Location is everything in real estate investment, and some states are making quite a splash in the market. Be it sky-high rental income, rapid property appreciation, or even just a more favorable tax setup, picking out the right state could be your golden ticket. From bustling cities to serene suburban areas, there is a perfect spot for every type of investor. Let’s look closer at the top 10 best states to invest in real estate if you’re looking for your next big opportunity.

Best States to Invest in Real Estate at a Glance

1. Utah

- Affordability Ranking: 8th

- Home Value & Supply Ranking: 5th

- Rent Potential Ranking: 17th

- Year-Over-Year Property & Rent Appreciation Changes: 21st

- Location Opportunity for Residents: 3rd

Because of this strong job and population growth, Utah presents a dynamic and highly ranked real estate investment environment. With a job growth of 3.20% and a population growth of 1.07%, Utah is a scorching hot market, which is very fitting for an investor looking both for short-term gains and long-term rental income. The median home value of $529,600 ranks 7th in the nation, reflecting solid demand in the state’s housing market due to its strong economy and people moving into the area.

Utah makes the cut with a respectable median household income of $79,449, ranking 11th despite its cost-of-living index being slightly higher at 101.5. With increased population and housing demand, investors can look forward to lucrative opportunities in Utah’s ever-expanding real estate market, especially in Salt Lake City.

2. Hawaii

- Affordability Ranking: 33rd

- Home Value & Supply Ranking: 2nd

- Rent Potential Ranking: 7th

- Year-Over-Year Property & Rent Appreciation Changes: 12th

- Location Opportunity for Residents: 12th

Hawaii ranks 2nd among the best states to invest in real estate. The state ranks 2nd among all 50 states regarding home valuations and supply, with a median home value of $720,200 and an inventory of over 5,000 homes. While the price of homes is higher, the average monthly rent is $1,651, ranking 1st, so you can surely get a quick return on your investment. Also, the percentage of renters in Hawaii ranks 4th at 40.6%, which means you’ll have plenty of tenants knocking at your door.

With a steady job growth rate of 4% and a 1st ranking happiness score of 66.31, Hawaii can provide a stable environment for property investments that will last long term. Investors who want high returns on larger investments, steady economic growth, and a population capable of supporting rental housing markets would find Hawaii a great location to build up their portfolio of properties.

3. New Jersey

- Affordability Ranking: 11th

- Home Value & Supply Ranking: 37th

- Rent Potential Ranking: 2nd

- Year-Over-Year Property & Rent Appreciation Changes: 3rd

- Location Opportunity for Residents: 16th

Ranked 3rd overall for best state to invest in real estate, New Jersey is attractive to real estate investors who want to try their hand at a higher-end market. The cost of living is slightly higher, with an index of 114.1, ranking it 40th overall. However, this is offset by a median household income of $89,296, which is 3rd in the nation. Strong income in New Jersey translates to a market full of potential buyers and renters who can afford prime property.

At an average home value of $477,600, it ranks 9th and represents an upscale market targeted for long-term appreciation and luxury rentals. Continuous economic growth with high demand for housing has made it an excellent spot for flipping homes and holding rentals. In addition, New Jersey’s diversified economic base and purchasing power will make it a lucrative haven for real estate investments in search of better returns in a strong market.

New Jersey is also one of the top places for real estate agents to work. Check our list of the 10 Best States for Real Estate Agents.

4. Massachusetts

- Affordability Ranking: 25th

- Home Value & Supply Ranking: 14th

- Rent Potential Ranking: 1st

- Year-Over-Year Property & Rent Appreciation Changes: 15th

- Location Opportunity for Residents: 22nd

Massachusetts is one of the most favorable states for real estate investment and is thus very popular among people interested in markets with solid growth potential. With a median home value of $614,700, investors can dive into a market with appreciable long-term growth potential. With its enviable median household income of $90,088, this state gives its residents the purchasing power to keep property prices high. It acts as a haven for those targeting high-end markets or luxury rentals.

Massachusetts also has a solid job growth rate of 2.5% and a high happiness score of 57.12. Because of a strong state economy, there is continued real estate demand here. The state will become an ideal place for investment, particularly for long-term investors desiring to take advantage of a high-income, stable market.

5. New Hampshire

- Affordability Ranking: 16th

- Home Value & Supply Ranking: 15th

- Rent Potential Ranking: 26th

- Year-Over-Year Property & Rent Appreciation Changes: 4th

- Location Opportunity for Residents: 24th

New Hampshire rounds out the top five best states for investors, emphasizing its return on investment potential and affordability. With a median household income of $88,465 and a median home value of $452,700, ranking 4th and 12th, respectively, New Hampshire gives high purchasing power to investors and rental options for tenants. In addition, the available inventory in the state ranks 8th, which shows investors that there are plenty of properties to buy and hold or flip.

The biggest opportunity in New Hampshire comes from the year-over-year changes in rent and home value, ranking 4th in the country overall. Year-over-year, it boasts a 9.4% increase in home value change and 7.93% rent value change. This speaks well to the return on investment that investors will see when seeking investment properties in this area. Generally, New Hampshire is an excellent choice for already established investors or those looking to enter a promising market.

6. Georgia

- Affordability Ranking: 7th

- Home Value & Supply Ranking: 36th

- Rent Potential Ranking: 21st

- Year-Over-Year Property & Rent Appreciation Changes: 14th

- Location Opportunity for Residents: 8th

Overall, Georgia ranked 6th as an attractive state for real estate investors because of its balanced blend of affordability and growth potential. It offers an affordable entry point for investors, with a cost of living index 91, where rental income and property appreciation can be maximized. The median home value in the state is $375,300, ranking 22nd for offering reasonably priced properties in a state where population and job growth are booming.

Its 2.8% job growth rate, the nation’s 14th best, pushes Georgia over the top. The addition of a population increase of 1.05% ensures continuous demand to buy and sell housing. Economic vitality across cities like Atlanta drives great rental markets and appreciation into the foreseeable future, making Georgia a prime option for growth investors.

7. Nevada

- Affordability Ranking: 36th

- Home Value & Supply Ranking: 4th

- Rent Potential Ranking: 9th

- Year-Over-Year Property & Rent Appreciation Changes: 33rd

- Location Opportunity for Residents: 5th

Nevada is an excellent choice for investment in real estate because it can help an investor capitalize on a balance between value and the potential of a market. The state’s cost of living index is 101.3 and ranks 28th overall; it is still an affordable state compared with many others. This affordability provides a solid entry point for investors looking to buy property without necessarily stretching their budgets. The median home value in Nevada is $428,100, which provides ample opportunities for real estate investors to take advantage of property appreciation.

There is a high percentage of renters at 38.4%, ranking 6th, which gives landlords an ideal base of tenants to work with. Plus, job growth and gross domestic product, ranking 1st and 2nd, respectively, show that the economy in Nevada is booming and welcoming new opportunities for residents. Nevada presents a good investment case for investors targeting long-term stability and growth both in residential and commercial real estate.

8. Minnesota

- Affordability Ranking: 4th

- Home Value & Supply Ranking: 35th

- Rent Potential Ranking: 14th

- Year-Over-Year Property & Rent Appreciation Changes: 16th

- Location Opportunity for Residents: 18th

Minnesota ranks 8th in our analysis for long-term real estate investment. With a median home value of $341,700, the Minnesota market offers midrange property prices for investors and decent returns through rental income and appreciation. The cost of living within the state is higher than some (94.1), but the state compensates for this with a median household income ranking 13th at $77,720. This income level provides a stable renter and buyer population, ensuring continued demand for housing.

Minnesota also has a high happiness score of 62.43, which ranks it 3rd and suggests a quality of life attractive to its residents. Though the job growth rate is more moderate at 2.50%, this hints at a stable economy and thus provides a sound backdrop for real estate investment. Minnesota offers a long-term growth opportunity for investors looking to capture a diverse market that is complemented by a solid local economy.

9. Delaware

- Affordability Ranking: 22nd

- Home Value & Supply Ranking: 3rd

- Rent Potential Ranking: 43rd

- Year-Over-Year Property & Rent Appreciation Changes: 13th

- Location Opportunity for Residents: 7th

Delaware ranks as one of the best states for real estate investment, particularly for those seeking to invest in markets that provide stable returns and long-term opportunities for residents. Year-over-year home and rent values grew in Delaware by 10.7% and 1.14%, respectively. This growth bodes well for the appreciation of property and the continuation of rental growth. Coupled with the median home value of $327,300, this creates some excellent opportunities for buy-and-hold investors and those looking to flip properties for a profit.

In addition, Delaware’s residents are happier and have more opportunities than most other states. The state’s gross domestic product of 3.1%, ranked 5th, and population growth percentage of 1.21%, ranked 6th, show a promising economic outcome. The happiness scale is also 17th in the country. Overall, Delaware is not a bad choice for investors searching for steady, long-term returns through real estate investment.

10. Rhode Island

- Affordability Ranking: 30th

- Home Value & Supply Ranking: 8th

- Rent Potential Ranking: 3rd

- Year-Over-Year Property & Rent Appreciation Changes: 18th

- Location Opportunity for Residents: 33rd

Rhode Island is the best state for real estate investment for investors who target more upper-income markets. With a median household income ranking 15th in the nation at $74,008, it is quite lucrative for an investor to target the more well-to-do renter in Rhode Island. The median home value in Rhode Island is $462,100, ranking 10th, so this higher price may attract residents to rent more than buy.

Rhode Island boasts a higher-than-average monthly rent of $1,031, ranking it 22nd overall. This means it maintains a very high standard of living that is attractive to any real estate investor. A combination of high income and a substantial percentage of renters at 41% make the state suitable for real estate investors looking to take advantage of buy-and-hold properties.

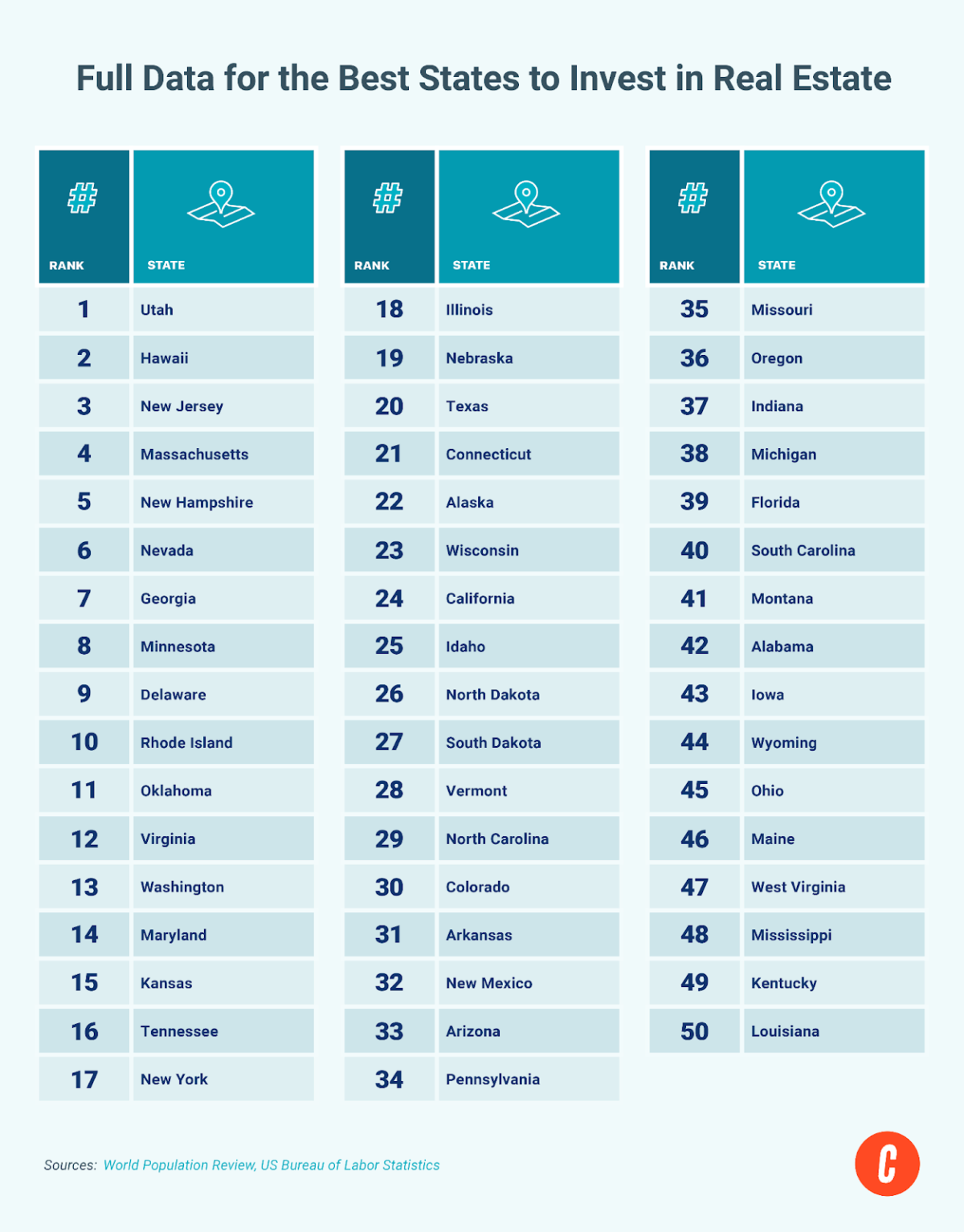

Full Data & Methodology for the Best States to Invest in Real Estate

Using an in-house tool, we ranked each state by gathering and tabulating data from various verified sources. The data was then further categorized into five distinct categories, each weighted 20%. Several data points were pulled in these subcategories to give each location an aggregate and comprehensive ranking. This process then provided our fair and objective assessment overall for each state.

The complete data can be viewed here, but read our breakdown and methodology below.

Resident Affordability Ranking

- Cost of Living Index (data from World Population Review): A lower cost of living will attract more people to that area, develop more demand for housing, and thus allow real estate investors to take advantage of the area’s growing population.

- Median Household Income (data from World Population Review): A higher median household income suggests greater purchasing power among residents. This income leads to a solid real estate market with better prices for homes and rentals.

Home Value & Supply Ranking

- Median Home Value (data from World Population Review): The higher the median home value, the more likely the market may appreciate, and the investor can make a profit using increased property values and rental rates over time.

- Available Inventory (data from FRED): Higher available inventory means more choices for investors to find properties. Higher inventory should drive more favorable deals, offering greater flexibility in selecting high-potential investments.

- Property Tax Burden (data from Wallet Hub): The lower the property tax burden, the lower the ongoing costs are for investors. This would enhance profitability, especially for those holding rental properties or seeking long-term appreciation.

Rent Potential Ranking

- Average Monthly Rent (data from World Population Review): The higher the average monthly rent, the greater the cash flow for investors from property rentals.

- Rental Vacancy Rate (data from US Census Bureau): A low vacancy rate indicates high demand for rentals, so a real estate investor will have better chances of keeping their property occupied throughout the year.

- Percentage of Renters (data from US Census Bureau): A high percentage of renters bodes well for investors looking to rent their properties.

Year-Over-Year Property & Rent Appreciation Changes

- Year-over-year Home Value Change (data from Voronoi): A positive year-over-year home value change exemplifies the appreciation in property values.

- Year-over-year Rent Value Change (data from Rent.com): Increased year-over-year rent values translate to increased rental income for investors, further enhancing cash flow and making property ownership more profitable.

Location Opportunity for Residents

- Gross Domestic Product (GDP) (data from US Bureau of Economic Analysis (BEA)): A high GDP is an indicator of a robust and growing economy that can sustain high wage levels, good demand for housing, and hence a very healthy real estate market for investors.

- Percentage of Job Growth (data from World Population Review): This will reflect a strong job market, meaning the local economy is a good one that draws people in.

- Percentage of Population Growth (data from World Population Review): A growing population boosts housing demand, guaranteeing investors a stable market of prospective renters.

- Happiness (data from World Population Review): A high happiness score means that the residents of this area have a better quality of life, which may make the area attractive to more people moving in, thereby raising demand for housing and rentals.

Frequently Asked Questions (FAQs)

Where is the best place to invest in US real estate?

Kansas is unrivaled in investment choice regarding US real estate. Kansas has a low cost of living index, making it a relatively cheap market in which to invest. The median value of homes is a low enough entry price for investors to buy properties without a high price and still have the potential for the property to appreciate. Also, it is one of the most affordable states to live in, proving to be very supportive of a good rental market. Added to this, the consistent job growth and a stable economy make Kansas a more secure environment for investors to acquire consistent cash flow through rental income or property sales.

What state is the best to make money on real estate?

Massachusetts is considered one of the best states for making money with real estate mainly because of its high rental potential and a very stable economy. Its median household income reflects its purchasing power and the ability to pay premium property prices and rents. The median value of a home in Massachusetts is $614,700, which means it is a high-end market where investors can get long-term appreciation in value. Lastly, the state has a high average monthly rent compared with the 50 other states, so it’s an attractive place for investors to have higher cash flow.

What are the worst states to buy property in?

The worst states for buying a property include West Virginia, Louisiana, Maine, and Montana because of their unfavorable economic conditions and slow real estate markets. These states have low median household incomes, so the purchasing power is reduced among the residents. These facts also affect the demand for housing as a whole. For example, West Virginia and Louisiana are among the states that have the lowest median household incomes in the country. Therefore, getting high-paying tenants or buyers in such states may be challenging. There is also a very low percentage of renters, reducing the opportunities in the rental market for investors.

Your Take

Real estate investors should consider several factors when selecting the best states to invest in real estate because it will crucially impact returns on investment. Each state offers unique opportunities, from affordability and rental demand to property appreciation and job growth. Investors should identify locations with favorable economic conditions, an increase in population, and a growing housing market to make the most of their potential return. Whether focusing on rental income, long-term appreciation, or flipping properties, identifying a state that aligns with your specific investment goals is crucial to success in real estate investments.

Add comment