For real estate investors to be successful, they must understand the market dynamics. The real estate cycle can be incredibly complex, but it can also be categorized into four relatively simple phases. A smart investor will take the time to stay up-to-date on market trends to understand where the market is, where it’s going, and how that impacts their investment strategy.

What Is the Housing Market Cycle?

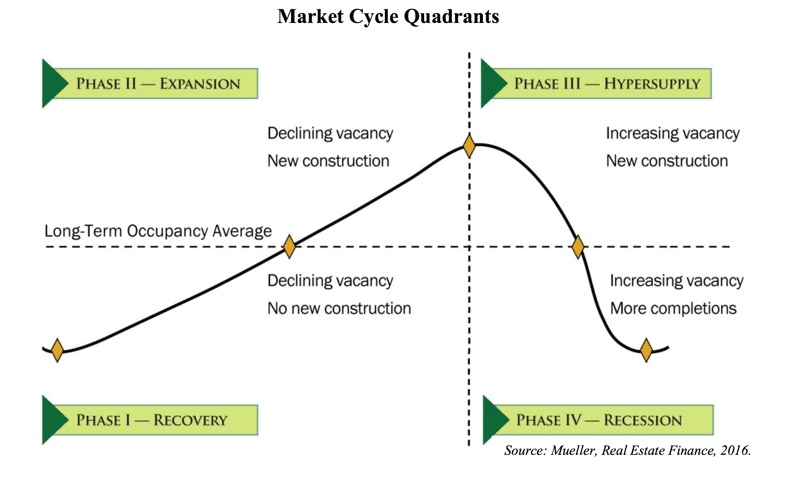

The real estate cycle is the natural process of growing, expanding, and receding in the real estate market. It’s generally divided into four stages: recovery, expansion, hyper-supply, and recession. Each cycle phase is unique and impacts the real estate market differently, like price, vacancies, and inventory.

People generally estimate that the real estate market cycle takes an average of between 10-18 years. However, this can change pretty drastically depending on some of the factors that affect the market. Many different things affect the natural flow of real estate cycles, like the following:

- Interest rates

- Economic health

- Demographics

- Government policies

- Real estate development

- Business growth

- Employment rates

Use this real estate cycle chart to help identify the state of the market (we’ll use this chart throughout the article to show the various stages):

Why Investors Need to Understand the Cycle

If you want to be a successful real estate investor, you need to understand the market beyond a real estate cycle chart. Investing is a long-term strategy, and it’s easy to make poor decisions if you don’t understand how the market naturally ebbs and flows. Understanding the real estate market cycles will help you to do the following:

- Know when the optimal times are to buy and sell

- Adjust your pricing strategies for buying and selling based on the state of the market, demand, and pricing changes

- Generate a higher profit because you have a long-term perspective

- Avoid poor investments by making choices before the market makes a downturn

Understanding the housing market cycle is essential to make profitable investments. Learn how to plan even more effectively in our guide to making a real estate investment business plan.

Stages of the Housing Market Cycle

At any point, many factors affect the real estate market. However, every change in the market can fit into one of four stages of the real estate cycle: recovery, expansion, hypersupply, and recession.

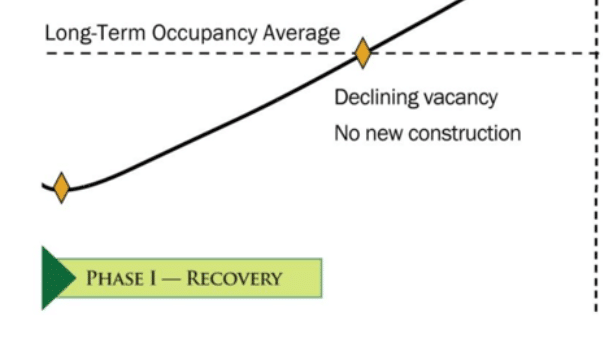

1. Recovery

The first part of the real estate cycle is right after a recession when the market is trying to recover. At the beginning of the recovery phase, people still feel the effects of the recession. There is typically an excess supply of properties that doesn’t match a decline in demand. This phenomenon creates a drop in the prices of rent and properties.

What investors should do during recovery:

- Purchase below-market properties (best to do in the early stages of recovery)

- Sell renovated properties that were purchased during a recession

- Negotiate property prices to get undervalued properties or the best value for your flipped homes

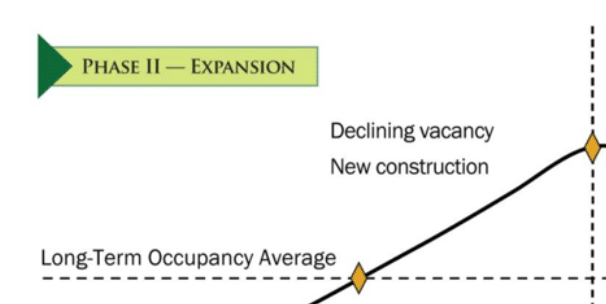

2. Expansion

As recovery continues, some call parts of this phase “the honeymoon.” This is when the general economy is growing, employment rates are starting to improve, and demand for real estate is increasing. You’ll see signs of the expansion phase when properties sell more quickly, rent prices are starting to increase, and there is a higher competition for bank foreclosures. This is the part of the real estate cycle when supply and demand are the most balanced.

What investors should do during expansion:

- Research growing areas to invest in locations that are in high demand

- Renovate or develop properties (high demand justifies the cost)

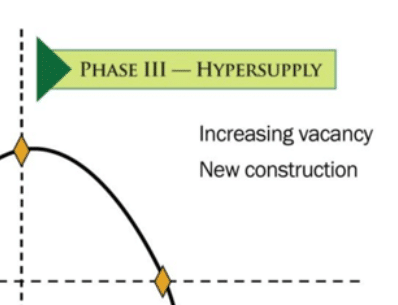

3. Hypersupply

The next part of the housing market cycle is when the pendulum swings a little too far in the opposite direction, and now the supply of real estate exceeds the demand for it. This can be caused by overbuilding during the expansion phase. Watch for this part of the real estate market cycle by looking for low unemployment rates, quickly selling properties, and increases in property and rent prices.

It’s common for some investors to panic when they find themselves in this spot on the housing market cycle graph because they know a recession is coming. You can always liquidate your assets, but it’s often a wise strategy to hold properties and generate short-term cash flow. However, it’s smart to prepare for an upcoming recession by adjusting your pricing strategy.

What investors should do during hypersupply:

- Hold properties and let them appreciate

- Focus on generating short-term cash flow

- Prepare for upcoming recession

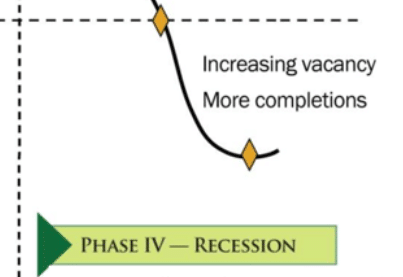

4. Recession

Of all the real estate market cycles, the recession stage is the most daunting for investors. At this point, there is an overabundance of inventory that surpasses demand. This means there are more vacancies, and prices start to fall again. During this stage, job growth slows down, leaving fewer buyers and renters to fill your rentals. At the same time, home values increase more quickly. Even though recessions are typically challenging for rental property owners, slow periods of the economy are the best time to invest in real estate.

What investors should do during a recession:

- Buy distressed, undervalued properties with high long-term potential

- Look for distressed properties or those in foreclosure

- Develop a long-term rental or flip strategy for investments

Frequently Asked Questions (FAQs)

What are the four cycles of real estate?

The four stages of the real estate cycle are recovery, expansion, hyper-supply, and recession. They are closely connected to the economy, so it’s important to understand various factors that affect the real estate market.

How long is the housing market cycle?

Real estate cycles can move quickly or stay consistent for varying amounts of time. Although there isn’t a specific time period, most cycles last anywhere from 10 to 18 years.

What phase of the real estate cycle are we in in 2024?

In the middle of 2024, we’re seeing high interest rates, high home prices, and slow moving home sales. Even though 56% of Americans believe we’re in a recession, experts don’t agree. In fact, sources like Bankrate predict the market will improve slightly since there is still a low and high level of demand.

Bringing It All Together

Understanding the real estate market cycle can be overwhelming at first, but it’s an extremely important concept to master for aspiring real estate investors. Make sure to understand the ins and outs of each part of the cycle and learn how to recognize shifts in the housing market cycle to make the best decisions for your business.

Add comment