A cash for keys agreement is an easy way for landlords to get unwanted tenants to move out without going through the whole eviction process. The landlord makes a cash offer, checks out the property, and both sides sign a written agreement to finalize it. This method saves time and money while giving landlords quicker access to their property. It all hinges on good communication with the tenant to make things go smoothly.

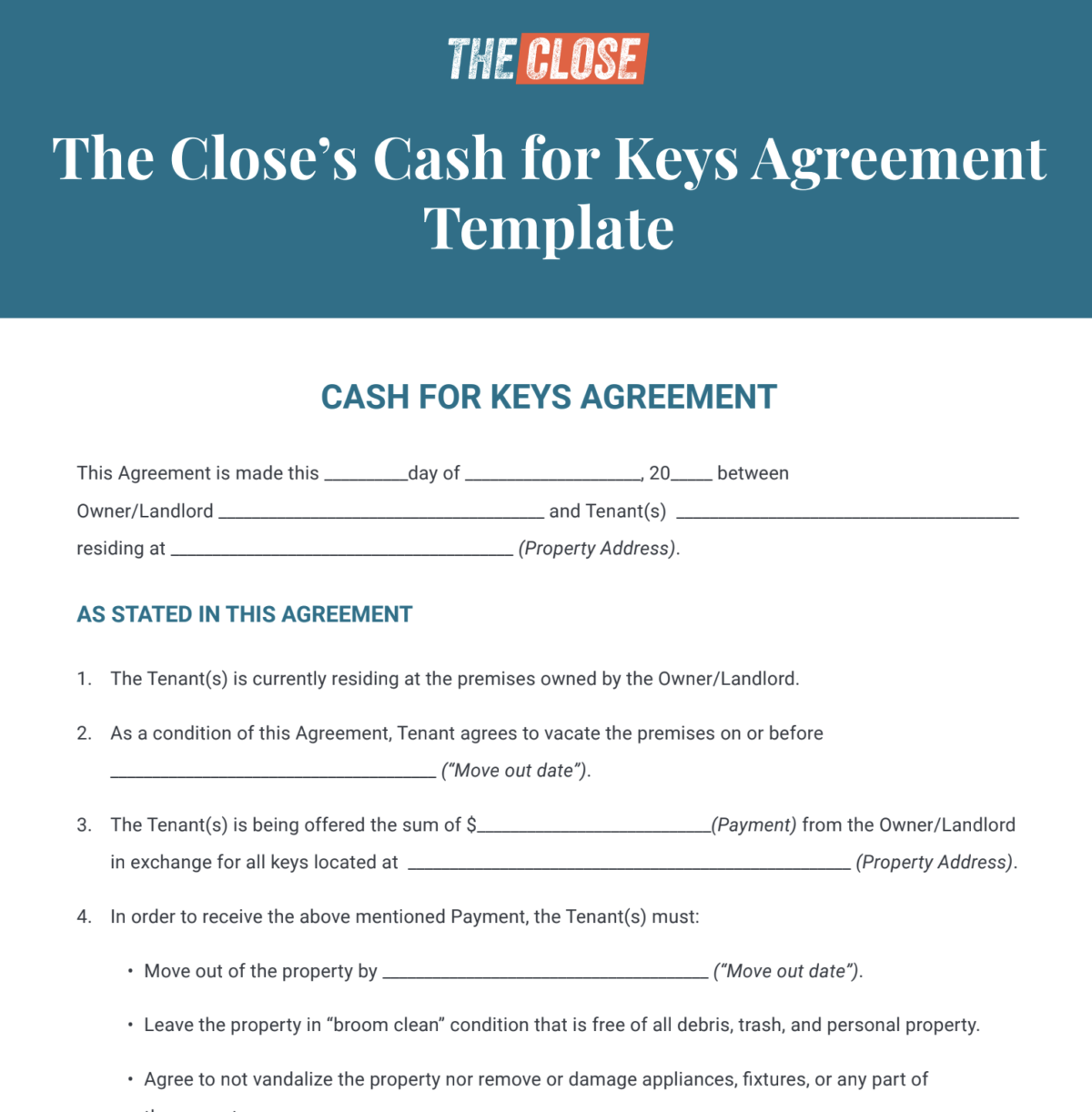

A downloadable cash for keys agreement form template is available below for use and modification according to your needs.

What Is Cash for Keys?

Cash for keys is a deal between a landlord and a tenant where the landlord gives the tenant some cash in exchange for their keys. This setup is a win-win for everyone! The tenant gets some cash to help with their move, and the landlord can snag their property back without too much fuss.

Setting up these keys for cash agreements can help keep the eviction process at bay. This means landlords won’t have to deal with court fees, spend time in housing court, or worry about unpaid rent from tenants. It’s a favorable option for both parties, completely voluntary, and keeps things out of the legal system, so it won’t impact the tenant’s credit score.

Pros & Cons

Before you dive into this keys for cash agreement, let’s take a moment to weigh the good and the not-so-good about this exchange. While it can be a speedy and breezy way to get your rental digs back, it might also come with extra costs. So, here are the ups and downs to think about before you take the plunge:

|

|

|

|

|

|

|

|

|

|

|

|

Step-by-Step Guide to Implement Cash for Keys

Now that you know what a cash for keys agreement is and its benefits and drawbacks, it’s time to make it happen.

Step 1: Decide If Cash for Keys Is the Best Option

Ideally, you’d like a tenant to leave without spending extra cash. However, that may not be possible, especially if you have a lot of time left on the lease or stubborn tenants who are not paying their rent. If there’s not much time left on the lease agreement, you might save some money. But, if you need the tenants out ASAP, cash for keys is a viable option.

A cash for keys for renters may be implemented in the following circumstances:

- If renters are behind on rent: A cash for keys agreement can assist renters by offering them money in exchange for voluntarily vacating the property. This benefits tenants by providing funds for moving and helping them avoid eviction, while landlords can quickly regain their property without legal delays.

- Vacating rental tenants for a rent increase and improvements: Raising the rent may be necessary for financial reasons to boost return on investment (ROI). This entails making improvements that align with the new rent amount, requiring the current tenant to vacate.

- Vacating tenants so you or a family member can live in the property: No rent increase or improvements are needed; you are just regaining possession of your property for personal reasons.

- Vacating current tenants so you can sell the property: When selling your property, if the potential buyer requires immediate possession for personal use, you may need to vacate before completing the sale unless there’s a sale clause in your lease.

- Vacating former homeowners still occupying a real estate-owned (REO) property after the lender has taken possession: When a foreclosed property fails to sell at auction, the lender reclaims it. Some lenders may offer the former homeowner cash to vacate the property and surrender the keys, making it easier for the lender to sell the property and recoup their losses.

This keys for cash process is legal in all 50 states as long as landlords present the agreement in a friendly and voluntary way. It’s always a good idea to check your state laws to ensure you follow the rules, especially regarding security deposits and any rent, damages, or repairs deductions.

Step 2: Approach Tenants to Discuss Leaving

Schedule a time to speak to your tenant in person or on the phone. They might decide to move out independently without official notice. If they’re not cooperative or keep avoiding you, it’s time to move forward with eviction. Make sure to give them a written notice per your state’s laws. You might need to send it via certified mail or get help from a sheriff or process server. If you’re using mail, keep track of the delivery with a return receipt so you know it got to someone at the property.

Some tenants may be willing to discuss the eviction notice further after receiving it. Follow up with a phone call and, if they don’t leave voluntarily, propose a standard cash for keys agreement, emphasizing its advantages. Highlight that eviction can harm their future housing prospects and credit score, while this agreement offers monetary compensation.

Step 3: Decide How Much to Offer

If the tenant seems open to an agreement, the next move is figuring out how much to offer them. It might help to think about how much an eviction could cost you—things like legal fees, lost rent, court costs, and expenses from turning over the property can add up to thousands. Once you have that number, make them an offer lower than that to make the agreement more appealing for tenants.

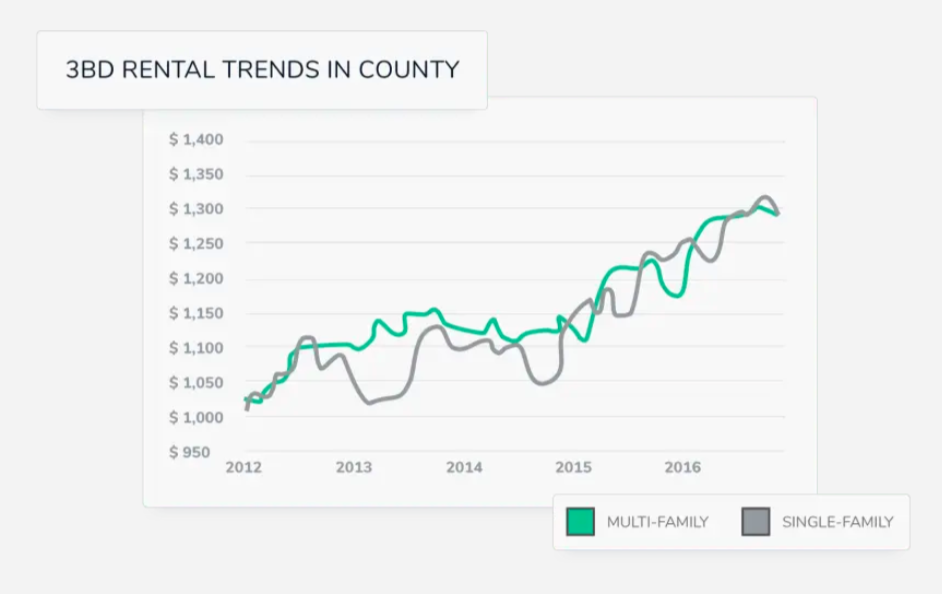

It’s also wise to look at what similar places are renting for in your area—that way, your cash offer can cover the first and last month’s rent, plus maybe a security deposit for your tenant. That incentive could motivate them to hand over the keys and move out quickly. Think about setting a reasonable deadline for them to move out and use that along with your cash offer to negotiate an agreement.

Property management platforms like Avail are super helpful for landlords. It offers handy rent analysis reports that show rental market trends and comparable properties nearby. Plus, its online payment system encourages tenants to pay on time, which can help avoid those tricky cash-for-keys situations. It’s a win-win for everyone.

Step 4: Extend a Verbal Offer & Negotiate as Needed

Another critical element to a successful cash for keys tenant deal is being super specific about the terms of the agreement. When you’re chatting about the offer with your tenants, keep it clear about the following items:

Tenants might try to haggle or throw out some counteroffers. If they seem reasonable, you can totally go for it, but don’t get too sidetracked if the initial offer is already solid. If you stray too far from what was proposed, you might come off as a pushover or shell out more cash than you need to. Watch for sketchy moves where tenants might try to squeeze extra money or time out of you.

Step 5: Arrange a Property Inspection & Sign the Cash for Keys Agreement

Before you wrap things up and share the cash for keys letter with your tenant, take a sec to check out the property and make sure it’s in good shape. Sometimes, tenants can be a bit rough on the property, so it’s worth keeping an eye out for any major damage that could mess with the deal. Don’t forget to include all agreed-upon terms from your verbal conversation in the written agreement.

Step 6: Do a Final Walkthrough on Moving Day & Exchange Cash for Keys

Set up a meeting with the tenant to sign off on the agreement and do a last walkthrough of the place with the tenant. And make sure to pin down a date for handing over the keys and settling any cash. It’s a solid plan for both of you to sign two copies of the agreement to keep handy for your own records! If everything’s clean and there’s no significant damage, go ahead and hand over the cash and change the locks. If there are any issues, just figure out what needs to be deducted from the cash payment or security deposit before giving the tenant their funds.

Don’t forget to download our rental move-in and move-out checklist to help you with the final walkthrough!

![The Close’s Rental Move-in and Move-out Checklist]](https://assets.theclose.com/uploads/2024/11/Screenshot-9.png)

Step 7: Facilitate a Smooth Transaction With Proper Documentation

While a keys for cash agreement might not be the perfect fit for every tenant situation, if you’re in a position to avoid the eviction process, here are some friendly tips to keep in mind:

- Agreement should always be in writing: An agreement should be written as a binding contract and encompass all relevant information about the terms, including the vacancy date, agreed-upon amount, and apartment condition upon move-out. This helps avoid any confusion between both parties.

- Make sure you have proof of transaction: While the agreement is technically called a “cash for keys agreement,” you can offer certified funds instead of cash to have a payment record. Both parties sign a document acknowledging the cash payment receipt if cash funds are provided.

- Create a stringent tenant screening process: To prevent removing problematic tenants in the future, pre-screen tenants and conduct credit and background checks before approving applications.

- Waiver of all claims: The agreement should state that the tenant releases the landlord from future lawsuits or claims related to the property and landlord-tenant relationship.

- Ensure you are negotiating and making the agreement with the leaseholder: Be cautious of potential scams in which squatters or undisclosed subtenants may attempt to receive the cash. Unauthorized changes in occupancy without notifying the landlord are a common tenant scam to be aware of.

FAQs

Is cash for keys legit?

Yes. Cash for keys is a legitimate practice used in certain situations. While it takes place outside the formal legal system, this voluntary agreement necessitates a written document where both parties mutually consent to the terms of the transaction and affix their signatures.

Is cash for keys taxable income?

Yes. The money received in this type of agreement is taxable. In most situations, it is classified as extraordinary income, and tenants who receive payment should report it as miscellaneous funds on the tax return. If the tenant has specific tax questions, it is recommended that they seek advice from a professional tax preparer. They can offer a more precise response, considering various factors related to the tenant’s tax status.

Is cash for keys a better alternative than eviction?

In certain circumstances, cash for keys offers a better alternative to the standard eviction process. Landlords can avoid covering court costs, spending time and money on housing court, and other rental expenses left uncovered by tenants. This agreement lets both parties save time and money while leaving the tenant’s credit score unaffected.

Your Take

A cash for keys agreement can be a great way to avoid the hassle and expenses of a long eviction process. It’s brilliant for all real estate investors and landlords to have a ready-to-go agreement for when needed. Plus, using tenant screening services can help you find the best tenants and steer clear of any future issues.

If you have any questions or want to chat about this topic, feel free to comment below—I’d love to hear what you think!

Add comment