seller receives, potentially increasing the chance of them accepting it.

What happens if my contingent offer falls through?

If a seller cannot fulfill the contingencies of your offer, the sale will not move forward. In this case, your earnest money deposit will be refunded, and you will need to either continue your home search or renegotiate with the seller to reach a new agreement.

Bringing It All Together

Understanding the concept of what contingencies are in real estate comes with time and experience, but it’s an essential piece to any transaction. Now that you’ve just armed yourself with more knowledge about common contingencies, various types of contingency clauses, and their respective advantages and disadvantages, you can help your clients navigate the process more effectively.

Have you ever worked with a buyer or seller client with a contingency? What was your experience?

Add comment