An investment property loan is any type of financing you use to buy or refinance a property that generates income, like a rental property (single-family home or a multifamily property) or a commercial property. Loans for investment properties can vary significantly — but ultimately, the best investment property loans have a low interest rate, a term length that fits your investment plan, and reasonable eligibility requirements for investors.

Our choice of the six best loans for investment properties are:

- Kiavi: Best for quick and easy funding

- Lima One Capital: Best for flexible rental property financing

- Visio Lending: Best for short-term rental properties

- RCN Capital: Best for experienced investors

- Pennymac: Largest variety of investment property loans

- Lendio: Best for commercial properties

Best Investment Property Loans Compared

| Types of funding offered | Terms | |

|---|---|---|

| DSCR loan terms:

|

|

| Single-family rental loan terms:

|

|

| DSCR loan terms:

|

|

| Long-term rental loan terms:

|

|

| Conventional mortgage loan terms:

|

|

| Commercial mortgage loan terms:

|

|

Kiavi: Best for quick and easy funding

|

|

|---|---|

Pros

| Cons

|

Why we chose Kiavi

Kiavi is an online real estate lender that offers a variety of the best loans for real estate investors, from fix and flip loans to rental portfolio loans. It even topped our list of the best fix and flip loan providers for its easy process. Its online platform makes the application and funding process very easy, and allows you to get funding in as little as seven days, depending on the type of loan and size.

It also offers competitive interest rates with a strong credit score and history. Although there isn’t a huge variety of loans for rental properties specifically, it offers the best investment property loans for investors who want a simple, easy, and fast loan process.

Kiavi’s loan types and terms

|

|

Lima One Capital: Best for flexible rental property financing

|

|

|---|---|

Pros

| Cons

|

Why we chose Lima One Capital

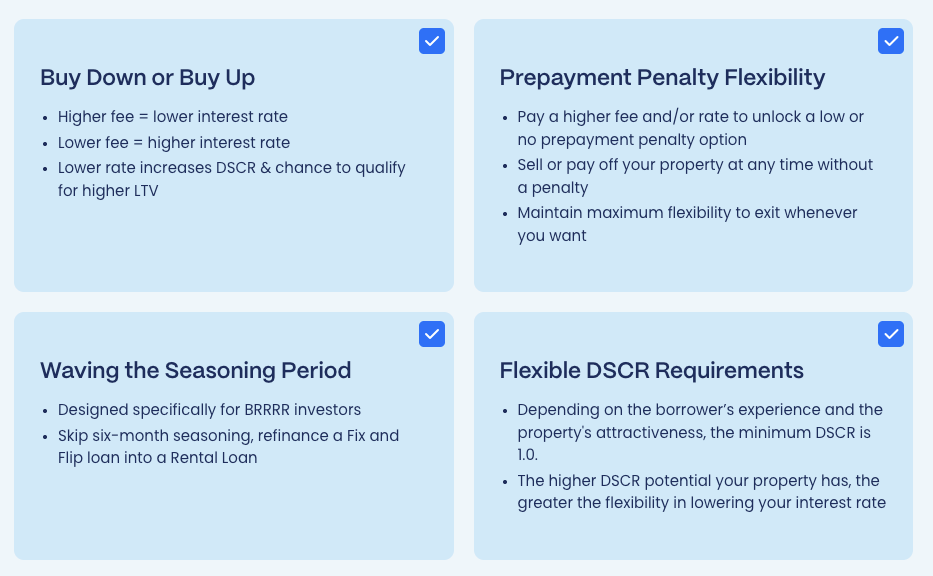

Lima One Capital is another online lender that offers a variety of funding for different types of investors, like commercial property investors, developers, and flippers. It stands out from other lending options because of its loan options for rental property owners. There are three different types of rental property loans (portfolio rental loan, single-family rental loan, and short-term rental loan), and each offers very flexible terms. Because of these customization options, it’s clear that Lima One offers the best loans for rental property.

Lima One Capital’s loan types and terms

|

|

Visio Lending: Best for short-term rentals

|

|

|---|---|

Pros

| Cons

|

Why we chose Visio Lending

With Visio Lending, there are two types of DSCR loans (debt-service coverage ratio) for rentals: a loan for long-term rental properties and a different loan for short-term rental properties. DSCR loans are one of the best loans for an investment property because they are based on the income generated by your rental properties instead of your personal income. Plus, Visio’s short-term rental loan offers a fixed rate and up to 80% loan-to-value, making it easy for you to grow or start a vacation property investment.

Visio Lending’s loan types and terms

|

|

RCN Capital: Best for experienced investors

|

|

|---|---|

Pros

| Cons

|

Why we chose RCN Capital

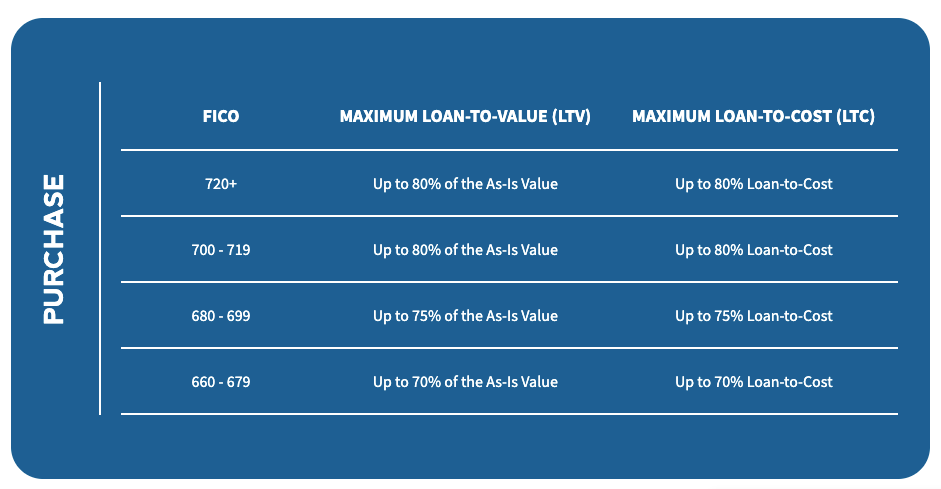

RCN Capital is well known for offering many of the best loans for investment properties, including new construction, portfolio loans, and long-term rental loans. One of its most unique features is that they base loan terms off of your credit score and business history.

For example, its long-term rental loan will finance up to 80% LTV if you have a credit score over 700. If your credit score is under 680, it will only cover up to 70% LTV. This makes RCN Capital the best loan for experienced investors to get the best rates.

RCN Capital’s loan types and terms

|

|

Pennymac: Largest variety of investment property loans

Pros

| Cons

|

Why we chose Pennymac

Pennymac is a mortgage lender that offers the widest variety of real estate loans on our list. While many of their mortgage loans are meant for residential properties, they can be used for investment properties and even have benefits like a low 15% down payment.

It is one of the few investment property loan providers that offers VA loans for primary residences and investment properties. Keep in mind that mortgages typically offer the lowest interest rates of all the types of investment loans — for example, Pennymac’s current interest rate for a jumbo mortgage starts at just 6.125%.

Pennymac’s loan types and terms

|

|

Lendio: Best for commercial properties

|

|

|---|---|

Pros

| Cons

|

Why we chose Lendio

Lendio isn’t a direct loan provider, but an online marketplace with over 75 lenders. Even though it isn’t a real estate-specific lender, it offers some of the best commercial real estate loans on the market. It is one of the few online lenders to offer a conventional commercial mortgage option with flexible terms and the ability to get funding in eight weeks or less. It also offers SBA loans, which are ideal for funding commercial real estate. Overall, Lendio offers the best investment property loans for commercial real estate investors.

Lendio’s loan types and terms

|

|

How to choose the best loan for investment property

When residential home buyers think about buying a home, they only have a few options to choose from. For investors, on the other hand, there are many different types of loans and providers to choose from — which can be overwhelming.

The best loan for investment property owners depends on many different factors. You have to start with a solid understanding of your business, your immediate and long-term goals, and your current financial status. Then, you can consider the following criteria:

- Type of investing: Consider how you’ve invested in real estate so far and your future plans. This may help you get a clearer understanding of what you can afford and how your ideal loans should be structured.

- Type of financing: Each type of loan offers different interest rates, eligibility criteria, and terms, so make sure you understand the pros and cons of all your options.

- Eligibility & terms: In general, financing options with fewer eligibility criteria have higher interest rates. Make sure you understand what you can qualify for and the specific long-term impact of each potential choice.

Looking to start investing in commercial real estate? Check our How to Buy Commercial Real Estate guide to get started.

Types of investment property loans

In general, investment property loans are mortgages or loans that are used to finance an income-generating property, like rental properties or commercial properties. When people talk about loans for investment properties, they could actually be referencing a wide range of loans.

However, the following are generally considered the best loans for investment property:

| Type | Pros | Cons |

|---|---|---|

| Conventional loans (mortgages) |

|

|

| DSCR loans (debt service coverage ratio) |

|

|

| Portfolio loans |

|

|

| Commercial investment loans |

|

|

| Home equity loans |

|

|

Methodology: How we evaluated the best investment property loans

Our methodology at The Close is to provide real estate business owners with the most accurate and objective information to help them make the right business decisions. Our team of professionals, researchers, writers, real estate agents, and experts have done detailed research to evaluate the best investment property loans for investors of all kinds.

Our criteria include:

- Loan types: Since there are many different ways to invest in real estate, we looked for loan providers that offered a range of financing options for investors.

- Loan terms: We carefully considered the terms of each loan that we chose as the best loan for investment property owners, looking specifically at interest rates, short and long-term payment structures, and fees.

- Eligibility: We chose loan options with eligibility requirements that most real estate investors can meet, looking at business requirements, minimum credit scores, and types of properties the lender approved

- Availability: Since our aim is to support investors all over the country, we chose providers with a wide reach.

- Customer reviews: We chose lenders that have strong reputations and excellent reviews on multiple third-party websites.

Alternative loans for investment properties

Investing in real estate is an open-ended career — there are so many different strategies and types of real estate investing. There may be a time when you need to finance an investment property or properties, but none of the typical methods fit your needs. There are plenty of alternative options, including:

- Hard money loans: Best for fix-and-flip investors or those looking for short-term financing, these loans come from a hard money lender. It typically has fewer eligibility requirements but higher interest rates. For options, check our guide to the best hard money lenders.

- Business loans: General business loans can be used when you don’t meet the criteria for real estate-specific financing. They can be short or long-term, but may have higher interest rates than conventional financing. These are typically a good option for those who need to do renovation or maintenance work for a property.

- Bridge loans: These short-term loans are meant to be used when there’s a gap between your immediate financial needs and your long-term financing plan. Bridge loans are perfect for those with quick investment projects that they plan to sell or refinance.

- FHA loans: FHA loans are provided by the Federal Housing Administration. There are FHA loans for primary residences and FHA loans specifically made for multifamily properties, which typically offer more flexible qualification criteria.

Frequently asked questions (FAQs)

What type of loan is best for an investment property?

The most common and most popular type of loan for investment properties is a conventional mortgage. However, owners of multiple rental properties often use portfolio loans (or blanket loans) to consolidate their payments. DSCR loans are also popular options for rental property owners to finance an investment based on their property’s revenue and not their personal income.

Can I put less than 20% down on an investment property?

While most investment property financing will require 20-30% down, there are exceptions depending on the loan type, the lender’s preference, and your creditworthiness as a borrower. For example, Pennymac offers loan options with down payments as low as 15%.

Is it hard to get a loan for an investment property?

Getting a loan for an investment property can be more challenging than getting a mortgage for your primary home. Investment properties are considered to be more risky, so there are higher eligibility requirements, and you typically need a larger down payment.

Add comment