There are many rules and regulations imposed on the real estate industry. One crucial regulation to know about is the Real Estate Settlement Procedures Act (RESPA). This Act was imposed to protect consumers seeking financing for real estate purchases from deceptive practices and unfair business arrangements. Real estate agents must understand that the RESPA law is essential to ensure compliance and provide the best service to clients. I will cover the critical aspects of RESPA, including its purpose, requirements, and examples of application in real estate.

Key Takeaways:

- RESPA stands for Real Estate Settlement Procedures Act.

- In short, RESPA is a federal law created to promote fairness and transparency during the real estate settlement process.

- It protects homebuyers and homesellers from hidden fees, kickbacks, and conflicts of interest among real estate service providers.

- The Consumer Financial Protection Bureau (CFPB) enforces RESPA.

- Violations of RESPA can lead to hefty fines, legal action, loss of licensure, and restitution to affected customers.

What Is RESPA?

RESPA is a federal law that aims to protect homebuyers and homesellers by promoting transparency and fairness in the real estate closing process. RESPA in real estate applies to loans secured by a mortgage on residential properties with one to four family units. The law mandates that real estate agents, brokers, lenders, and other settlement service providers disclose important information to consumers.

Enacted in 1974, RESPA was originally enforced by the US Department of Housing and Urban Development (HUD). Since its inception, many amendments have been made to the law to enhance consumer protection and adapt to the evolving real estate market. Key amendments include RESPA covering subordinate lien loans and the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, which transferred enforcement of RESPA from HUD to the CFPB.

- 1974: RESPA was passed into law.

- 1983: The Act extended coverage to controlled business arrangements.

- 1990: Disclosures for closing and annual statements were mandated; Section 6 on mortgage servicing was added.

- 1992: RESPA was amended to cover subordinate lien loans, computer loan originations, and disclosures in writing for mortgage and agent referrals.

- 1996: HUD removed compensation for referrals to affiliate companies and stricter payment rules.

- 2002: RESPA was revised to include more consumer choices, limited fees, and greater disclosure.

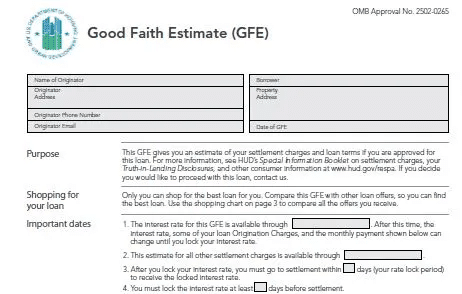

- 2008: A standard Good Faith Estimate (GFE) form was introduced, a settlement statement was revised, mortgage servicing disclosures were streamlined, outdated provisions were removed, and electronic disclosures were permitted.

- 2010: Dodd-Frank Act shortened the time limits, increased penalties, and provided amendments.

- 2011: The CFPB took over RESPA regulatory duties.

- 2013: Regulations under the Truth in Lending Act (TILA) for closed-end consumer home loans were combined into a single disclosure.

- 2013–2014: Amendments modified process and notification procedures and added provisions for escrow payments, force-placed insurance, general servicing updates, and loss mitigation.

- 2020: Frequently asked questions addressing gifts and promotional activities were updated.

Gathered from RESPA News, NAR, and Rocket Mortgage

What Is the Main Purpose of RESPA?

The primary purpose of RESPA is to eliminate kickbacks, referral fees, and other unethical practices that can increase the cost of closing on real estate for consumers. By enforcing transparency and requiring clear disclosure of fees and business relationships, RESPA helps prevent conflicts of interest and promotes fair competition in the real estate market. Understanding what RESPA is and its objectives is essential for ensuring fair and transparent real estate transactions.

The Real Estate Settlement Procedures Act prohibits several practices to protect consumers from unfair and costly transactions. Key prohibitions include the following:

- Kickbacks and referral fees: RESPA bans any value exchange for business referrals among settlement service providers. For example, real estate agents cannot get a kickback from the lender for referring a client.

- Unreasonable escrow amounts: Lenders must be reasonable in requiring borrowers to deposit money into escrow accounts for property taxes and insurance. This restriction prevents lenders from overcharging borrowers and holding excessive amounts of their money.

- Required use of specific service providers: RESPA prohibits requiring buyers or sellers to use a particular title insurance company or other settlement service provider as a condition of sale. Consumers have the freedom to choose the service providers of their choice.

- Markups and fee splitting: RESPA forbids markups, where a service provider increases the cost of a third-party service and pockets the difference. Fee splitting is also prohibited, where service providers split fees without providing additional services.

- Excessive fees: The act prevents lenders from charging excessive service fees, ensuring consumers are not overcharged for necessary settlement services.

- Improper disclosure practices: RESPA requires full disclosure of all fees and business relationships. Failure to adequately disclose these can lead to penalties and legal action.

RESPA Requirements

Specific RESPA requirements have been implemented to help mitigate any possible RESPA violations. All those involved in the real estate closing process must follow these requirements to protect consumers. Under RESPA, real estate agents and other settlement service providers must adhere to these key requirements to ensure transparency and fairness:

- GFE: Lenders must provide a GFE of settlement costs within three business days of receiving a loan application.

- HUD-1 settlement statement: This document itemizes all charges imposed on borrowers and sellers related to the settlement and must be provided to the borrower at least one day before closing.

- Mortgage servicing disclosure statement: This statement must be provided within three days of the loan application. It informs borrowers whether their lender intends to service the loan or transfer it to another lender.

- Affiliated Business Arrangement (AfBA) disclosure: If a real estate professional refers a client to a business in which they have a financial interest, they must disclose this relationship to the client at the time of the referral.

- Initial escrow statement: This statement must be provided at or within 45 days of closing and outlines the estimated costs that the borrower will pay into escrow for property taxes and insurance in the first year of the loan.

- Annual escrow statement: Lenders must provide borrowers with an annual statement summarizing all deposits and payments made from their escrow account over the year.

- Servicing transfer statement: When a loan’s servicing is transferred to a new lender, both the old and new lenders must notify the borrower of the transfer and provide relevant contact information.

How Does a RESPA Violation Get Enforced?

The CFPB primarily enforces RESPA violations. When a violation is suspected, the CFPB may launch an investigation to determine if there has been a breach of the law. This process often involves reviewing transaction documents, interviewing involved parties, and assessing compliance with RESPA’s disclosure and prohibition requirements. If the investigation uncovers evidence of a violation by a real estate agent or lender, the CFPB can take enforcement actions. These actions include imposing fines, requiring restitution to affected consumers, and mandating corrective measures to prevent future violations.

In addition to the CFPB, state attorneys general can enforce RESPA, making it more imperative for real estate professionals to understand what RESPA is. They may initiate legal proceedings against individuals or companies that violate the act, which can lead to civil penalties, injunctions, or other legal remedies. For real estate professionals, the consequences of a RESPA violation can be very severe, including reputational damage, loss of licensure, and significant financial penalties beyond your commission splits.

Examples of RESPA Violations

A good understanding of RESPA rules and what constitutes a violation of RESPA is needed for real estate professionals to ensure compliance and protect consumers. RESPA violations can result in severe penalties and damages that can affect your business long term. Here are four common examples of RESPA violations:

Example 1: Kickbacks & Referral Fees

Sarah is a real estate agent with a long-standing arrangement with a local title company. Whenever she refers a client to this title company, they give her a gift card as a token of appreciation. Although this may seem very innocent and appreciative of her business, it is a direct violation of RESPA because there can be no value exchange for business referrals among settlement service providers.

Example 2: Required Use of Specific Service Providers

Mark is a lender and tells his clients that their mortgage approval is contingent upon using a specific home inspector who happens to be his friend. By mandating the use of this service provider, Mark violates RESPA. RESPA ensures consumers have the freedom to choose their settlement service providers regardless of the recommendations made by their agents or lenders.

Example 3: Excessive Escrow Amounts

A loan officer requires her clients to deposit a large sum into an escrow account for property taxes and insurance. The amount requested far exceeds what is necessary. Therefore, this violates RESPA because the excessive demand breaches RESPA’s guidelines that set limits on the amounts required for escrow accounts.

Example 4: Improper Disclosure Practices

A mortgage broker receives multiple loan applications from potential homebuyers. However, the broker neglects to provide the clients with a GFE within the required three-day period after receiving their applications. This GFE is crucial as it outlines the anticipated settlement costs, allowing borrowers to make informed decisions and compare loan offers. This lack of transparency clearly violates RESPA’s mandatory disclosure requirements.

FAQs

What types of transactions are covered by RESPA?

RESPA applies to federally related mortgage loans, which include most residential mortgage loans used to purchase, refinance, or improve properties with one to four family units. This Act encompasses loans made by banks, savings and loan associations, credit unions, and other lenders insured or regulated by federal agencies.

What are the consequences of violating RESPA?

Violating RESPA can lead to severe consequences, including hefty fines, restitution payments to affected consumers, and corrective actions mandated by regulatory authorities. Additionally, real estate professionals in violation may face reputational damage, loss of licensure, and potential civil lawsuits initiated by state attorneys general or private parties.

How can consumers ensure that they are protected under RESPA?

Consumers can protect themselves under RESPA by being vigilant and informed about their rights. This diligence includes carefully reviewing all loan documents, understanding the GFE and the HUD-1 Settlement Statement, and being aware of any potential conflicts of interest disclosed by their real estate agent or lender. If consumers suspect a RESPA violation, they can file a complaint with the CFPB.

Bringing It All Together

Getting a grip on what RESPA is in real estate can feel like cracking a code, but it’s all about keeping things fair and square for your clients, which is a huge pro for us real estate agents. This Act protects homebuyers from sneaky fees and shady dealings by demanding transparency and honesty from everyone involved in the settlement process. There are no more kickbacks or hidden costs because everything’s out in the open.

For real estate agents, understanding the real estate terms and following RESPA rules isn’t just about staying on the right side of the law. It’s about building trust and making clients feel confident in their big decisions. So, make sure to keep it fair and transparent, because when your clients win, your GCI wins as well.

Add comment