1031 exchange—weird name, amazing money-saving concept for investors! A 1031 exchange is a very common real estate investing strategy used by investors to buy and sell properties. It is a tax-deferral method that enables real estate investors to avoid paying immediate capital gains taxes on the sale of a property by reinvesting the proceeds into another one. However, there are strict rules, tight timelines, and the need for a qualified intermediary. Learn about the 1031 exchange rules, how they work, their benefits, and their limitations in our guide below.

What Is a 1031 Exchange?

So, let’s break down the definition of a 1031 exchange. It takes place under Section 1031 of the Internal Revenue Code. It allows investors to postpone or defer the payment of capital gains taxes when one investment property is sold and another property of equal or greater value is purchased. The properties involved must be held for business or investment purposes and be “like-kind.”

The term “like-kind” is one of the rules for the 1031 exchange, which may sound like a restrictive requirement, but it is pretty broad regarding real estate. Almost any real property held for investment purposes will qualify as like-kind. You can exchange commercial property for a residential rental or raw land for a shopping center. The key is that both properties are intended for investment or productive use in a business.

You’ll find this tax strategy is beneficial for real estate investors who want to avoid huge tax liabilities and have more capital to reinvest in new properties. A 1031 exchange has a tight schedule, so you must act precisely according to the rules provided by the IRS to avoid paying the capital gains tax.

How 1031 Exchanges Work + Examples

A 1031 exchange is a multi-step process with strict adherence to numerous IRS guidelines to keep the tax-deferred status. Every step of the process is crucial, and any missed deadline or mismanaged transaction will create grounds for disqualification. Hence, the investor will end up paying capital gains taxes on any realized gain from the sale. Understanding how each phase works is important, from selling the initial property to acquiring the replacement property.

Below is a breakdown of what is a 1031 exchange in real estate and how it unfolds:

-

Step 1: Sell the relinquished property. The 1031 exchange process starts with the sale of the investment property. The proceeds from the sale do not come directly into your hands, as required by law, so they have to be forwarded to a qualified Intermediary. You must refrain from handling the money at any point or risk jeopardizing the exchange.

-

Step 2: Identify replacement property. You have 45 days following the sale to identify a replacement property. These 45 days are referred to as the identification period. The IRS allows you to identify up to three properties, regardless of value, or any number of properties whose value does not exceed 200% of the value of the relinquished property.

-

Step 3: Reinvestment in replacement property. This is the third vital step. The new property must be purchased within 180 days, starting from the date of sale of the old property. The actual purchase must close, and all proceeds from the sale must be reinvested.

Example 1: An investor sells a rental property valued at $400,000 and identifies two replacement properties. One is valued at $450,000, and another at $475,000. The investor completes the 1031 exchange within the timeline and purchases the $450,000 property, deferring the taxes on the sale of the first property.

This transaction fits the process for the 1031 exchange for several reasons. The investor has followed the IRS rule that when reinvesting in a “like-kind” property, both the sold and acquired properties are used for business or investment. Since he bought a property worth more than $400,000, he invested all net proceeds from his sale without any taxable leftover investment subject to taxation.

Example 2: A businessperson sells an office building for $600,000 and, instead of paying taxes on the sale, does a 1031 exchange and reinvests in a warehouse valued at $650,000. This purchase allows the tax deferral from the sale for the reinvestment of more capital.

The 1031 exchange enables the businessperson to delay paying capital gains taxes from the sale of the office building to use any gain for purchasing a higher-priced property. It allows them to reinvest all of their net proceeds in the new property and expand the real estate portfolio without immediate capital gain tax burdens.

1031 In-depth Timeline

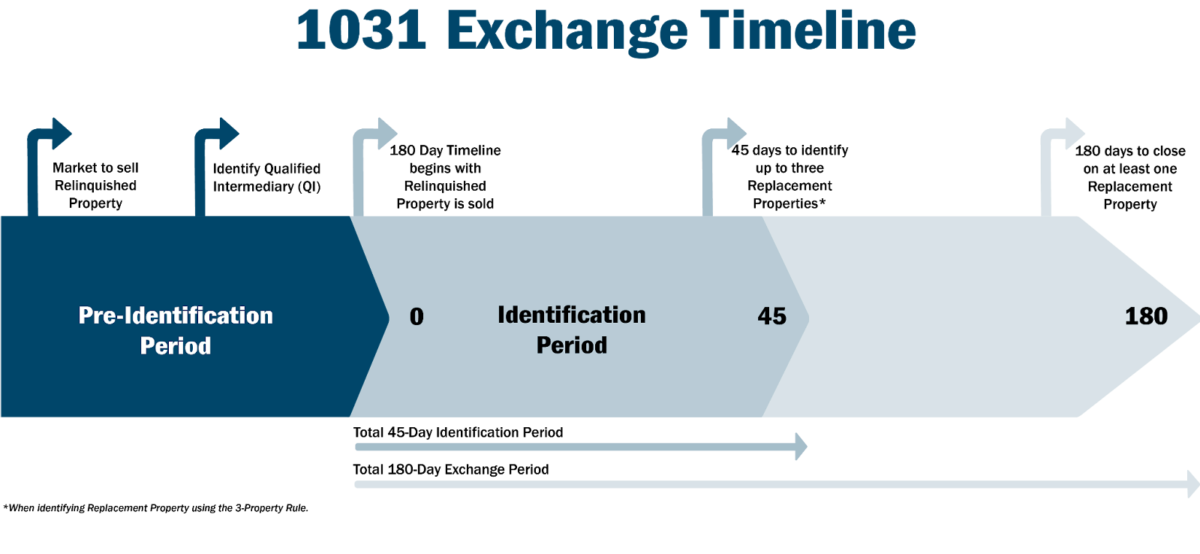

The 1031 exchange is a process wholly governed by an IRS timeline. Failure to meet the deadlines of each step involved in the exchange will void it and immediately create a tax liability. There are significant stages in a 1031 exchange timeline, from the sale of the original property to the replacement property acquisition. A successful exchange can be achieved by adequately comprehending and adhering to each step in the process. A general outlook at the 1031 exchange rule dictating a specific purchase and investment timeline:

- Day 0: The original property sells, and proceeds go to the qualified intermediary.

- Day 1-45: This is the period in which the investor has to identify a replacement property. Identify up to three properties or more than three, with an aggregate value not exceeding 200% of the relinquished property value. This is also known as the identification period.

- Days 1-180: Beginning from the date of sale, the investor has 180 days to close on the new property. The exchange is considered a failure if it does not happen in this window.

Pros & Cons of 1031 Exchange

Like any investment strategy, the 1031 exchange rules have advantages and disadvantages. Though the ability to defer capital gains taxes is highly attractive to real estate investors, it is also a very regulated process that comes with tight guidelines and timelines. Here are some key pros and cons of using a 1031 exchange:

|

|

|

|

|

|

|

|

FAQs

How soon can you occupy a 1031 exchange property?

In general, if you are seeking to convert a property you acquired in a 1031 exchange to your residence, you should wait at least two years from the date of the exchange before occupying. For at least that period, the property must be an investment property and rented or otherwise held for business use.

The IRS usually checks the motive for buying properties, and move-ins too early can harm tax deferral. It can be converted to a personal residence after the two-year mark, but you’ll have to meet additional requirements of owning the property for at least five years and using it as your primary residence for at least two of those years to avoid capital gains taxes.

What are the disadvantages of a 1031 exchange?

Although a 1031 exchange offers significant tax deferral benefits, there are several disadvantages. One major con is an extremely tight timeline. Investors are supposed to identify a replacement property within 45 days and close on it in 180 days, which is quite tough, especially in competitive real estate markets. Yet another negative factor is the complexity of the process. IRS rules are very detailed, and non-fulfillment may lead to an immediate imposition of capital gains taxes. Again, the exchange only delays taxes and, therefore, does not prevent the taxes from being payable once the last property is sold without a further exchange.

What is the average return from a 1031 exchange?

The return on a 1031 exchange depends on the properties involved, timing, and local real estate market conditions. Generally speaking, real estate investments usually provide returns ranging from 6% to 12%, but since a 1031 exchange can defer capital gains taxes, more capital can be leveraged into the replacement property to increase overall returns.

The investor can reap better cash flow or appreciation by reinvesting 100% of the sale proceeds into a new investment instead of selling the property and paying taxes. However, the true return from a 1031 exchange depends on the particular case based on the investor’s strategy, the property’s performance, and market trends.

Bringing It All Together

Leveraging the 1031 exchange is a great tool real estate investors use to defer taxes and build their portfolios by reinvesting in like-kind properties. The process, however, is quite complicated, with a lot of strict rules and deadlines involved. But, for an investor who can follow the 1031 exchange rule, large tax deferrals are the most substantial advantage and will provide success in the long term.

Have you ever done a 1031 exchange? If so, let us know about your experience!

Add comment